"In this silent divergence, the firms who understand how to wield AI at scale will not just outcompete others-they'll reshape the rules of the game before the rest realize the game has changed."

"The capacity to synthesize, simulate, and act on data faster than the market, the regulator, or even the client can perceive is emerging as the new force in finance."

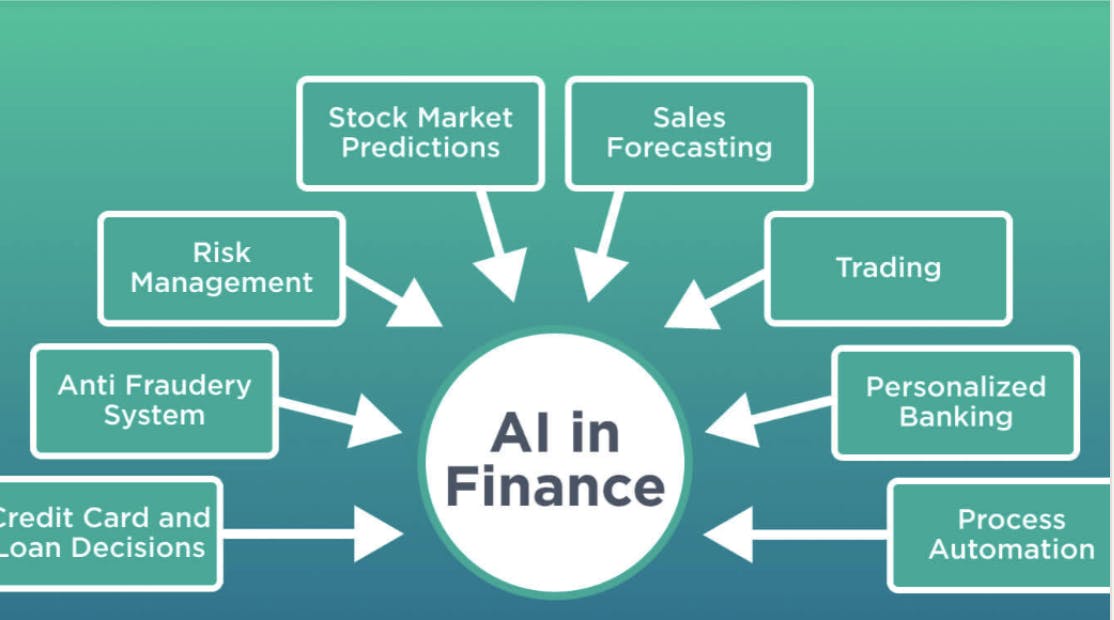

AI has become a critical topic in corporate strategy discussions, particularly on Wall Street. However, a new challenge is emerging: the Intelligence Gap. This gap highlights a divergence in firms' abilities to leverage AI, leading to systemic risks based on knowledge asymmetries. Those firms capable of rapidly synthesizing and acting on information will reshape competitive landscapes. Traditional competitive advantages are evolving as intelligence capital, or the ability to quickly assimilate data, becomes crucial for success in the financial sector. This newfound focus on cognitive compounding is often overlooked, signifying a future where speed and knowledge dictate market leadership.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]