#ai-infrastructure

#ai-infrastructure

[ follow ]

#data-centers #nvidia #advertising #energy-policy #openai #semiconductors #chatgpt #mergers--acquisitions

fromFortune

1 day agoCEOs are bullish but nervous: David Solomon's Davos readout on deregulation and 'shotgun' policy | Fortune

Speaking on the Goldman Sachs Exchanges podcast on Jan. 20, ahead of his trip to Davos, Solomon described a business landscape defined by a sharp dichotomy. On one side, the macroeconomic setup for 2026 is "pretty good for risk assets and for markets," fueled by a "confluence of very stimulative actions," including monetary easing and a massive capital investment boom in AI infrastructure. On the other, executives are grappling with anxiety about inconsistent policymaking and geopolitical "noise."

Business

fromBusiness Insider

2 days agoOpenAI is making more than $1 billion a month from something that has nothing to do with ChatGPT

OpenAI has pulled in a billion-dollar month from something other than ChatGPT. Sam Altman said in a post on X on Thursday that OpenAI added more than $1 billion in annual recurring revenue in the past month "just from our API business." "People think of us mostly as ChatGPT, but the API team is doing amazing work!" the OpenAI CEO wrote.

Artificial intelligence

Artificial intelligence

fromFortune

2 days agoElon Musk warns the U.S. could soon be producing more chips than we can turn on. And China doesn't have the same issue | Fortune

Electrical power shortages and grid limitations are the primary constraint on U.S. AI deployment despite rapidly increasing chip production.

Artificial intelligence

fromComputerWeekly.com

2 days agoDavos 2026: Smart thinking needed for sovereign AI investment | Computer Weekly

Strategic interdependence combining localized AI investments and trusted partnerships can enable smaller economies to gain competitiveness despite US–China investment dominance.

fromwww.engadget.com

3 days agoElon Musk is reportedly trying to take SpaceX public

Elon Musk is reportedly looking to finally take SpaceX public after years of resistance, according to sources who spoke to The Wall Street Journal. The company has long said it wouldn't choose an IPO until it had established a presence on Mars. That isn't happening anytime soon. So why now? Company insiders have suggested it's because Musk wants to build AI data centers in space. Google recently announced it was looking into putting a data center in space, with test launches scheduled for 2027.

Artificial intelligence

from24/7 Wall St.

3 days ago3 International Growth Stocks That Can Compete With U.S. Technology

Silicon Motion Technology ( NASDAQ:SIMO) is a Hong Kong semiconductor firm that specializes in NAND flash controllers. These memory storage solutions are critical for the AI buildout, and investors have started to pick up on it. The company's stock has more than doubled over the past year and is up by more than 20% to start the year. Revenue increased by 14% year-over-year in Q3 2025, and most of the growth was driven by AI infrastructure.

E-Commerce

from24/7 Wall St.

3 days ago3 Stocks That Could Double In 2026

Micron Technology ( NASDAQ:MU) could be the biggest beneficiary of the next bull market. It ended the year with a strong financial profile and growing demand for its solutions. Exchanging hands for $365, the stock has gained 233% in the past year. The demand for its NAND, DRAM, and high-bandwidth memory has outpaced supply and expanded margins. In the recently announced results, the company reported $13.64 billion in revenue, beating estimates. It was an impressive 57% year-over-year jump, driven by the growing demand for its specialized memory chips.

Business

fromBusiness Insider

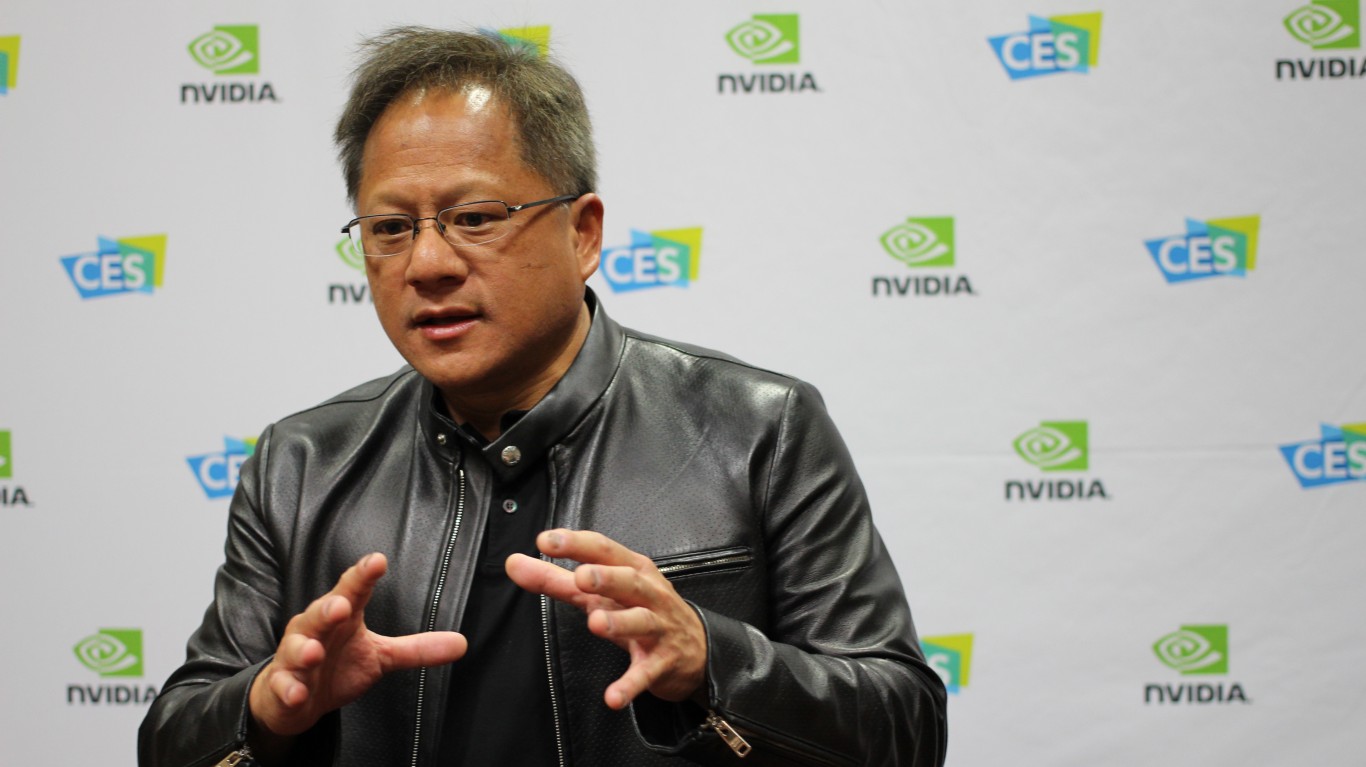

3 days agoNvidia's Jensen Huang says it's a good time to be a plumber - and not just because it's an AI-proof job

Is AI coming for your job? If you work in construction or plumbing, that's perhaps not a question you need to worry about. Speaking at the World Economic Forum on Wednesday, Nvidia CEO Jensen Huang said it was a great time to be a tradesperson because the AI boom is creating demand for manual labor to build data centers. "It's wonderful that the jobs are related to tradecraft and we're going to have plumbers and electricians and construction and steelworkers," he said in a conversation with BlackRock CEO Larry Fink in Davos, Switzerland.

Artificial intelligence

fromTechzine Global

3 days agoVertiv focuses on modular cooling for AI data centers

Vertiv has announced new configurations of its MegaMod HDX solution, a prefabricated power and liquid cooling infrastructure designed for environments with very high power densities. The solution is intended for applications such as artificial intelligence and high-performance computing and is available in North America and the EMEA region. According to Vertiv, the new variants respond to the rapidly growing demand for computing power and associated cooling capacity in data centers.

Tech industry

fromComputerworld

5 days agoGartner: Global AI spending to reach $2.5 trillion in 2026

Gartner predicts that global spending on AI will reach $2.52 trillion in 2026. That is an increase of 44 percent compared to the previous year. Much of the growth is expected to be driven by AI infrastructure, particularly investments in AI-optimized servers, which are expected to increase by 49 percent and account for 17 percent of the total AI spend.

Artificial intelligence

from24/7 Wall St.

6 days agoSuper Micro Jumps 11%: Turnaround Begins or a Dead Cat Bounce?

Super Micro Computer ( NASDAQ:SMCI ) was once a Wall Street favorite, riding the artificial intelligence (AI) wave with shares surging nearly 100% in early 2025. But investor trust eroded as revenues stalled and gross margins compressed amid execution issues and competition. Sales dropped 15% year over year in its fiscal 2026 first quarter to $5 billion, significantly missing the company's guidance range of $6 billion to $7 billion.

Business

fromwww.theguardian.com

1 week agoWe could hit a wall': why trillions of dollars of risk is no guarantee of AI reward

Trillions of dollars rest on the answer. The figures are staggering: an estimated $2.9tn (2.2tn) being spent on datacentres, the central nervous systems of AI tools; the more than $4tn stock market capitalisation of Nvidia, the company that makes the chips powering cutting-edge AI systems; and the $100m signing-on bonuses offered by Mark Zuckerberg's Meta to top engineers at OpenAI, the company behind ChatGPT.

Artificial intelligence

fromwww.cnn.com

1 week agoAds are coming to ChatGPT conversations

OpenAI announced on Friday that it will be testing ads in its free version for logged-in, adult US users. It's also rolling out an $8-per-month Go subscription tier that includes some upgraded capabilities, such as longer memory and more image creation opportunities, a lower price than its Plus ($20/month) and Pro ($200/month) subscriptions. Go subscribers will also get ads, while Plus, Pro and OpenAI's business customers won't. OpenAI CEO Sam Altman has previously expressed reservations about introducing ads to ChatGPT.

Artificial intelligence

Artificial intelligence

from24/7 Wall St.

1 week agoWatch February Earnings From NVIDIA and Microsoft to Predict Where This Mag7 ETF Goes Next

Equal-weight exposure to the seven largest tech companies concentrates AI infrastructure-driven growth risk and reward, with performance hinging on continued enterprise AI spending.

fromTheregister

1 week agoOver half of enterprise AI stalls on infrastructure mess

"If you look at the enterprise, there's just enormous enthusiasm to deploy AI, but the problem is that the infrastructure, the power, and the operational foundation that is required to run it just aren't there," Alex Bouzari, CEO of DDN, told The Register. "And so as a result, it pops up in the financial elements with IT projects getting delayed, the GPUs being underutilized, power costs going up. And so the economics, I think, for lots of organizations don't pencil out because of these challenges."

Artificial intelligence

fromTheregister

1 week agoPower shortages threaten to cap datacenter growth

A looming shortage of electrical power is set to constrain datacenter expansion, potentially leaving many industry growth forecasts looking overly optimistic. In its latest report, " Five Predictions for 2026," Uptime Institute says that power will become the defining constraint on datacenter growth in 2026 and beyond. This is because it simply isn't possible to add extra grid and generating capacity at the same rate as new server farms are popping up, so something is going to have to give.

Environment

fromComputerWeekly.com

1 week agoMicrosoft urges tech rivals to cover datacentre expansion-related power costs to protect consumers | Computer Weekly

"Some have suggested that AI will be so beneficial that the public should help pay for the added electricity the country needs for it ... but we disagree with this approach," he continued. "Especially when tech companies are so profitable, we believe that it's both unfair and politically unrealistic for our industry to ask the public to shoulder added electricity costs for AI. Instead, we believe the long-term success of AI infrastructure requires that tech companies pay their own way for the electricity costs they create."

Artificial intelligence

from24/7 Wall St.

1 week agoBroadcom (NASDAQ: AVGO) Stock Price Prediction and Forecast 2026-2030 (Jan 2026)

Despite the past year's stock market volatility, the explosive demand for semiconductors and microchips that has grabbed news headlines and led the market higher over the past few years remains. As the drive toward integrating artificial intelligence (AI) into our everyday lives progresses, a handful of mega-cap companies are capable of meeting that demand. While Nvidia Corp. ( NASDAQ: NVDA) may get the lion's share of attention, companies like Broadcom Inc. ( NASDAQ: AVGO) will also be playing a central role in supply.

Business

Artificial intelligence

fromFortune

1 week agoDon't trust 'GEO' to guard your brand's reputation in an agentic AI world, one insider warns | Fortune

Google enabled purchases directly from Search AI Mode and Gemini using a Universal Commerce Protocol, prompting retailer adoption and new agentic commerce tools.

Artificial intelligence

fromScalac - Software Development Company - Akka, Kafka, Spark, ZIO

1 week agoLast month in AI - December 2025

Rapid 2025 AI advances drove intense model competition, major open-source alternatives, new local-device AI clustering, national policy action, and massive infrastructure investment.

fromEngadget

1 week agoMark Zuckerberg announces new 'Meta Compute' initiative for its data center and AI projects

Zuckerberg said that Meta's head of global engineering Santosh Janardhan will lead the "top-level initiative" and that recent hire and former Safe Superintelligence CEO Daniel Gross will "lead a new group responsible for long-term capacity strategy, supplier partnerships, industry analysis, planning, and business modeling." McCormick is expected to "work on partnering with governments and sovereigns to build, deploy, invest in, and finance Meta's infrastructure."

Artificial intelligence

from24/7 Wall St.

2 weeks agoA Clean Energy ETF Soared 50% While Everyone Moved On

iShares Global Clean Energy ETF ( NYSEARCA:ICLN) delivered a 49% return over the past year, nearly tripling the S&P 500's 18% gain. The fund tracks approximately 100 global companies in renewable energy, utilities, and clean technology. With $1.9 billion in assets and a 0.39% expense ratio, ICLN provides broad exposure to solar, wind, fuel cells, and electric utilities positioned to benefit from surging power demand.

Business

from24/7 Wall St.

2 weeks agoThis Tiny ETF Is One Of The Best Ways To Bet On AI Stocks Right Now

IGPT delivers aggressive growth through concentrated AI exposure. With 72% of assets in information technology and communication services, this is a pure-play thematic fund. The ETF holds roughly 115 positions, but the top 10 represent 62% of assets. IGPT overweights companies directly building or deploying AI systems rather than those tangentially benefiting from the trend.

Business

fromFortune

2 weeks agoThe future depends on copper, but a coming shortage makes it a 'systemic risk' to the economy and a strategic flashpoint, S&P Global warns | Fortune

"The result will be a shortfall of 10 million tons that represents a "systemic risk for global industries, technological advancement and economic growth," the report said."

Business

fromInfoWorld

2 weeks agoSnowflake to acquire Observe to boost observability in AIops

Snowflake is planning to acquire AI-based site reliability engineer (SRE) platform provider Observe to strengthen observability capabilities across its offerings and help enterprises with AIOps as they accelerate AI pilots into production. Longer term, Snowflake is positioning itself as infrastructure for AI at scale. As AI agents generate exponentially more data, vertically integrated data and observability platforms become essential to running production AI reliably and economically,

Artificial intelligence

fromTheregister

2 weeks agoAI chip frenzy to wallop DRAM prices with 70% hike

Memory prices are set to spike again as chipmakers prioritize AI server production over consumer devices, with analysts warning of a high double-digit jump in Q1 2026 alone as demand outpaces supply. Samsung Electronics and SK hynix are reportedly planning to raise server memory prices by up to 70 percent this quarter, according to Korea Economic Daily. Combined with 50 percent increases in 2025, this could nearly double prices by mid-2026.

Artificial intelligence

from24/7 Wall St.

2 weeks agoWhy Amazon's Spending Spree Makes It a Must-Buy Now

Amazon's free cash flow has faced ongoing declines amid aggressive investments. In the third quarter, trailing 12-month free cash flow dropped to $14.8 billion, down 69% from $47.7 billion a year earlier. This followed a slide from $18.2 billion in the second quarter, driven by a $50.9 billion year-over-year increase in property and equipment purchases. Cash capital expenditures reached $34.2 billion in Q3 alone, with $89.9 billion spent year-to-date.

Business

from24/7 Wall St.

3 weeks agoRoundhill's AI ETF Rips 45% Higher As The AI Buildout Continues In 2026

The Roundhill Generative AI & Technology ETF ( NYSEARCA:CHAT) soared just over 45% in 2025, outpacing the S&P 500's 17% gain and the Nasdaq-100's 21% advance. The fund's 2026 performance trajectory depends on hyperscaler spending on AI infrastructure and the fund's concentrated exposure to companies building that infrastructure. Hyperscaler Capital Spending Is the Engine The biggest macro factor affecting CHAT's performance is capital expenditure by the world's largest cloud providers.

Business

Venture

fromFortune

3 weeks agoAn AI super-bull who just backed the Nvidia-Groq deal warns of a data center bust: 'We foresee a significant financial crisis' | Fortune

Speculative third-party data-center builders face a likely financing crisis by 2027–2028 due to extreme capex, valuation mismatches, and lack of enterprise customer traction.

fromBusiness Insider

3 weeks agoSoftBank is buying DigitalBridge for $4 billion to accelerate its AI ambitions

SoftBank said it will acquire digital infrastructure investor DigitalBridge for about $4 billion. The Japanese conglomerate said it is doubling down on building the data centers, connectivity, and power needed to support AI at a global scale. "As AI transforms industries worldwide, we need more compute, connectivity, power, and scalable infrastructure," said Masayoshi Son, chairman and CEO of SoftBank Group. The deal underscores SoftBank's push to control more of the physical infrastructure behind AI as competition for computing resources intensifies.

Tech industry

Business

from24/7 Wall St.

3 weeks agoAn Actively Managed AI ETF Put 18% Into Two Chip Giants Just Ahead of Massive Infrastructure Buildout

BAI is an actively managed ETF offering concentrated, full-stack AI infrastructure exposure, led by semiconductors and hyperscalers, with $8B AUM and 0.55% expense.

[ Load more ]