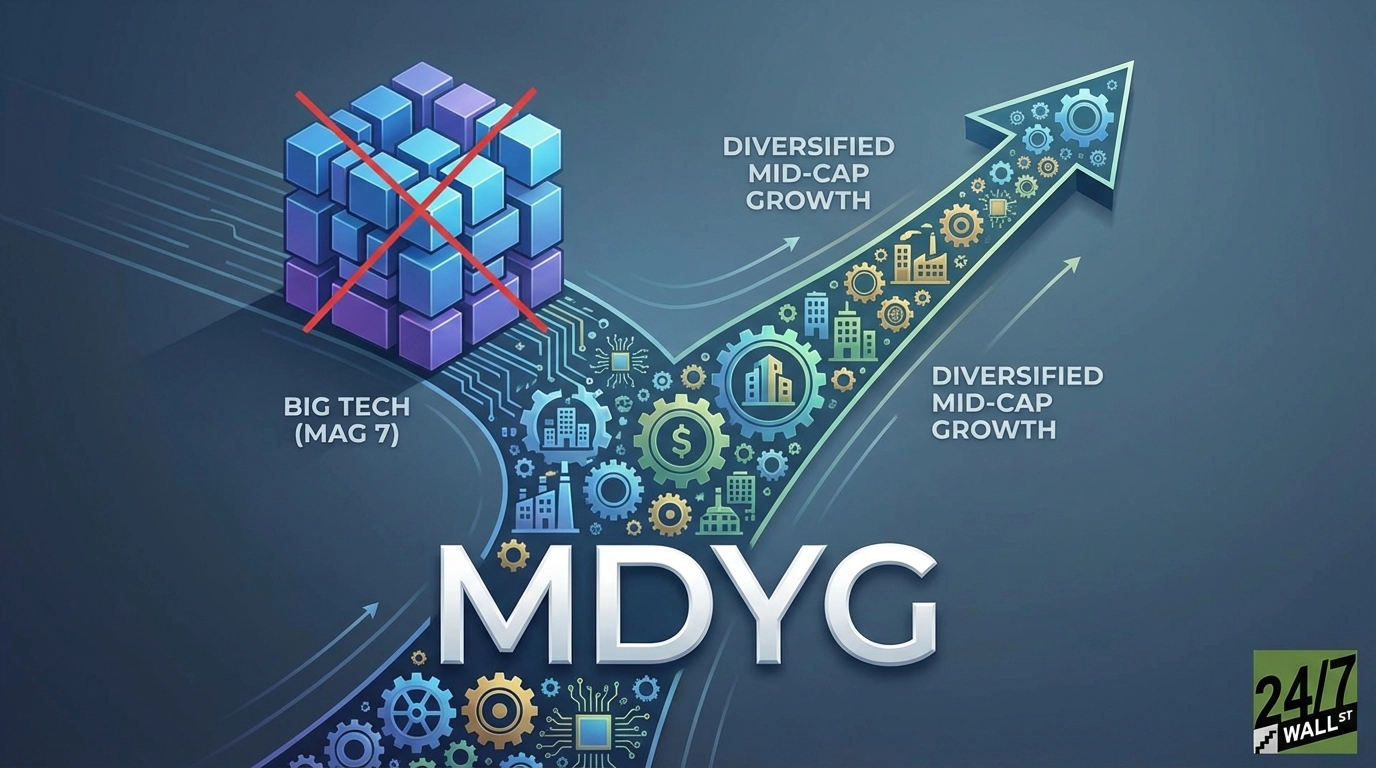

"The Magnificent Seven stocks now represent 35% to 40% of the S&P 500, creating historically high concentration risk. SPDR S&P 400 Mid Cap Growth ETF ( NYSEARCA:MDYG) offers a middle path, delivering growth exposure while sidestepping mega-cap tech dominance. Built for Diversified Growth Exposure MDYG takes a fundamentally different approach to growth investing than tech-heavy indexes. The fund allocates over a quarter of assets to industrials, providing exposure to the infrastructure and manufacturing renaissance that's reshaping the American economy."

"Technology holdings take a supporting role rather than dominating the portfolio, focusing on specialized players solving specific problems-optical networking, semiconductor equipment, and cloud infrastructure-rather than the consumer-facing mega-caps that drive traditional growth funds. The fund targets the sweet spot of mid-cap growth: companies that have proven their business models work but still have room to expand meaningfully. The 0.15% expense ratio positions MDYG competitively among mid-cap growth ETFs, keeping costs low enough that they won't meaningfully erode returns over time."

MDYG offers a middle path for growth investors by focusing on mid-cap companies rather than mega-cap technology leaders. The fund allocates over a quarter of assets to industrials to capture gains from infrastructure and manufacturing trends. Technology holdings play a supporting, specialized role in areas like optical networking, semiconductor equipment, and cloud infrastructure. The fund targets companies with proven business models that retain meaningful expansion potential. A 0.15% expense ratio keeps costs low, and a modest dividend yield provides small cash returns. MDYG traded higher stability for lower peak returns versus the Nasdaq-100's recent surge.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]