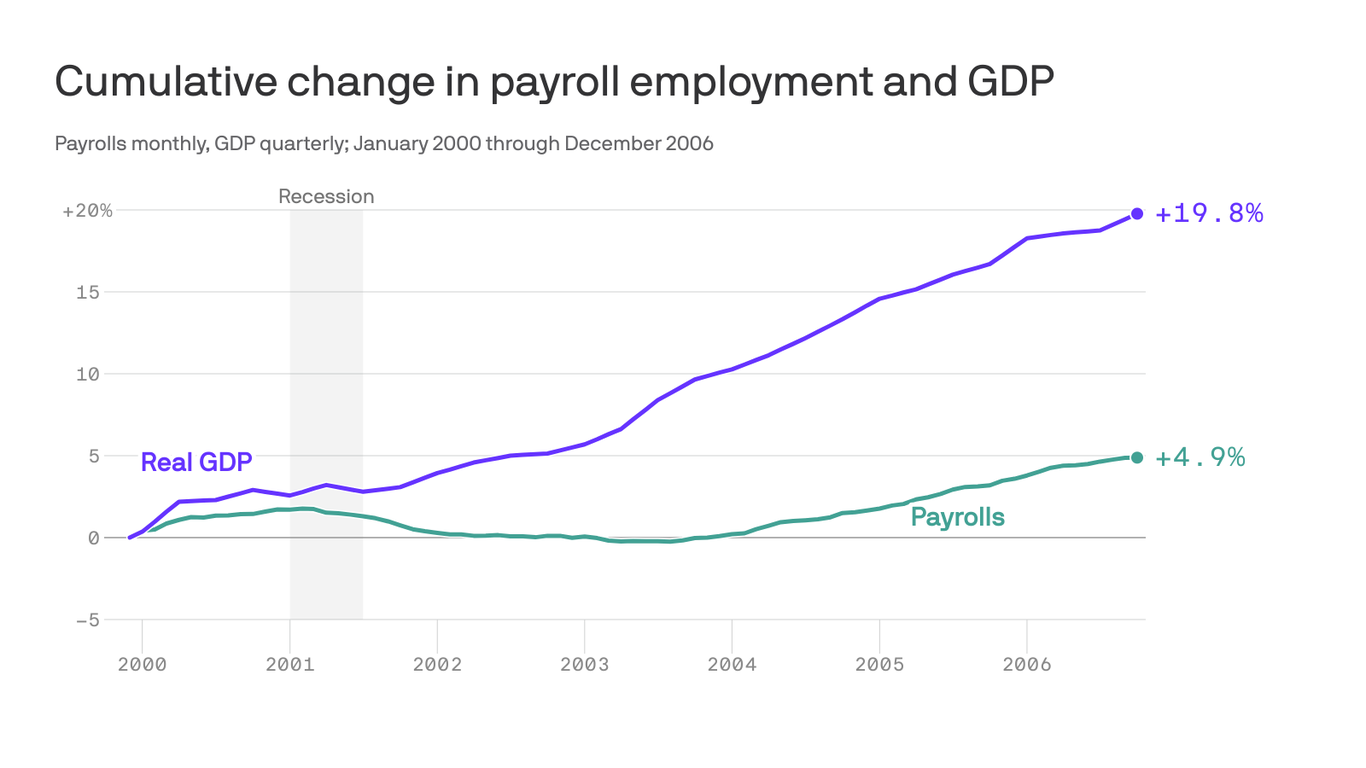

"The economists who make these calls would eventually conclude that there was a short recession in 2001, but it was a curious kind of recession - and at best a borderline call. GDP never fell for two consecutive quarters. GDP was narrowly up (0.2%) in 2001 and returned to solid growth in 2002. The GDP slump was caused by a collapse in investment in telecommunications equipment."

"After shedding 1.7 million jobs in 2001, employers cut another 518,000 in 2002. Year-on-year job growth was still negative as late as November 2003, two full years after the recession had technically ended. At year-end 2003, total employment was lower than it had been at the end of 1999 - while America's economic output was 10% higher."

"Between the lines: This combination of solid GDP growth and continued job losses reflected soaring productivity. Corporate America was finally getting the bang for its buck out of years of information technology investment. High productivity growth, in other words, can make society richer in the long run while causing, or at least coinciding with, a painful period of adjustment for workers."

The S&P 500 peaked in March 2000 and job growth turned negative in early 2001. Economists labeled 2001 a short, borderline recession even though GDP did not fall for two consecutive quarters and was narrowly up 0.2% that year, returning to solid growth in 2002. The GDP slump largely reflected a collapse in telecommunications equipment investment. Personal consumption expenditures remained positive throughout, bolstered by 2001 tax cuts and Federal Reserve rate cuts. Employers shed 1.7 million jobs in 2001 and another 518,000 in 2002, leaving employment below 1999 levels despite output being 10% higher. Rapid productivity gains, enabled by IT investment and outsourcing, allowed output to rise while employment lagged, producing a lengthy, jobless recovery.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]