"Apple's valuation metrics show a forward P/E of 33x and a trailing P/E of 36x, these are premium multiples for a company that hasn't had a blockbuster product in years. The company's most recent fiscal year showed earnings growth following two years of near-stagnation. Retail sentiment data from Reddit supports this 'richly valued' view, and our data shows bearish sentiment scores in the 32-38 range on r/wallstreetbets while r/stocks hovers around neutral."

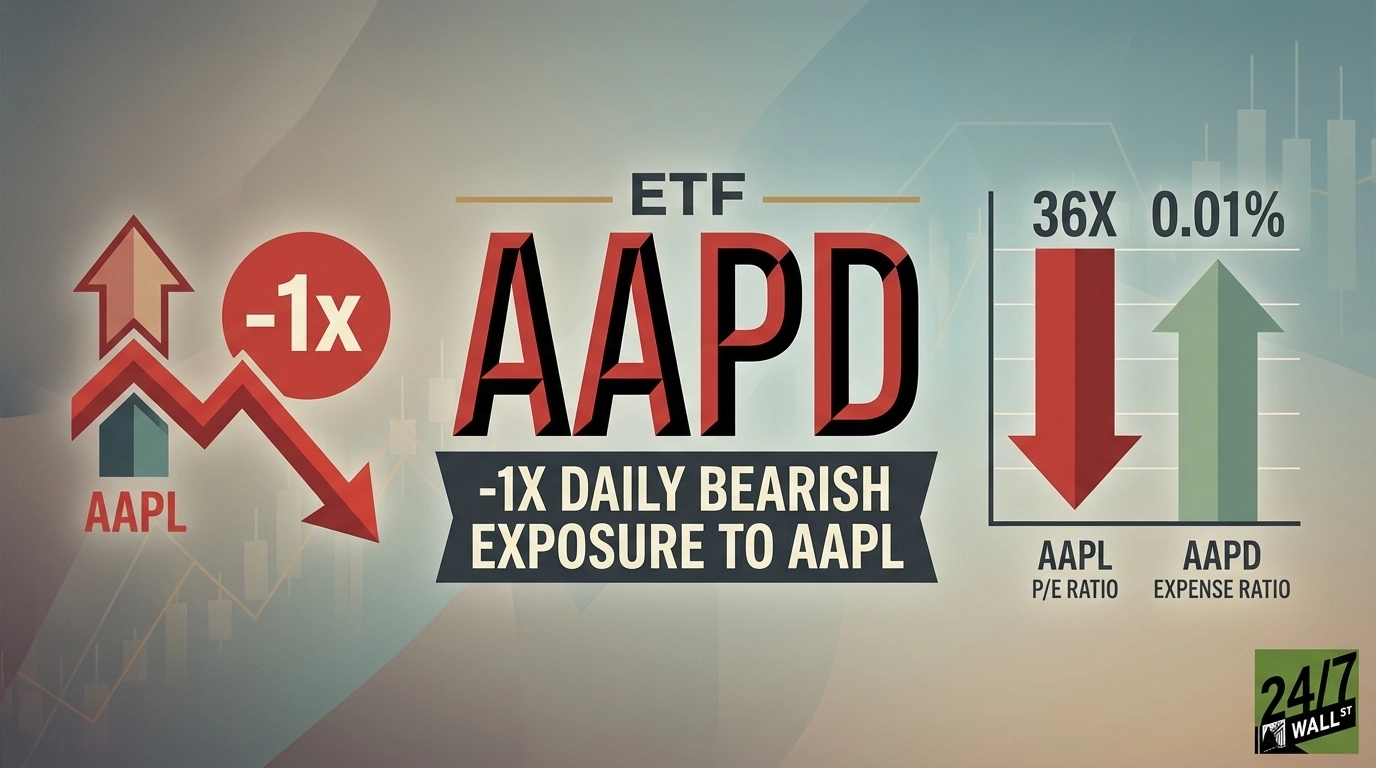

"AAPD provides -1x daily inverse exposure to Apple's stock price through derivatives. The ETF carries a 0.01% expense ratio and holds $18.9 million in assets under management. The ETF resets its exposure each day through daily rebalancing. Returns over periods longer than one day will deviate from a simple inverse of Apple's performance due to compounding effects. Direxion's daily fact sheet provides updated performance data showing how compounding affects returns."

"The ETF's asset base of $18.9 million affects liquidity characteristics. Daily volume and bid-ask spreads widen during Apple's earnings announcements when volatility increases. Note that while this can help you profit if Apple shares decline, it is not the type of ETF to own for long periods and perhaps confusingly will not create the inverse returns of Apple's shares in the long run due to daily rebalancing."

Apple trades at premium multiples with a forward P/E of 33x and a trailing P/E of 36x while delivering roughly 10% returns over the past year. Earnings grew in the most recent fiscal year after two years of near-stagnation. Retail sentiment on Reddit shows bearish scores in the 32–38 range on r/wallstreetbets while r/stocks remains near neutral. AAPD provides -1x daily inverse exposure to Apple through derivatives, carries a 0.01% expense ratio and manages about $18.9 million. The ETF rebalances daily so multi-day returns deviate from a simple inverse due to compounding. Liquidity and spreads widen around earnings, making AAPD a tactical short-term instrument rather than a long-term holding.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]