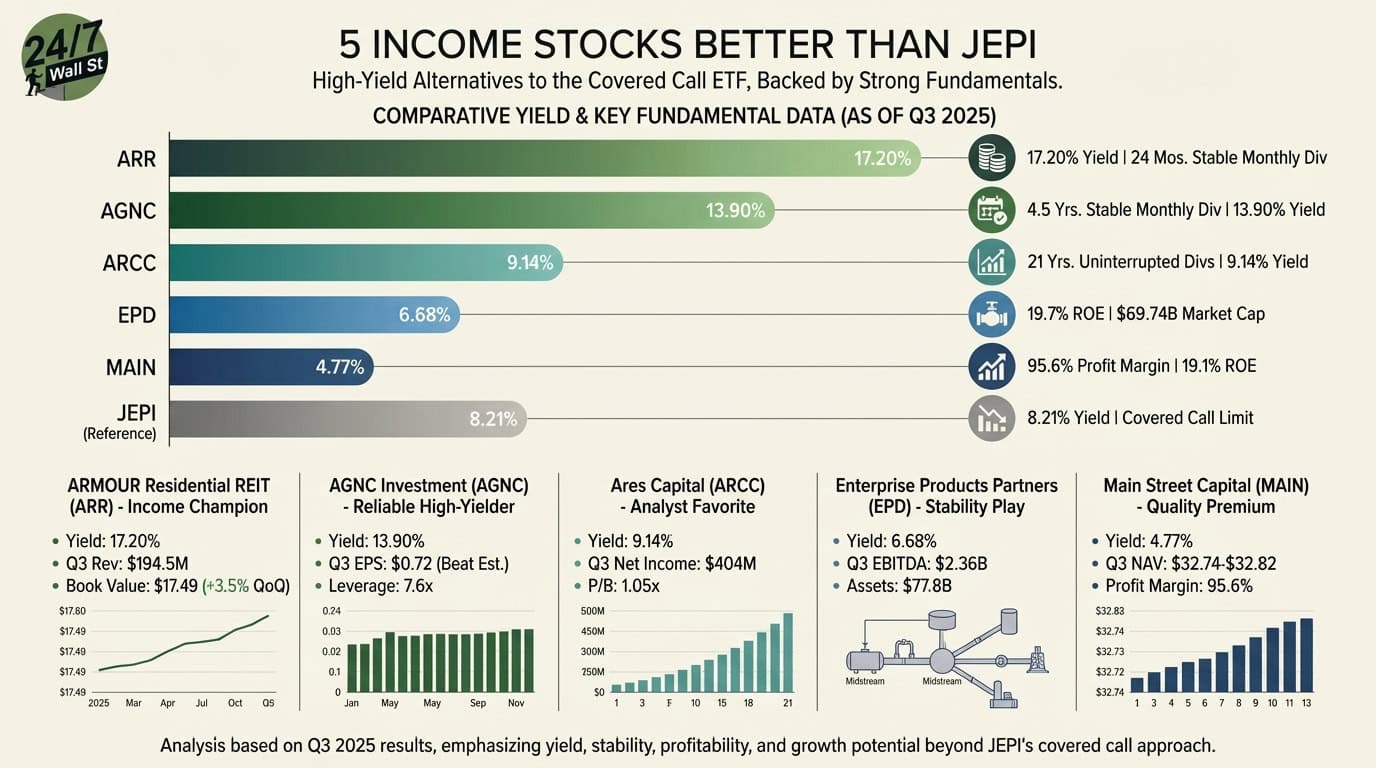

"Enterprise Products Partners offers a 6.68% distribution yield through its massive midstream energy infrastructure. While this trails JEPI's 8.21% yield, EPD compensates with exceptional stability and scale. The Houston-based partnership operates pipelines and facilities for transporting natural gas, NGLs, crude oil, and petrochemicals across North America. With $69.74 billion in market cap and $53 billion in trailing revenue, EPD dwarfs the other stocks on this list."

"Third quarter 2025 results demonstrated consistent cash generation: net income reached $1.34 billion on revenue of $12 billion, with EBITDA of $2.36 billion. Operating cash flow of $1.74 billion exceeded capex of $1.96 billion, though the partnership maintains flexibility with total assets of $77.8 billion against debt of $33.6 billion. EPD's 19.7% return on equity leads all five stocks, while its 0.575 beta indicates the lowest volatility. The partnership has maintained its $0.54 quarterly distribution with 32.9% insider ownership demonstrating strong management alignment."

JEPI has become a popular income investment since its 2020 launch, delivering an 8.21% yield through a covered call strategy on blue-chip stocks. Five stocks deliver superior distributions backed by strong fundamentals and proven track records. Enterprise Products Partners offers a 6.68% distribution yield via extensive midstream energy infrastructure and exceptional stability. The Houston-based partnership operates pipelines and facilities across North America and reports $69.74 billion market cap and $53 billion trailing revenue. Third quarter 2025 showed net income of $1.34 billion, revenue of $12 billion, EBITDA of $2.36 billion, and strong operating cash flow versus capex. The MLP structure requires K-1 tax forms.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]