"The world's largest construction equipment manufacturer generated $17.64 billion in Q3 revenue, marking 9.5% year-over-year growth driven by robust equipment sales. Operating margin compressed from 19.5% to 17.3% due to elevated manufacturing costs and tariff impacts. With a market capitalization of $288.3 billion, Caterpillar commands a premium valuation at 27x forward earnings and 21.6x EV/EBITDA. The company maintains exceptional return on equity of 46.3% and generated $4.05 billion in adjusted EBITDA during the quarter."

"Concerning signals emerged in late November and early December 2025. CFO Andrew Bonfield sold 10,000 shares at prices between $568.57 and $574.52, while Executive Chairman Donald Umpleby III disposed of 2,350 shares. Group Presidents Jason Kaiser and Denise Johnson executed significant stock dispositions at similar price levels. The stock's RSI reached 70.76 on December 10, indicating overbought territory near its 52-week high of $617.23. Analyst consensus remains mixed with 14 buy ratings balanced against 14 hold or sell ratings, and the $589.07 target price"

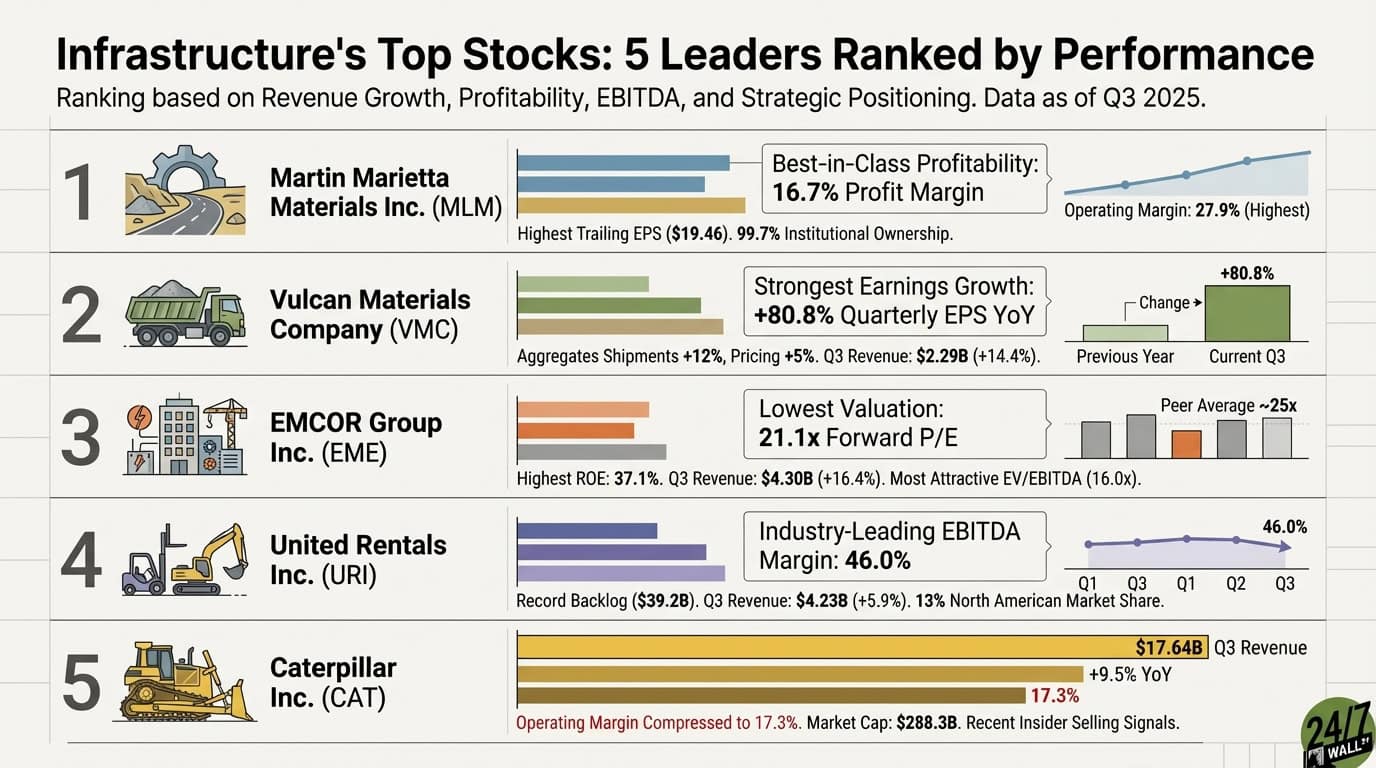

Infrastructure sector performance in Q3 2025 was mixed, marked by demand strength alongside margin compression and operational challenges. Caterpillar posted $17.64 billion in revenue, up 9.5% year-over-year, while operating margin fell from 19.5% to 17.3% because of higher manufacturing costs and tariffs; the company delivered $4.05 billion in adjusted EBITDA, a 46.3% return on equity, and trades at elevated multiples with notable insider share sales and an overbought RSI. United Rentals reported $4.23 billion in revenue, up 5.9%, with industry-leading but declining EBITDA margins of 46.0%, a record $39.2 billion backlog, 13% North American share, and $1.95 billion in adjusted EBITDA.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]