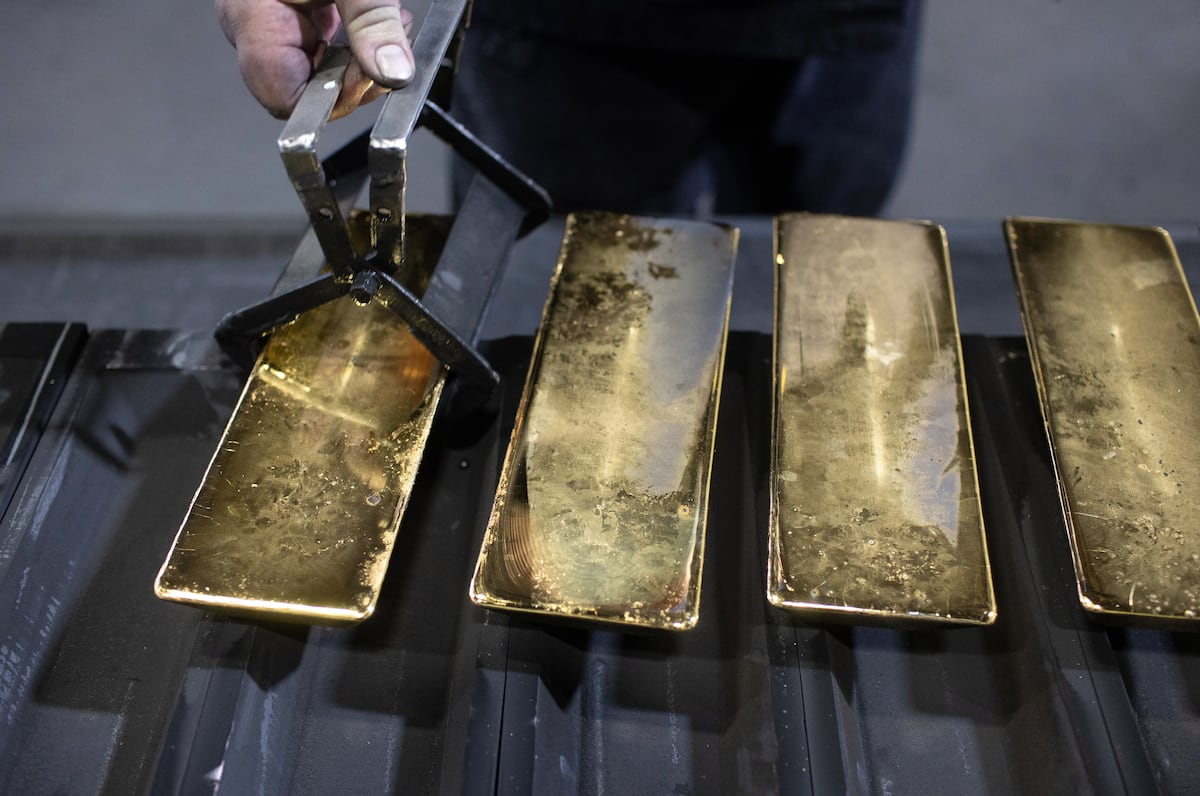

"Gold has gone crypto. The metal is now in its third consecutive year of gains and has nearly doubled in value between 2024 and 2025, shattering record after record until it broke through the $4,000-per-ounce barrier on Wednesday. Investor euphoria is reflected in the massive inflows into gold ETFs (exchange-traded funds that trade like stocks). According to the World Gold Council, the third quarter of 2025 set an all-time record for inflows into physically backed gold ETFs, totaling $26 billion."

"Central bank purchases have been a key driver of the rally. Monetary authorities have been stockpiling gold as a way to diversify reserves, reduce their dependence on the U.S. dollar, and even, if necessary, shield themselves from U.S. sanctions. The expected interest rate cuts in the United States are another factor: holding gold becomes more attractive when bond yields fall and inflation remains a threat."

"At the height of the cryptocurrency boom, when digital assets skyrocketed in value in 2023 and 2024, the idea spread that bitcoin could become the new gold the ultimate safe haven asset to which investors should automatically allocate part of their portfolios, even ahead of the precious metal itself. But now, as geopolitical risks mount and the U.S. dollar loses some of its appeal as a global benchmark, gold has firmly reasserted its dominance."

Gold has emerged as the leading safe-haven asset, gaining more than 50% in 2025 and nearly doubling between 2024 and 2025. The metal reached a record above $4,000 per ounce and entered a third consecutive year of gains. Massive inflows into physically backed gold ETFs set an all-time quarterly record of $26 billion in Q3 2025. Central banks have been major buyers, stockpiling gold to diversify reserves, reduce dollar dependence, and potentially shield against sanctions. Expectations of U.S. interest rate cuts and a weaker dollar have lowered the opportunity cost of holding gold, attracting institutional, speculative, and retail investors.

Read at english.elpais.com

Unable to calculate read time

Collection

[

|

...

]