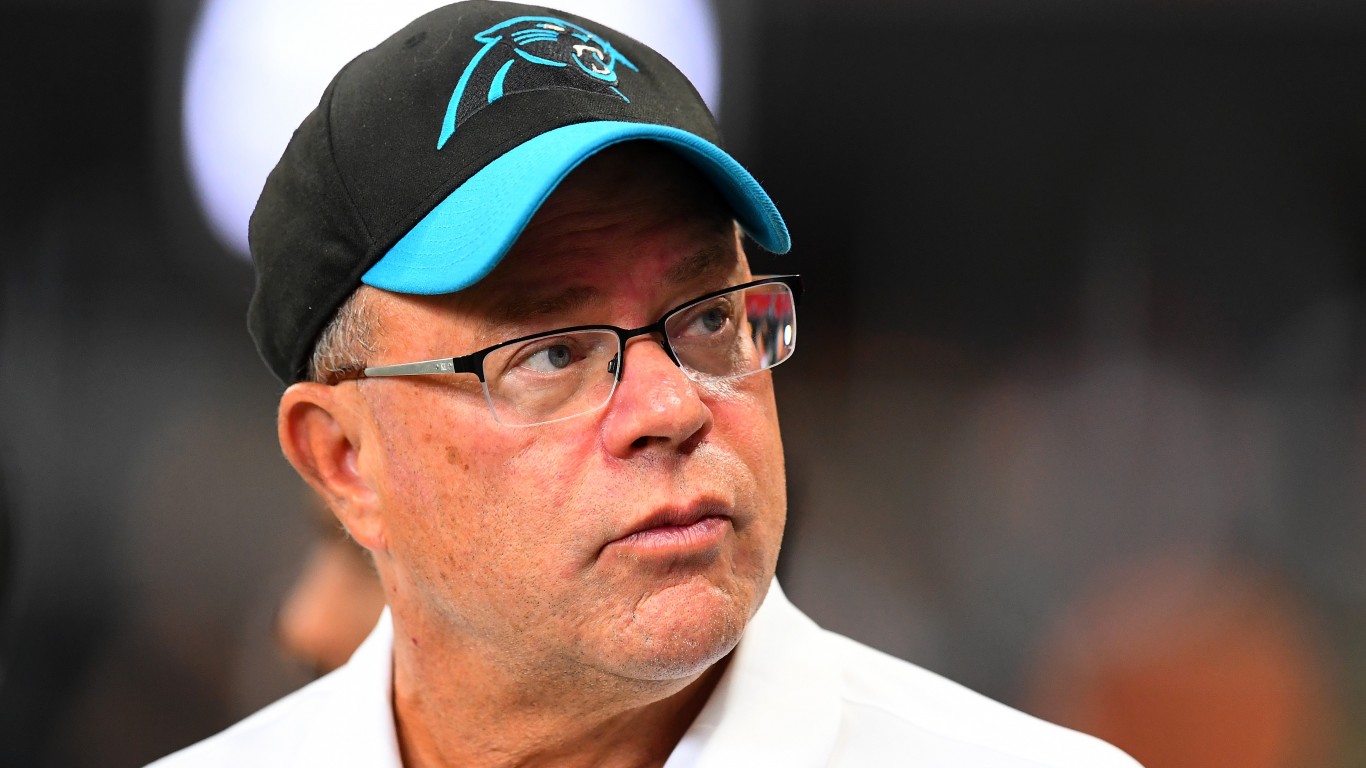

"David Tepper is a genius investor to follow if you seek to thrive in markets long-term. Appaloosa is heavy on the large-cap tech stocks, including those found in the Magnificent Seven group. If you're looking for some stocks with huge potential, make sure to grab a free copy of our brand-new "The Next NVIDIA" report. It features a software stock we're confident has 10X potential."

"Hedge-fund billionaire David Tepper has made recent portfolio adjustments. Appaloosa Management reduced its stake in Broadcom�Inc. in the most recent quarter, while substantially increasing its position in UnitedHealth Groups. He is also reducing stakes in semiconductor giants like Nvidia and increasing exposure to Chinese equities like Alibaba. He has publicly stated he won't "fight the Fed" despite feeling "miserable" about the market."

David Tepper's hedge fund, Appaloosa Management, holds a concentrated portfolio with heavy exposure to large-cap technology names, many tied to the generative AI boom. Recent adjustments include a reduced stake in Broadcom and cuts to semiconductor positions such as Nvidia, while substantially increasing exposure to UnitedHealth Group and Chinese equities including Alibaba. Appaloosa's top four stocks comprise roughly 37% of the fund's weight, reflecting high conviction in a handful of leaders. Tepper has acknowledged discomfort with current market conditions but signaled he will not 'fight the Fed.' Appaloosa remains positioned to benefit from continued dominance of major tech firms.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]