"The head of the International Monetary Fund (IMF) spoke in Davos about how the projected growth for the global economy, 3.3% in 2026, was beautiful but not enough. I want to appeal to all of you: do not fall into complacency. Growth is not strong enough. And that is why the debt weighing on our shoulders, which is approaching 100% of GDP, will be a very heavy burden, warned Kristalina Georgieva."

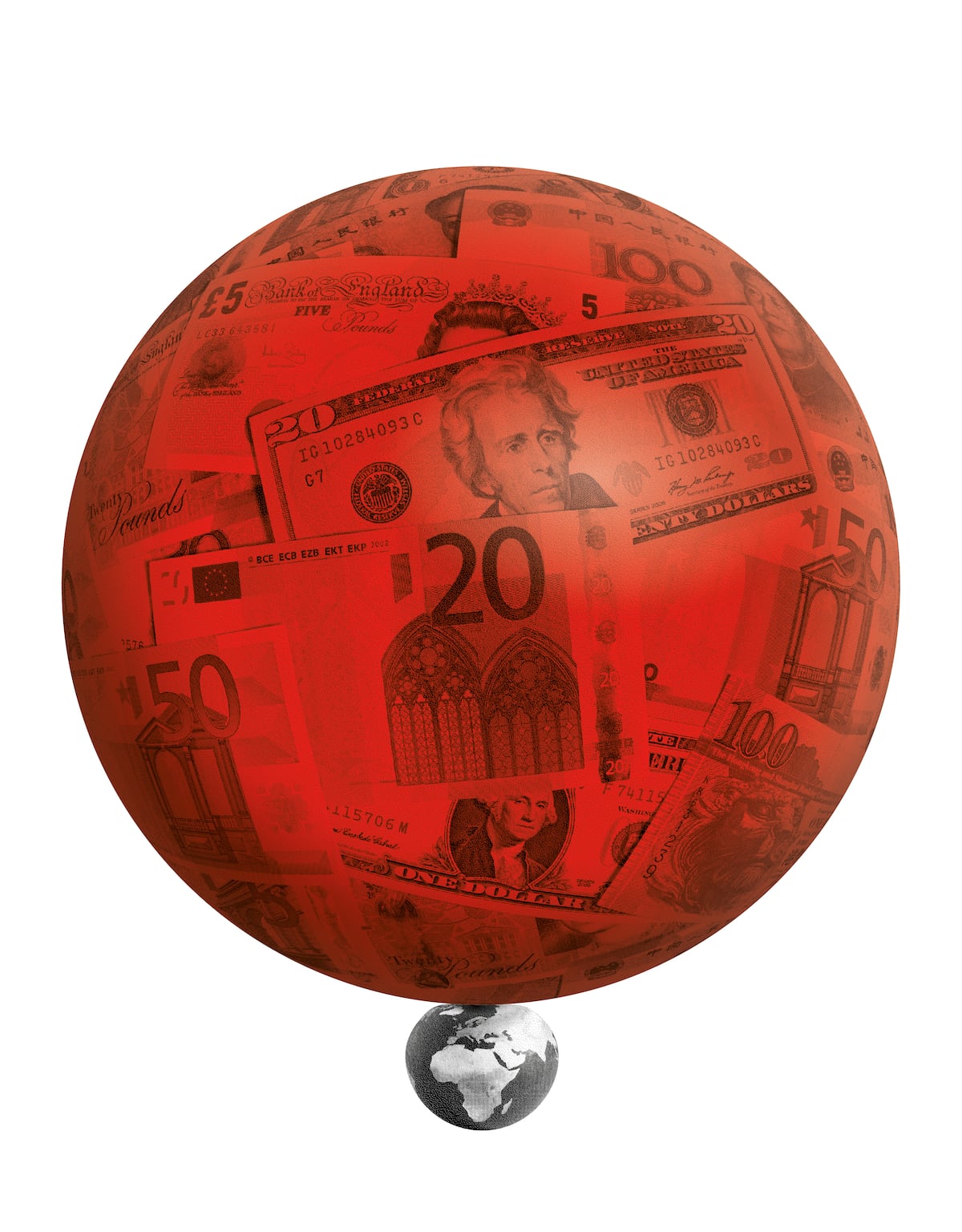

"So heavy, in fact, that public debt has become one of the structural features of the economy. Globally, it stands at $93 trillion and is expected to soon reach almost $100 trillion. What is worrying, beyond the figure itself, is that while household and corporate debt has been steadily declining since 2015 (now hovering around $151 trillion), governments continue to require more and more resources."

Projected global growth of 3.3% in 2026 is insufficient to reduce escalating public indebtedness. Global public debt is nearing $100 trillion, now about $93 trillion, and is expected to approach $100 trillion soon. Household and corporate debt have declined since 2015 and now hover around $151 trillion, while government borrowing continues to rise. Advanced-economy debt-to-GDP ratios exceed 110%, a level previously seen only in rare historical periods. The United States ran a 6.2% deficit last year, with a forecasted 5.5% this year, and public debt exceeded $36 trillion, near 123% of GDP. Rising deficits and slow growth make public debt a structural economic burden.

Read at english.elpais.com

Unable to calculate read time

Collection

[

|

...

]