fromLondon Business News | Londonlovesbusiness.com

2 months agoCommodities soaring, oil retreating and equities grinding higher - London Business News | Londonlovesbusiness.com

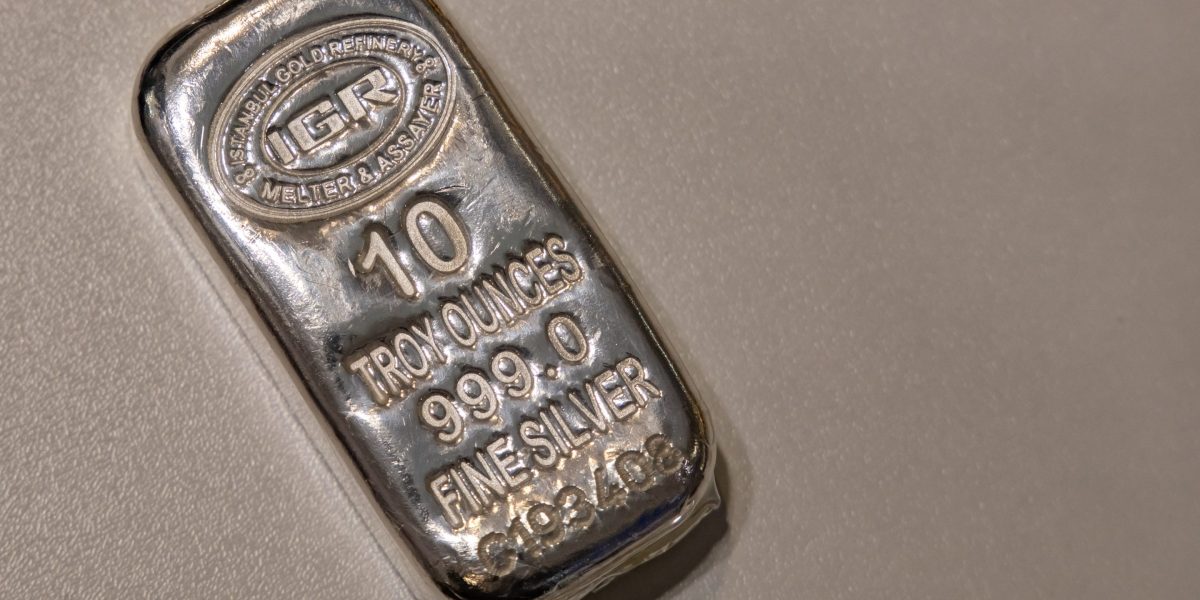

Global markets are nearing the year-end with striking contrasts across major asset classes, shaped by shifting rate expectations, geopolitical uncertainty, and uneven economic momentum. Nowhere was this divergence more evident than in the performance of commodities, oil, and global equities. Gold led with a gain of more than 60%, its strongest annual advance in over a decade, while silver outperformed even that, surging nearly 100% over the year. Both precious metals benefited from expectations of global monetary easing, persistent geopolitical tensions,