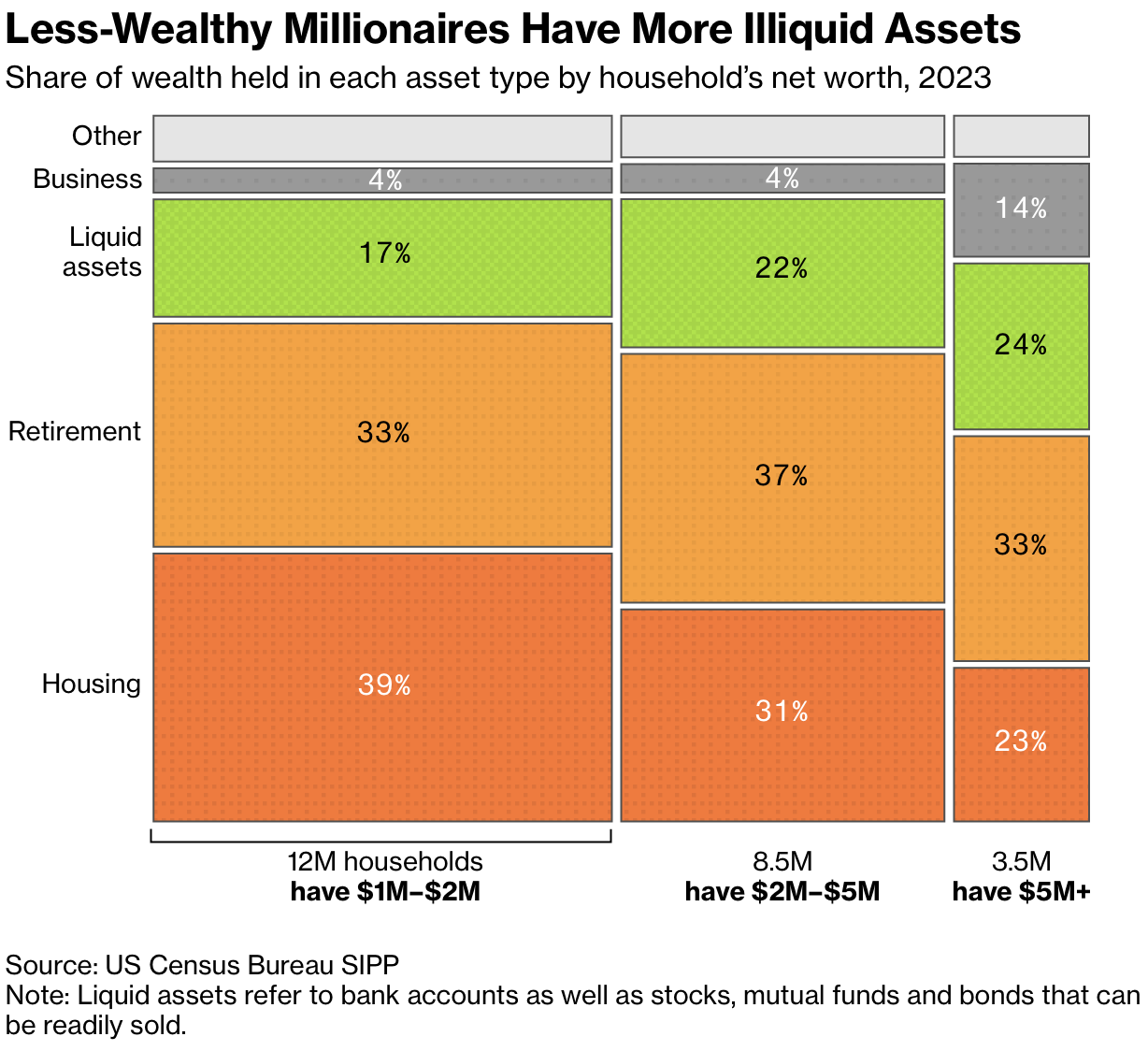

"Everyone loves reading about millionaires who don't have enough liquidity to buy things, but the seven-figure status is not what it once was. For Bloomberg, Andre Tartar, Ben Steverman, and Stephanie Davidson show the increasing number of millionaire households who have most of their net worth tied up in housing and retirement accounts."

"The mosaic plot above breaks down assets by millionaire income groups. About half of households fall within the $1M to $2M range and only 17% of their net worth counts as liquid assets (in green). The liquid share increases with net worth."

Many millionaire households hold the bulk of their net worth in non-liquid assets such as primary residences and retirement accounts. Asset composition varies across net worth groups, with about half of households between $1 million and $2 million. Households in the $1M–$2M range have only about 17% of net worth in liquid assets. The share of liquid assets increases as net worth rises, indicating that higher-net-worth millionaires hold a larger fraction of wealth in liquid forms. As a result, seven-figure net worth often overstates immediate spending power for many households.

Read at FlowingData

Unable to calculate read time

Collection

[

|

...

]