"Large-ticket recreational purchases have long been hampered by fragmented financing processes that leave both dealers and consumers frustrated with slow decisions and limited credit options. While Americans spend $150B annually across powersports, RV, marine, and outdoor power equipment markets, the purchasing experience has remained largely manual and inefficient, forcing consumers to navigate multiple lenders and dealers to struggle with closing deals."

"Octane addresses this friction by providing an end-to-end digital financing platform that combines instant prequalification technology with captive lending services, enabling dealers to close more sales while consumers secure competitive rates across credit profiles. Since launching its in-house lender Roadrunner Financial in 2016, Octane has originated over $7B in loans, grown originations by 30% year-over-year, and achieved GAAP profitability while serving 4,000 dealer partners and 60 OEM brands."

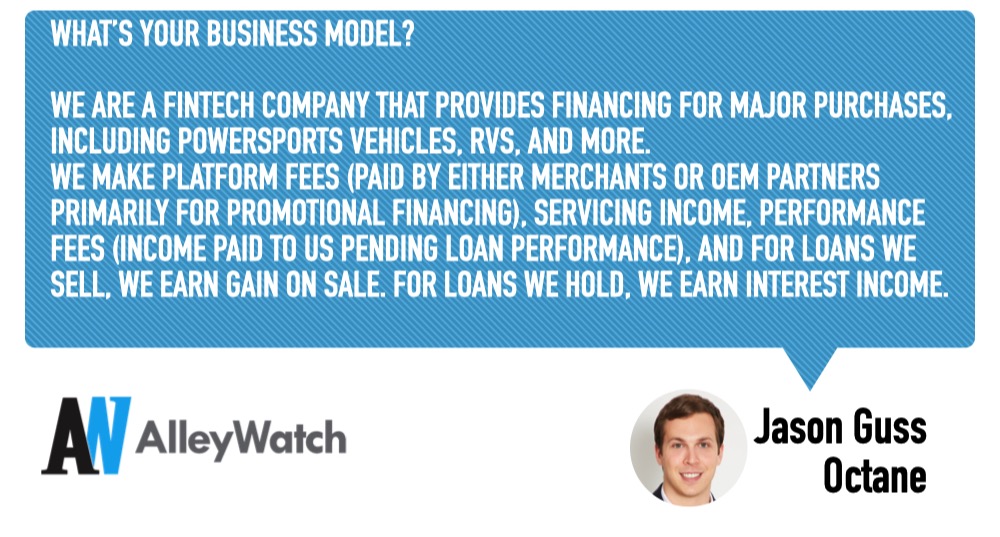

"The company's recent introduction of Captive-as-a-Service allows manufacturers and retailers to offer white-label financing under their own brand without building lending infrastructure from scratch, further positioning Octane to capture share in underserved consumer finance markets. AlleyWatch sat down with Octane CEO and Cofounder Jason Guss to learn more about the business, its future plans, recent funding round that brings total funding to $342M, and much, much more... Who were your investors and how much did you raise? Valar Ventures led the round with participation from Upper90, Huntington Bank, Camping World and Good Sam, Holler-Classic, and others."

Fragmented financing processes have slowed large-ticket recreational purchases across powersports, RV, marine, and outdoor power equipment sectors, despite $150B annual consumer spending. Octane provides an end-to-end digital financing platform combining instant prequalification technology with captive lending services to help dealers close more sales and offer competitive rates across credit profiles. Since creating in-house lender Roadrunner Financial in 2016, Octane has originated over $7B in loans, grown originations 30% year-over-year, and achieved GAAP profitability while serving 4,000 dealer partners and 60 OEM brands. A Captive-as-a-Service product enables manufacturers and retailers to offer white-label financing without building lending infrastructure. Series F raised $100M, bringing total funding to $342M.

Read at Alleywatch

Unable to calculate read time

Collection

[

|

...

]