#china-trade

#china-trade

[ follow ]

#tariffs #soybeans #exports #trade-surplus #nvidia #us-tariffs #middle-market-businesses #supply-chain-shifts

fromwww.bbc.com

3 weeks agoChinese whisky tariff cut to come into force on Monday

As a result of a new deal agreed during Sir Keir Starmer's trip to China, import taxes on whisky will be cut from 10% to 5% - a deal the UK government said would be worth 250m to the UK's economy over the next five years. Scotch whisky is a key export for Britain's drinks sector, with more than 5bn in annual exports. In recent years, China has been one of its fastest-growing markets.

UK politics

US politics

fromLondon Business News | Londonlovesbusiness.com

3 weeks agoTrump criticises Starmer over his China trip warning it's' very dangerous' - London Business News | Londonlovesbusiness.com

US President criticized Keir Starmer's meeting with Xi Jinping, calling closer UK–China ties 'very dangerous' and warning against Canada–China business deals.

from24/7 Wall St.

1 month agoNvidia (NASDAQ: NVDA) Bull, Base, & Bear Stock Price Prediction and Forecast (Jan 2)

The trade war with China was tough on Nvidia Corp. ( NASDAQ: NVDA) investors. Last April, shares hit a year-to-date low below $87 apiece. Like its fellow Magnificent 7 members, Nvidia struggled due to economic uncertainties about the effects of tariffs, as well as due to Chinese AI innovations. Bears saw Nvidia stock falling further because of bearish pressure from the broader market. Yet, some investors remain optimistic for a sustained rebound, and later in the year that seemed to be the case.

Artificial intelligence

from24/7 Wall St.

3 months agoTuesday's Top 10 Wall Street Analyst Upgrades and Downgrades: Crowdstrike, Starbucks, Constellation Energy, McDonalds and More

The futures are trading higher on Tuesday after a strong start to the week on Wall Street. Traders were buoyed by positive news on the potential for a trade agreement with China and the potential resolution of the TikTok issue. With Wall Street ready for a deluge of earnings this week, the most important of which come from technology giants in the Magnificent 7, it may remain a task for the momentum-driven rally to keep moving higher. Still, with strong retail participation and new money pouring into the market from overseas, the run to 7000 on the S&P 500 is on and humming.

US news

fromLondon Business News | Londonlovesbusiness.com

4 months agoSterling rises to one-week high against broadly weaker dollar despite tepid UK growth

Seeing again the flexing of the administration to use industrial policy as a tool to drive its wider economic and trade agenda. Bessent it wouldn't consider stock market volatility when dealing with China on trade. Those kinds of comments have in the past left markets on edge - no Trump put. But not yesterday - the S&P 500 rallied 0.4% as it climbed not just the wall of worry but also its 20-day SMA.

Business

Agriculture

fromFortune

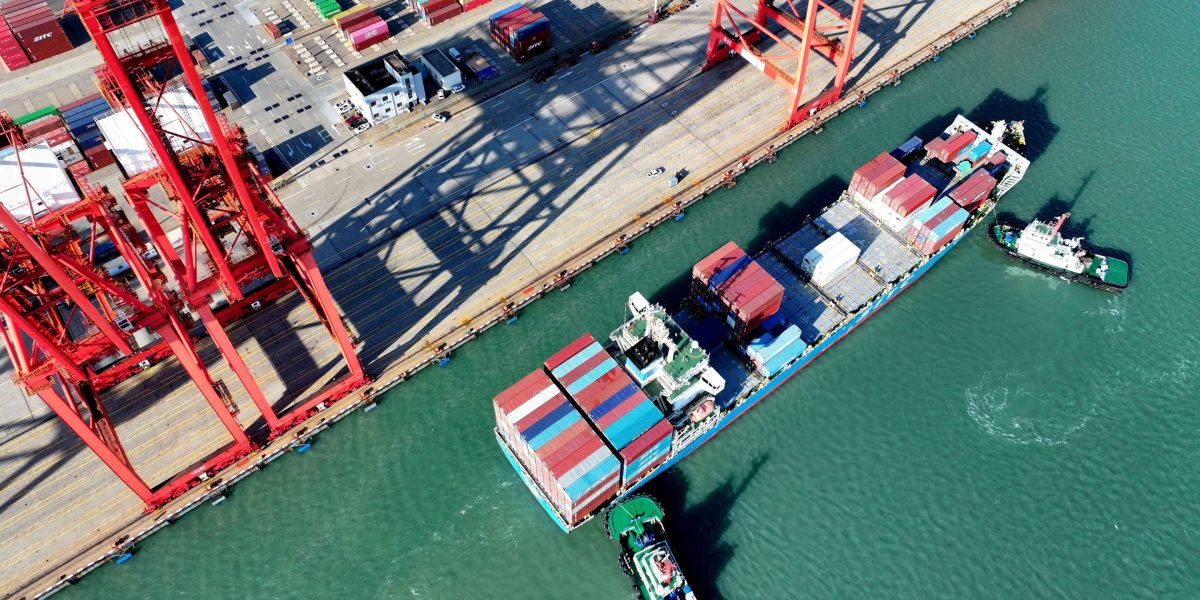

5 months agoRural America is suffering an economic crisis as crop prices plunge - 'U.S. soybean farmers cannot survive a prolonged trade dispute'

U.S. corn and soybean farmers face collapsing prices, rising input costs, and restricted export markets—especially China—threatening farm incomes and financial stability.

[ Load more ]