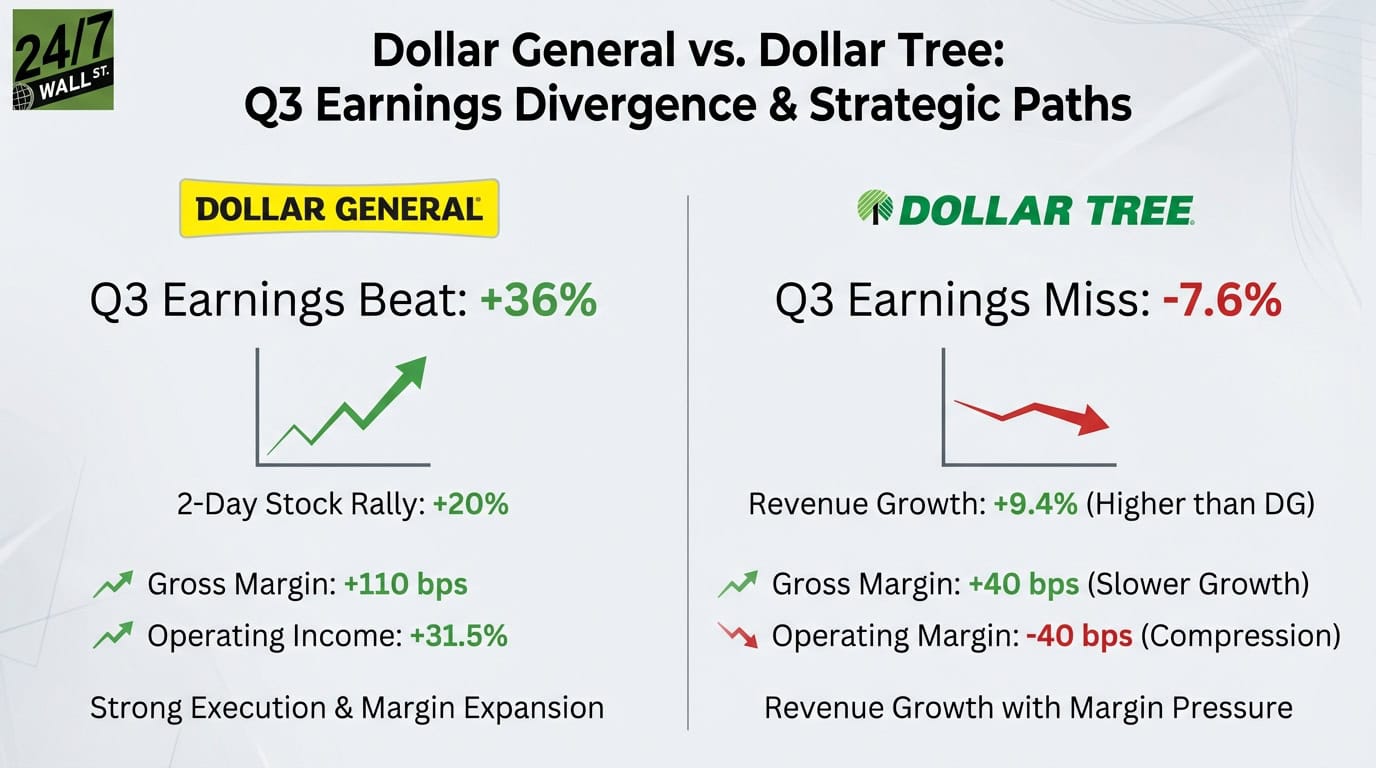

"Dollar General reported Q3 earnings of $1.28 per share against estimates of $0.94, a $0.34 surprise marking its fourth consecutive quarterly beat. Revenue of $10.65 billion edged past the $10.60 billion consensus despite 4.6% year-over-year growth. Gross margin climbed 110 basis points to 29.9% from higher inventory markups and lower shrink. Operating income jumped 31.5% to $425.9 million. CEO Todd Vasos announced 4,885 real estate projects planned for fiscal 2026. Same-store sales rose 2.5%, driven by pricing power and a shift toward higher-margin categories."

"Dollar Tree's Q3 told a messier story. Revenue of $4.75 billion missed the $4.79 billion estimate despite 9.4% year-over-year growth, double Dollar General's pace. Adjusted earnings of $1.21 per share beat the $1.10 estimate, but gross margin expanded only 40 basis points to 35.8%. Operating margin declined 40 basis points to 7.2%, even as revenue accelerated. Same-store sales of 4.2% beat Dollar General's 2.5%, but margin compression suggests growth came at a cost."

Dollar General beat Q3 earnings expectations, reporting $1.28 per share versus a $0.94 estimate and $10.65 billion in revenue with 4.6% year-over-year growth. Gross margin rose 110 basis points to 29.9% and operating income increased 31.5% to $425.9 million. Same-store sales climbed 2.5% and management announced 4,885 real estate projects for fiscal 2026 while emphasizing higher-margin categories and premium packaging. Dollar Tree posted $4.75 billion in revenue, grew 9.4% year-over-year but missed estimates, delivering adjusted earnings of $1.21. Gross margin expanded 40 basis points to 35.8% while operating margin fell 40 basis points to 7.2%, indicating margin compression amid multi-price expansion.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]