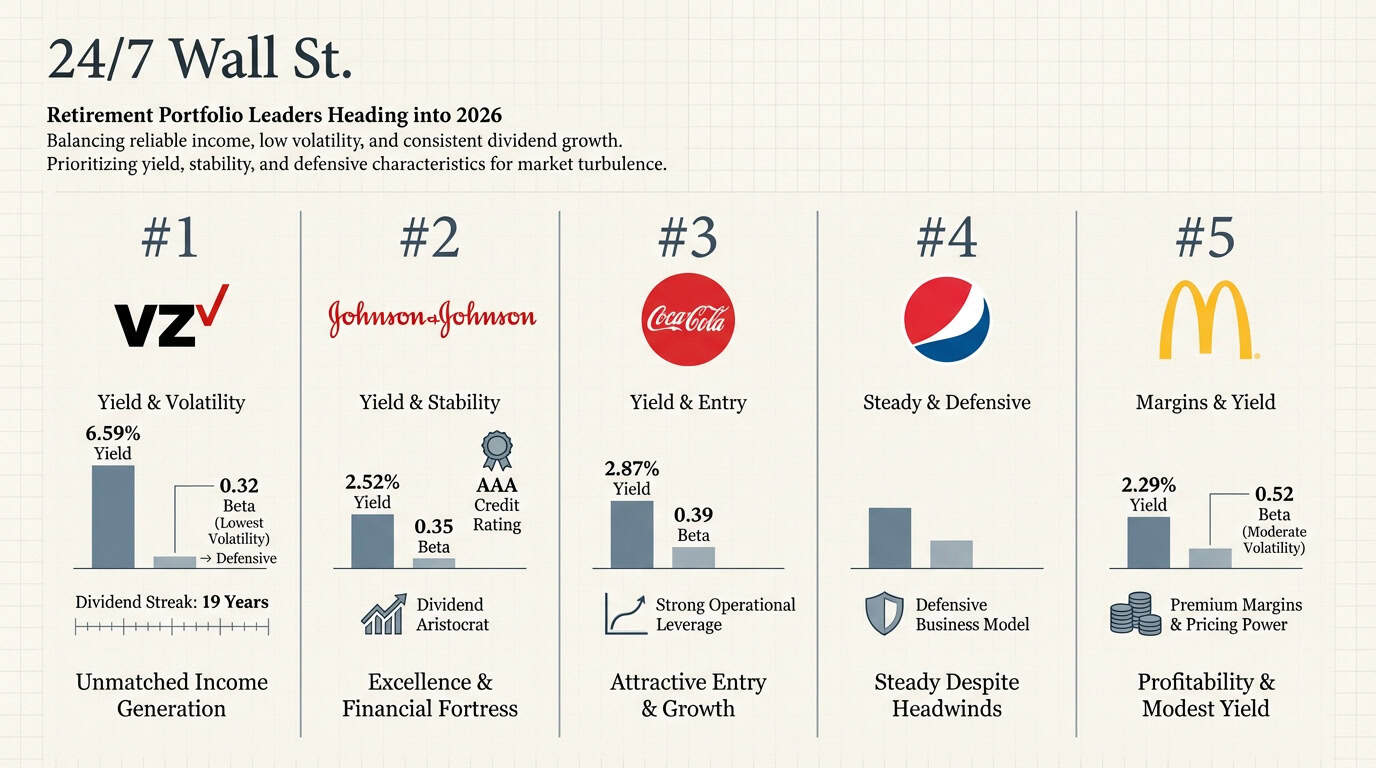

"For investors approaching or in retirement, the right stock portfolio balances reliable income, low volatility, and consistent dividend growth. Among six prominent dividend-paying stocks, five stand out for their financial stability, income generation, and defensive characteristics that help retirees navigate market turbulence. The evaluation prioritized dividend yield, dividend growth consistency, earnings stability, low volatility measured by beta, and strong cash flow generation. Secondary factors included profit margins, debt levels, and market position. Here's how the top five retirement stocks rank heading into 2026."

"McDonald's claims fifth with a 2.29% dividend yield and $7.08 annual payout per share. The fast-food giant's beta of 0.52 indicates moderate volatility, making it less defensive than other contenders but still suitable for conservative portfolios. What sets McDonald's apart is profitability. The company posted a 46.90% operating margin and 32% profit margin in its most recent results, demonstrating pricing power few restaurant operators can match."

Retirement-focused portfolios prioritize reliable income, low volatility, and steady dividend growth. Selection criteria emphasized dividend yield, dividend growth consistency, earnings stability, low beta, and strong cash flow, with profit margins, leverage, and market position as secondary considerations. Five dividend-paying stocks emerged as top retirement holdings heading into 2026. McDonald's ranks fifth with a 2.29% yield, $7.08 annual payout, 0.52 beta, and notably high operating (46.90%) and profit (32%) margins; revenue rose from $19.208 billion in 2020 to $25.920 billion in 2024 while net income nearly doubled. PepsiCo ranks fourth despite near-term earnings pressure.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]