fromwww.dw.com

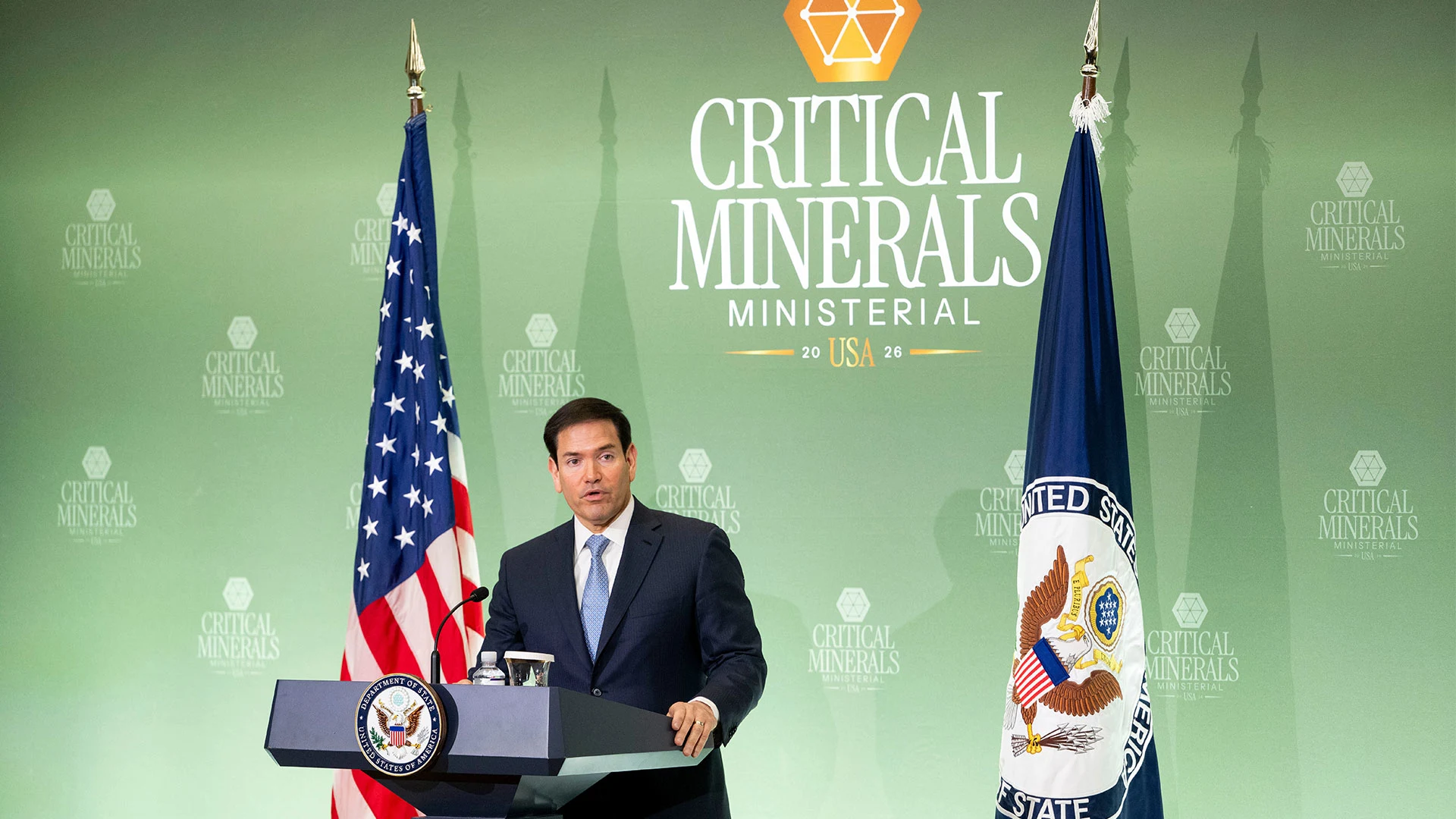

1 hour agoChina overtakes US to become Germany's top trading partner

The sum of exports and imports between the two countries last year totalled 251.8 billion (roughly $296.6 billion), a 2.1% increase, according to Destatis. China was Germany's most important trading partner from 2016 all the way through to 2023. In 2024, the US briefly held the title. German Chancellor Friedrich Merz is also set to visit China next week, where he is set to discuss trade and other topics.

Miscellaneous