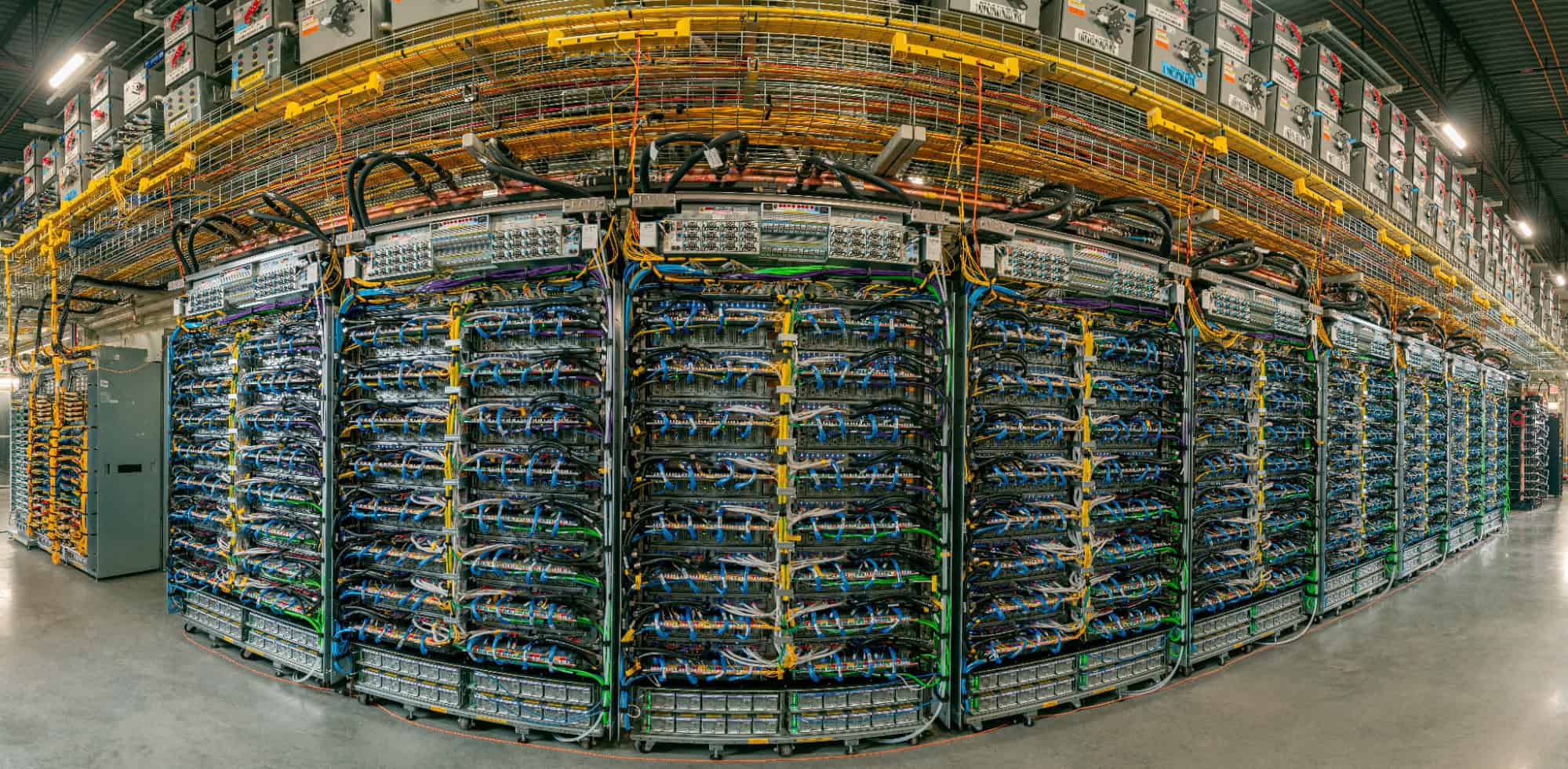

"Hyperscalers are collectively pouring approximately $700 billion into AI CapEx in 2026. Amazon ( Nasdaq: AMZN) | AMZN Price Prediction just announced $200 billion in planned spend, Alphabet ( Nasdaq: GOOGL) is projected $185, Meta Platforms ( Nasdaq: META) up to $135 billion, and Microsoft will reveal an updated capex target closer to summer. That kind of spending makes it "hard to bet against Nvidia," as one analyst put it."

"Hyperscaler spending is concentrated among the mega-cap tech giants. Alphabet, Meta Platforms, Microsoft ( NASDAQ:MSFT), and Amazon are deploying massive capital into AI infrastructure and cloud computing, with Microsoft's Azure and Amazon's AWS competing for AI workload dominance. Together, these hyperscalers are funding the largest technology infrastructure expansion in history. Secondary spending comes from 'neoclouds' like CoreWeave and Nebius, while other projects like sovereign AI data centers add even more fuel to the rapidly growing spending pie."

Hyperscalers plan roughly $700 billion in AI capital expenditures in 2026, led by Amazon ($200B), Alphabet ($185B), and Meta ($135B), with Microsoft updating targets soon. Mega-cap companies are deploying massive capital into AI infrastructure and cloud computing as Azure and AWS compete for AI workloads. Secondary spending comes from neoclouds like CoreWeave and Nebius, plus sovereign AI data center projects. Nvidia has seen explosive Data Center revenue growth across training and inference but its stock remains essentially flat year-to-date. The market appears to price execution risk or uncertainty about sustained GPU demand beyond initial buildout. Broadcom, Micron, and Bloom Energy have shown stronger recent gains.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]