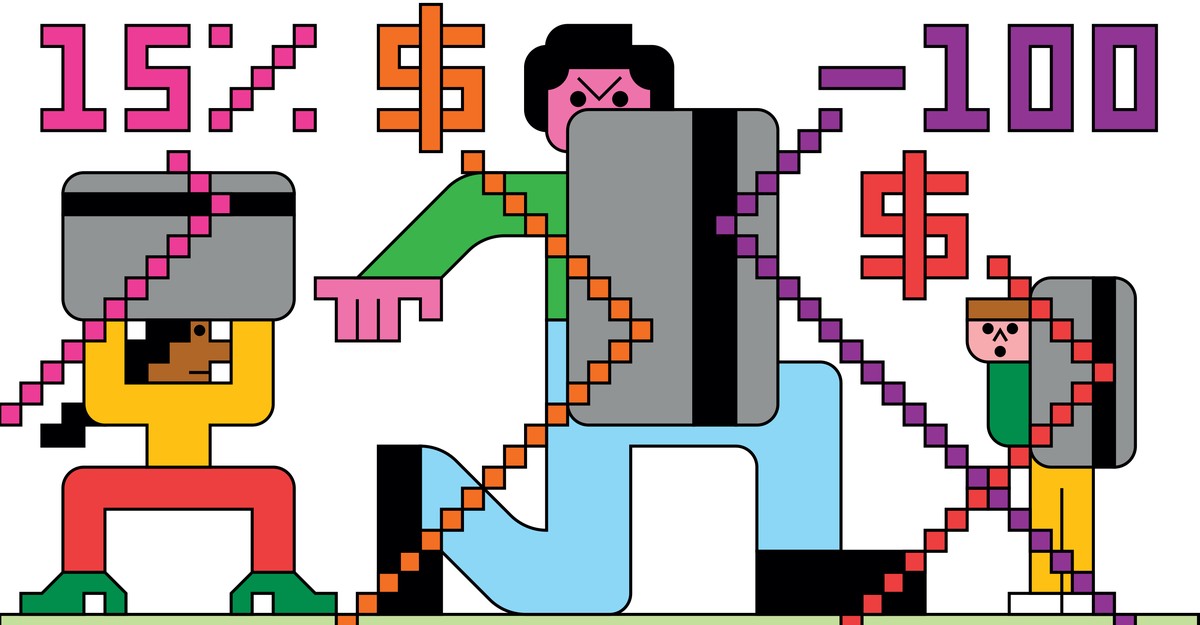

"For years, Americans have struggled with unrestrained spending on credit and the compounding debt that can come with it. Freezing your credit card (literally) is one way around it. But many Americans have turned to a different method: using a debit card. Around the turn of this century, credit accounted for more than two-thirds of card purchases and debit for about one-third, according to data from The Nilson Report, an industry-research publication."

"Its usage dipped after federal regulation capped how much money banks and payment processors could make on debit, but the cards are once again ticking up in popularity. Today, many companies seem intent on convincing consumers of debit's coolness. New financial players such as Venmo are now offering debit cards, retrofitting them with reward programs and marketing them heavily. Venmo's card was name-checked in an ad featuring the White Lotus stars Aimee Lou Wood and Patrick Schwarzenegger; Experian's appeared in a sponsored post on Travis Kelce's Instagram."

Consumers have long struggled with unchecked credit-card spending and various tactics exist to curb it, from literally freezing cards to switching to debit. Around 2000, credit accounted for over two-thirds of card purchases while debit made up about one-third. A 2009 law restricting credit access for under-21s and subsequent trends pushed debit to nearly half of U.S. card transactions by the 2010s. Debit use dipped after federal limits on bank and processor debit fees, then rebounded. Banks and new fintechs increasingly promote debit cards with rewards and heavy marketing, while high interest rates and cashless retail growth bolster debit appeal.

Read at The Atlantic

Unable to calculate read time

Collection

[

|

...

]