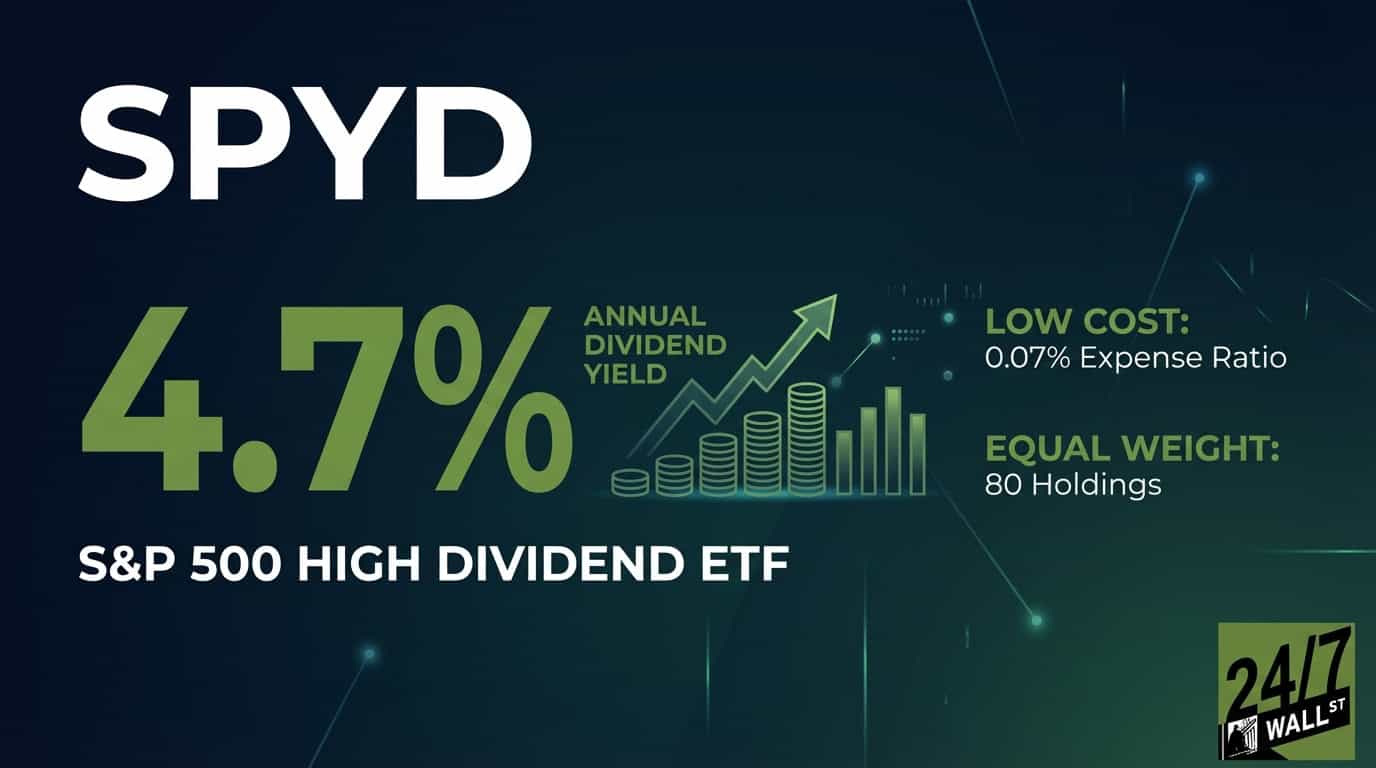

"While dividend ETFs like Schwab U.S. Dividend Equity ETF ( NYSEARCA:SCHD) dominate retail investor conversations, SPDR Portfolio S&P 500 High Dividend ETF ( NYSEARCA:SPYD) has quietly delivered a 4.7% yield at rock-bottom cost. With $7.4 billion in assets and a 0.07% expense ratio, this equal-weight ETF tracks the 80 highest-yielding S&P 500 stocks through a straightforward approach: invest in companies paying the fattest dividends, rebalance twice yearly, and distribute income quarterly."

"SPYD generates income purely from dividends paid by its underlying holdings. Unlike option-income ETFs that sell call premiums, this ETF simply collects and passes through dividend payments from 80 large-cap stocks. The equal-weight methodology means each position represents roughly 1.0-1.7% of the portfolio, avoiding concentration risk while maintaining heavy exposure to consumer staples (16.1%), financials (15.7%), and utilities (13.6%)."

"CVS Health ( NYSE:CVS) (1.72% weighting) presents the most alarming case. With earnings per share of $0.38 against a $2.66 annual dividend, the company pays out approximately 700% of earnings as dividends. Quarterly earnings collapsed 43.2% year-over-year, and profit margin sits at 0.12%. This mathematically unsustainable situation suggests an imminent dividend cut unless the company can pull off a heroic turnaround."

SPDR Portfolio S&P 500 High Dividend ETF (SPYD) yields 4.7% while charging a 0.07% expense ratio and holding $7.4 billion in assets. The ETF uses an equal-weight approach across the 80 highest-yielding S&P 500 stocks, rebalances twice yearly, and distributes income quarterly. SPYD generates income solely from dividends rather than option premiums. Position weights range roughly 1.0–1.7%, reducing concentration and resulting in heavy exposure to consumer staples (16.1%), financials (15.7%), and utilities (13.6%). Dividend sustainability varies among top holdings, with some companies showing financially unsustainable payouts and others exhibiting more manageable payout ratios and growth.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]