"The company says those affiliates "have access to the Platform on terms and conditions that are not preferential relative to other Participants, including compliance with all Rules" and "have not received capital from the Company." It also states that affiliates "do not have access to the Company's operations, including its servers, databases, accounts, or source code, except to the extent that other Participants have such access and, in that event, only on the same terms and conditions applicable to other Participants.""

"Beyond access and capital limits, the filing requires that affiliates "act in a fair and responsible manner in all of its activities on the Platform" and disclose "to the Company of any actual or potential conflicts of interest in its operations, algorithms, or systems." Taken together, the commitments are meant to show regulators that Gemini is building its prediction markets business with market integrity front and center."

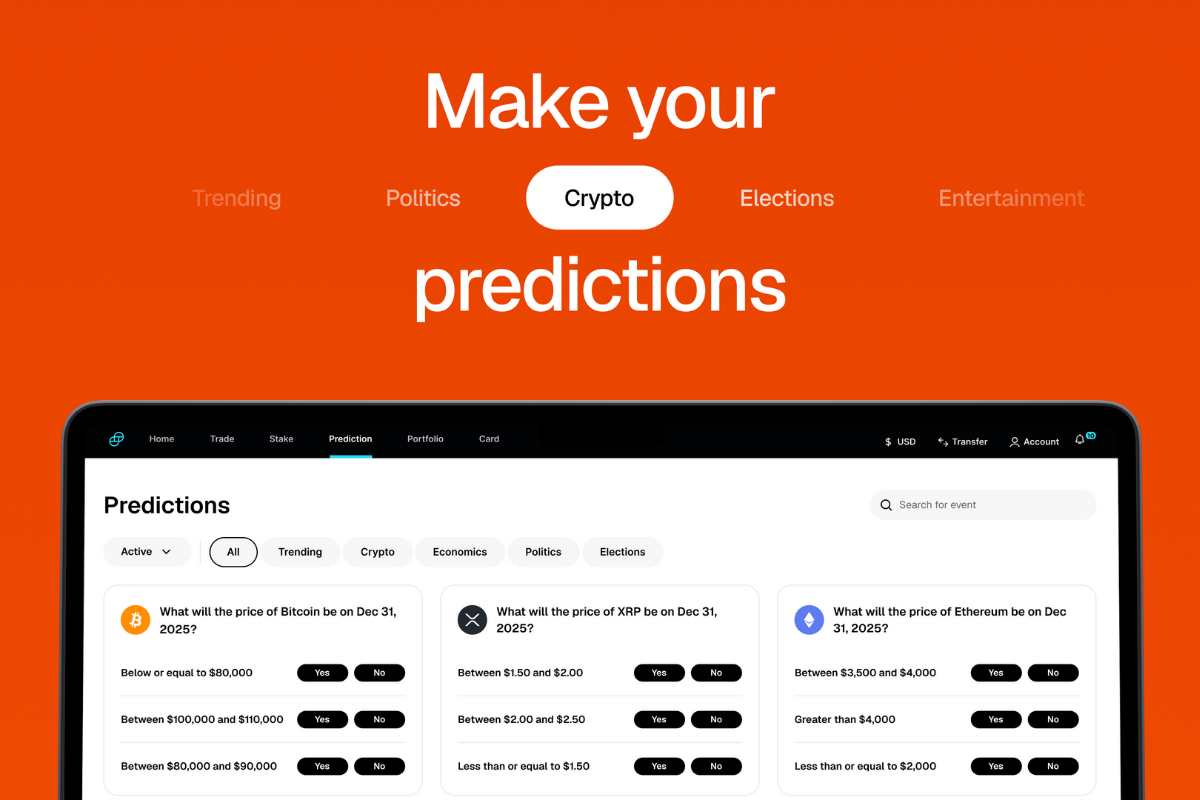

A regulatory filing to the U.S. Commodity Futures Trading Commission and internal compliance documents outline how Gemini will structure a federally compliant prediction market via Gemini Titan. Affiliates will face strict guardrails: no preferential access, no capital from the company, limited operational access only on parity with other participants, and mandatory disclosure of actual or potential conflicts. Affiliates must act fairly and responsibly on the platform. Gemini Titan has secured a CFTC Designated Contract Market license to list event contracts that allow yes-or-no positions tied to financial indicators or real-world developments, aligning with changes at the parent company.

Read at ReadWrite

Unable to calculate read time

Collection

[

|

...

]