Information security

fromAbove the Law

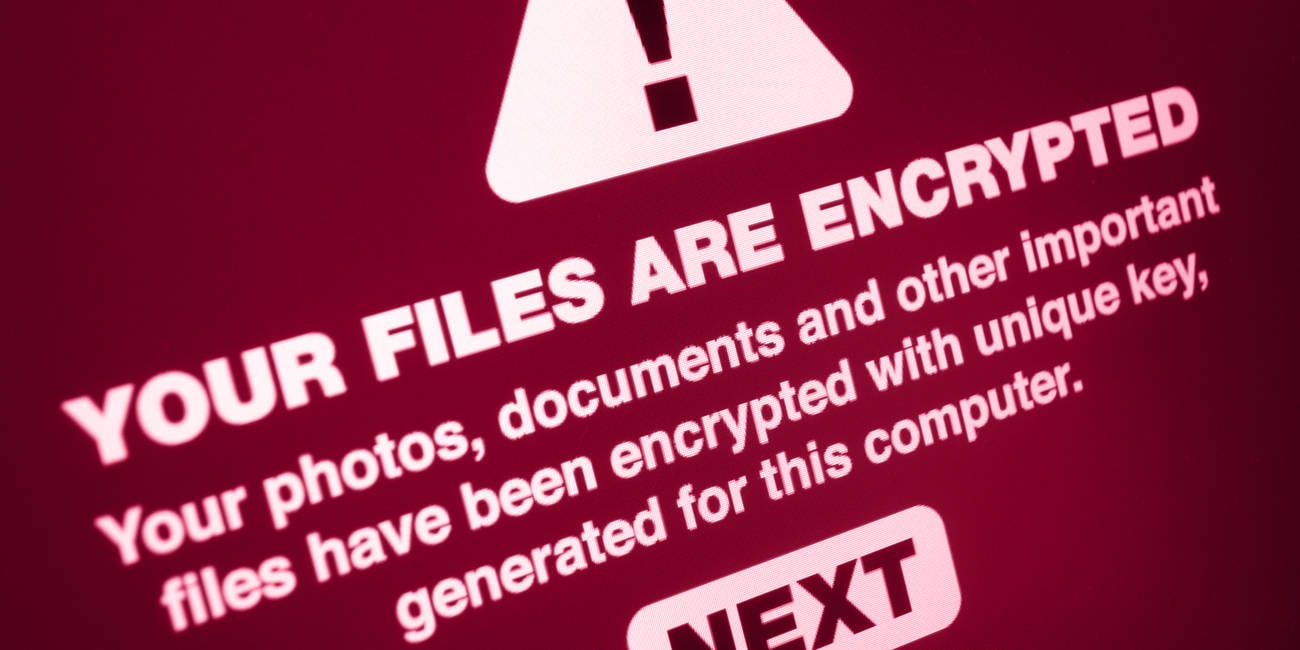

3 days agoThink You Are Covered? Better Read Your Cybersecurity Policy - Carefully - Above the Law

Cyber insurance often fails to fully protect organizations due to exclusions, leaving law firms particularly vulnerable without proper cybersecurity and coverage review.