"As investors turned their back on software (notably, the seat-based software-as-a-service companies), they're turned towards hardware in a big-time way. You wouldn't know it by looking at those flat shares of Nvidia ( NASDAQ:NVDA), but the iShares Semiconductor ETF ( NASDAQ:SOXX) is up around 13% year to date, with few signs of slowing down. The winners within semis have been broad, but the undisputed kings of the 2026 semiconductor surge belongs to the memory and storage stocks."

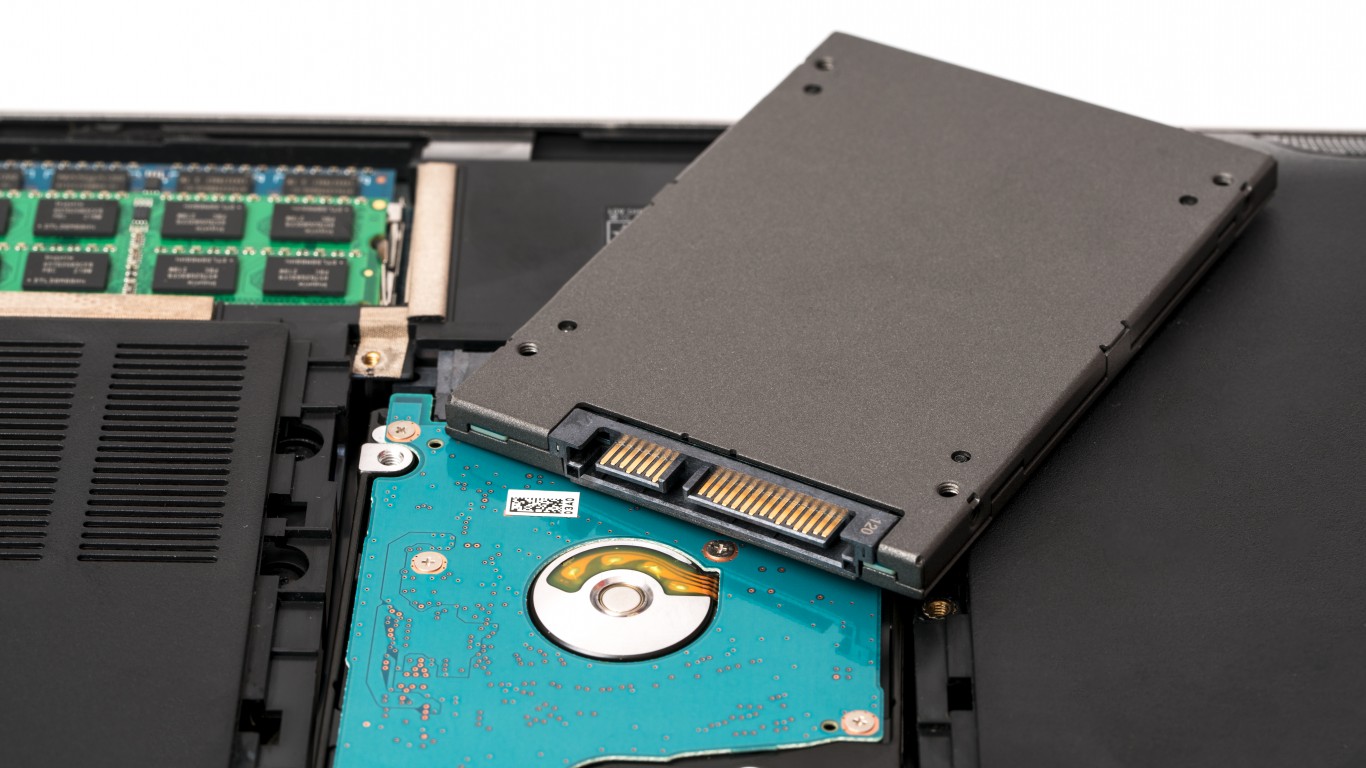

"Undoubtedly, storage stands out as the massive bottleneck in this AI boom, especially as backlogs swell and lead times spike. As AI agents and a new slate of AI-native apps hit the market, perhaps the memory storage demand could intensify, allowing the big players to raise the bar on pricing. It's not just the AI revolution that's powering this unprecedented memory storage boom."

Investors have shifted focus from seat-based SaaS to hardware, buoying semiconductor gains such as a roughly 13% year-to-date rise in the iShares Semiconductor ETF. Memory and storage stocks lead the 2026 semiconductor surge, with Sandisk up about 1,747% and Western Digital roughly 455% over the past year. Storage is a major bottleneck for AI, as backlogs swell and lead times increase while AI agents and AI-native applications expand demand. Quantum computing prospects drive additional demand through "Harvest [data] now, Decrypt Later" strategies. Pricing power has risen for major storage suppliers, and normalization timing remains uncertain.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]