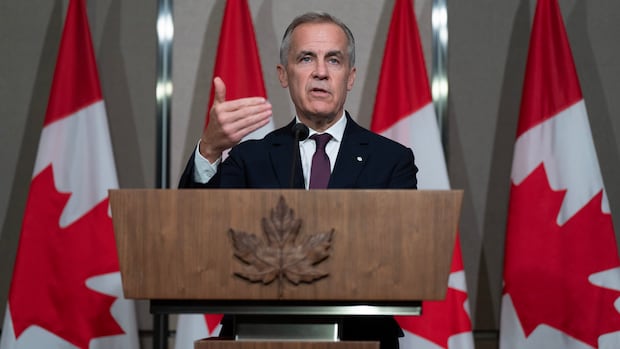

"These are decidedly not normal times. And Bank of Canada governor Tiff Macklem knows it. "The structural damage caused by tariffs is reducing our productive capacity and adding costs. This limits the ability of monetary policy to boost demand while maintaining low inflation," said Macklem last week. Lowering interest rates can only do so much, he says. And in this uniquely weird moment for the Canadian economy, he says monetary policy has a limit."

"There's a clear message in that statement. Not just to Canadians struggling to stay above water in these trying times. Economists say Macklem is sending an important signal to the federal government. The Bank seems to think it has done all it can and is now handing over the reins to the federal government to support the economy through fiscal policy, says David-Alexandre Brassard, chief economist at the Chartered Professional Accountants of Canada."

Canada's economy is weak, with sputtering growth and rising unemployment. Tariffs have caused structural damage that reduces productive capacity and raises costs, limiting monetary policy's effectiveness. Interest-rate cuts can mitigate spillovers but cannot target specific sectors, help firms find new markets, or reconfigure supply chains. The Bank of Canada cut its key rate by 25 basis points and signaled that rates will remain while inflation stays near the two percent target. Economists interpret the Bank's stance as a prompt for the federal government to deploy unprecedented fiscal measures in the upcoming budget to support the economy.

Read at www.cbc.ca

Unable to calculate read time

Collection

[

|

...

]