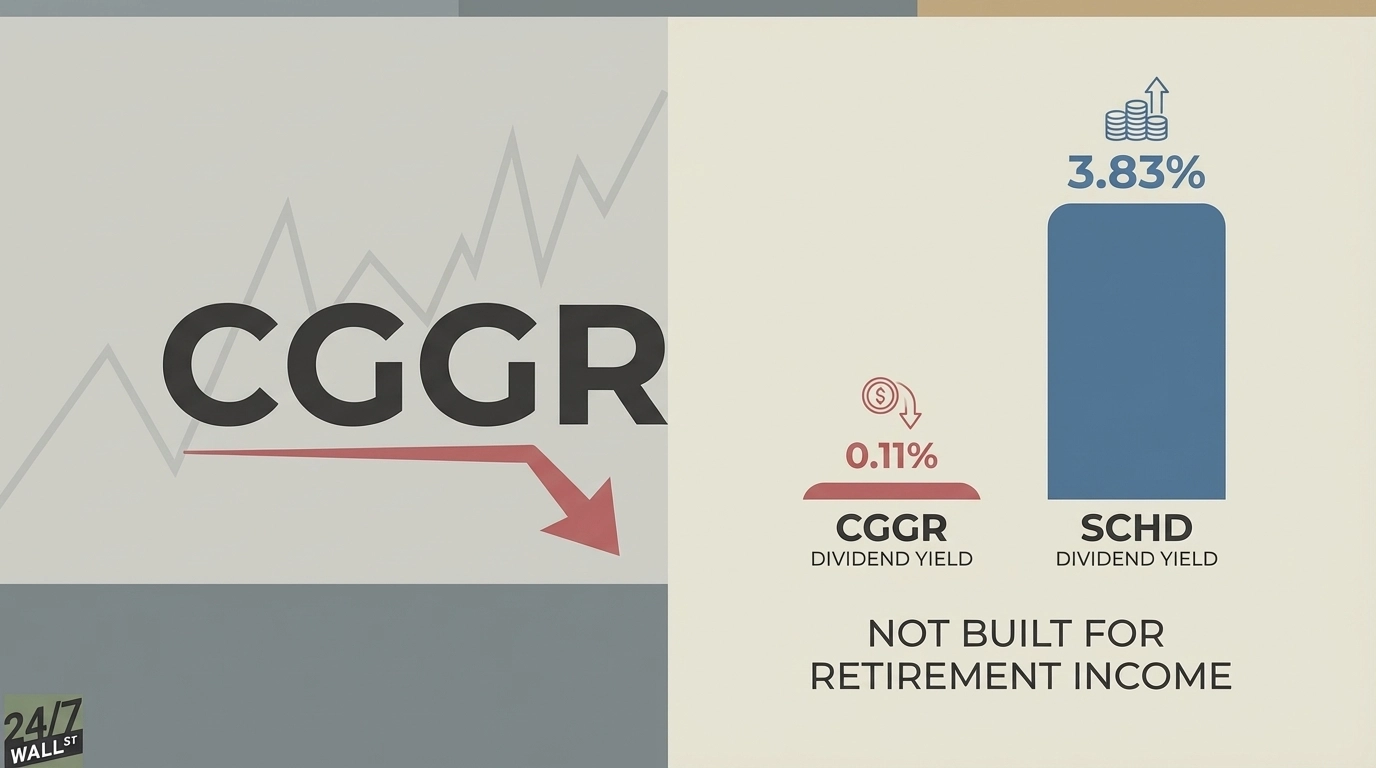

"CGGR's mandate is clear: provide growth through companies with superior appreciation potential. With over 57% concentrated in Information Technology, Communication Services, and Consumer Discretionary sectors, the fund pursues capital gains rather than dividend income. Top holdings include Meta Platforms (NASDAQ:META) (7.6%), Tesla (NASDAQ:TSLA) (6%), Broadcom (NASDAQ:AVGO) (5.7%), and Nvidia (NASDAQ:NVDA) (4.9%). The fund's 0.11% dividend yield tells the real story for retirees. A $500,000 investment would generate approximately $550 annually, barely covering monthly utilities."

"More concerning, CGGR's 2025 distribution of $0.04 represents a 65% decline from the $0.12 paid in 2024, signaling this minimal income stream lacks reliability. Performance Comes With Volatility CGGR has delivered on its growth promise, returning 20.9% year-to-date in 2025 and outperforming the S&P 500 by roughly 3.6 percentage points. Since its February 2022 inception, the actively managed fund has beaten its benchmark through concentrated positions in high-conviction growth names."

"But that outperformance demands tolerance for significant volatility. Holdings like Tesla, MicroStrategy (NASDAQ:MSTR) (0.56%), and Snap (NYSE:SNAP) (0.32%) can swing dramatically during market stress, precisely when retirees need stability. The fund's 16% portfolio turnover keeps tax efficiency reasonable, but the underlying holdings carry risk profiles unsuited to capital preservation. Using CGGR in retirement means accepting three fundamental compromises. First, income generation becomes nearly impossible, forcing retirees to sell shares systematically to"

CGGR focuses on capital appreciation by investing heavily in Information Technology, Communication Services, and Consumer Discretionary, with top holdings like Meta, Tesla, Broadcom, and Nvidia. The fund offers a 0.11% dividend yield, producing roughly $550 annually on a $500,000 investment, and its 2025 distribution dropped to $0.04 from $0.12 in 2024. The fund returned 20.9% year-to-date in 2025 and outperformed the S&P 500, aided by concentrated high-conviction positions, but those positions introduce significant volatility. A 16% portfolio turnover helps tax efficiency, yet risk profiles undermine capital preservation and reliable retirement income.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]