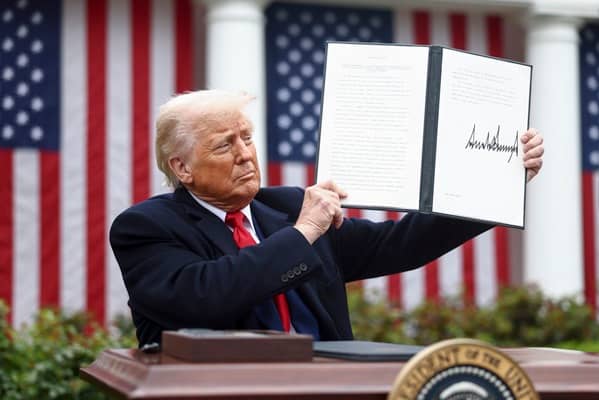

"Amidst the inflation and interest rate anxiety of 2023 and 2024, gold has been on an unstoppable rally with prices hitting an all-time high of over $3,400."

"The uncertainty stemming from aggressive economic measures proposed by Trump and China's hostility promises to undermine the dollar, amplifying gold's appeal as a safe haven."

In early April 2024, gold prices surged past $3,400 due to heightened geopolitical tensions and economic strategies from the U.S. and China. Trump's rhetoric around economic measures, combined with China's commitment to fiercely retaliate against U.S. sanctions, has instigated a climate of uncertainty that favors gold as a hedge against inflation and currency instability. This rise is also attributed to central banks' increasing demand for gold, following asset freezes related to geopolitical conflicts. As inflation fears loom, gold's role as a secure investment intensifies.

Read at London Business News | Londonlovesbusiness.com

Unable to calculate read time

Collection

[

|

...

]