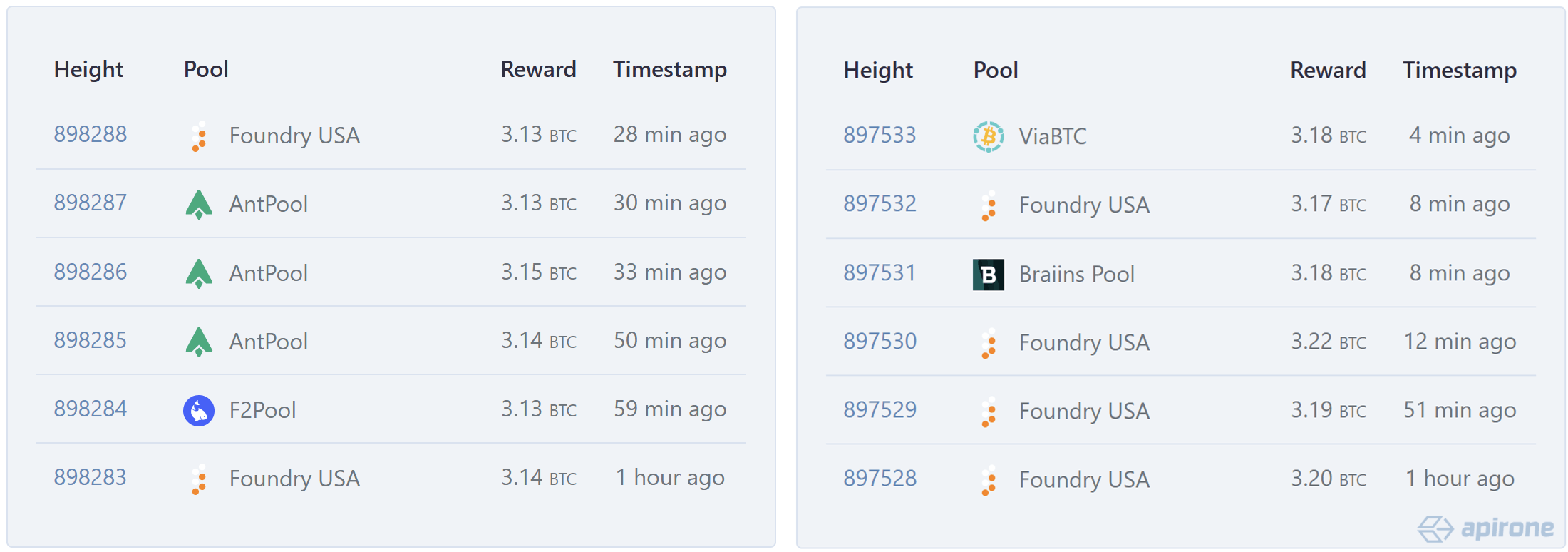

"By 2025, Bitcoin mining has become noticeably more centralized than ever before, with the largest pools controlling over 95% of the mined blocks."

"The concentration of computing power in Bitcoin mining threatens network stability and decentralization, as few pools can dictate transaction inclusion or exclusion."

"Despite concerns, Bitcoin's censorship resistance is maintained unless large mining pools collude to block transactions or attack the network."

"Centralization in Bitcoin mining is indicated by a few large pools controlling substantial hash rate, raising fears of selfish mining and double-spending."

By 2025, Bitcoin mining has become increasingly centralized, with a small number of pools dominating over 95% of blocks mined. This concentration raises concerns about the network's stability and decentralization, especially regarding transaction control and trust. The potential threats from dominant pools include selfish mining and double-spending attacks. Even with less than 51% control, these pools can influence the mining landscape significantly. Current analysis methods focus on hashrate distribution through coinbase transactions to evaluate and measure the extent of centralization in Bitcoin mining.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]