"But why has Bitcoin been falling so much over the past 24 hours? There are two major factors at play. The first has to do with what happened in the stock market yesterday. When markets opened, AI-related stocks were flying high due to the previous day's news that Nvidia Corporation (Nasdaq: NVDA) had exceeded expectations for its Q3 2026 earnings. This good news, momentarily, gave investors a confidence boost."

"But as the day continued, those bubble fears resurfaced, and investors sold Nvidia heavily, along with other AI stocks and other tech stocks. This selloff contributed to a steep decline in the markets, which ended down for the day. Unfortunately for cryptocurrencies, many people who invest in volatile AI stocks also invest in crypto. And when one of those assets declines, they tend to sell off the other asset to lock in any accumulated profits and buffer against losses elsewhere in their portfolio."

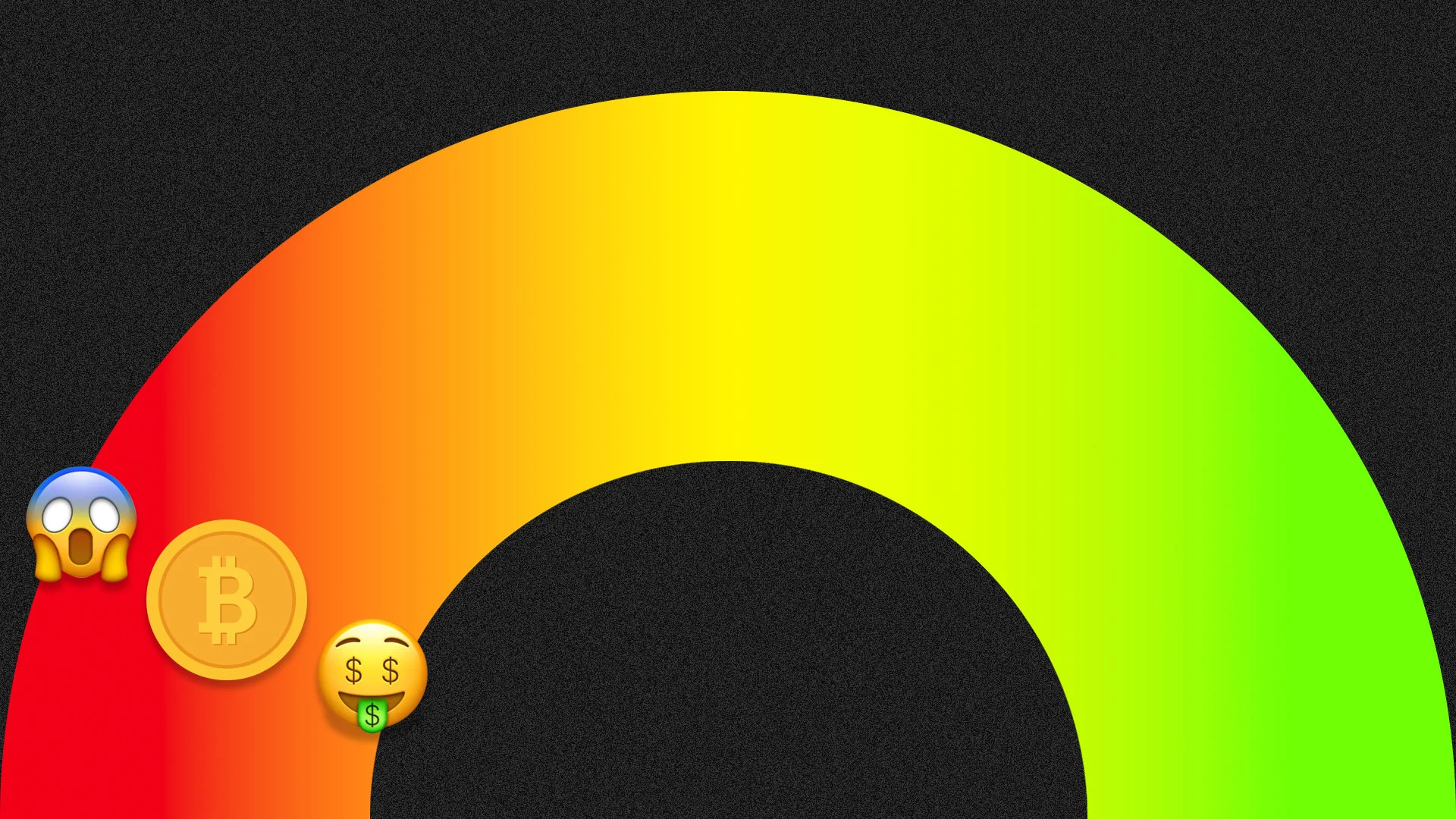

Bitcoin declined more than 10% in 24 hours to $82,185 per token, reaching a low not seen since April after a prior five-day decline of about 2.5%. Fear-and-greed indices that measure investor sentiment are near historic lows. Two major factors likely contributed to the rapid drop: a sharp selloff in AI and other tech stocks following volatile reactions to Nvidia’s Q3 2026 earnings, and stronger-than-expected U.S. September jobs data reporting 119,000 new jobs versus roughly 50,000 expected. Cross-asset selling occurred as investors holding both volatile AI stocks and crypto liquidated positions to manage risk.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]