"The proposed multi-layer blockchain architecture enhances the cross-border trading of CBDCs, ensuring security, integrity, and interoperability, while being cost-efficient even with liquidity fragmentation."

"Multiple Layer-3s allow various Automated Market Makers (AMMs) to compete for the lowest costs, demonstrating that a multi-AMM setup is preferable to a single AMM approach."

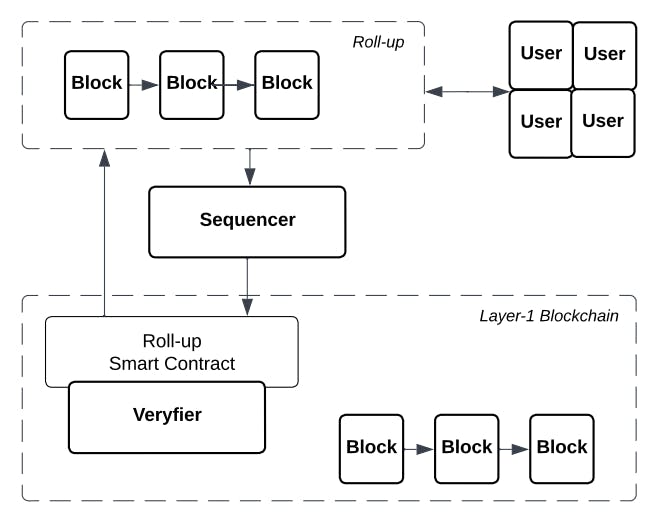

This article proposes a multi-layer blockchain architecture aimed at facilitating cross-border trading of Central Bank Digital Currencies (CBDCs). The system features a permissioned layer-2 that ensures security through public consensus while allowing interoperability with domestic implementations. Additionally, it introduces multiple Layer-3s supporting various Automated Market Makers (AMMs) that compete to minimize trading costs. Simulations based on historical FX rates affirm the architecture's efficiency over a single AMM model, positioning it as a viable alternative for future CBDC interactions, with Project Mariana serving as a benchmark for analysis.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]