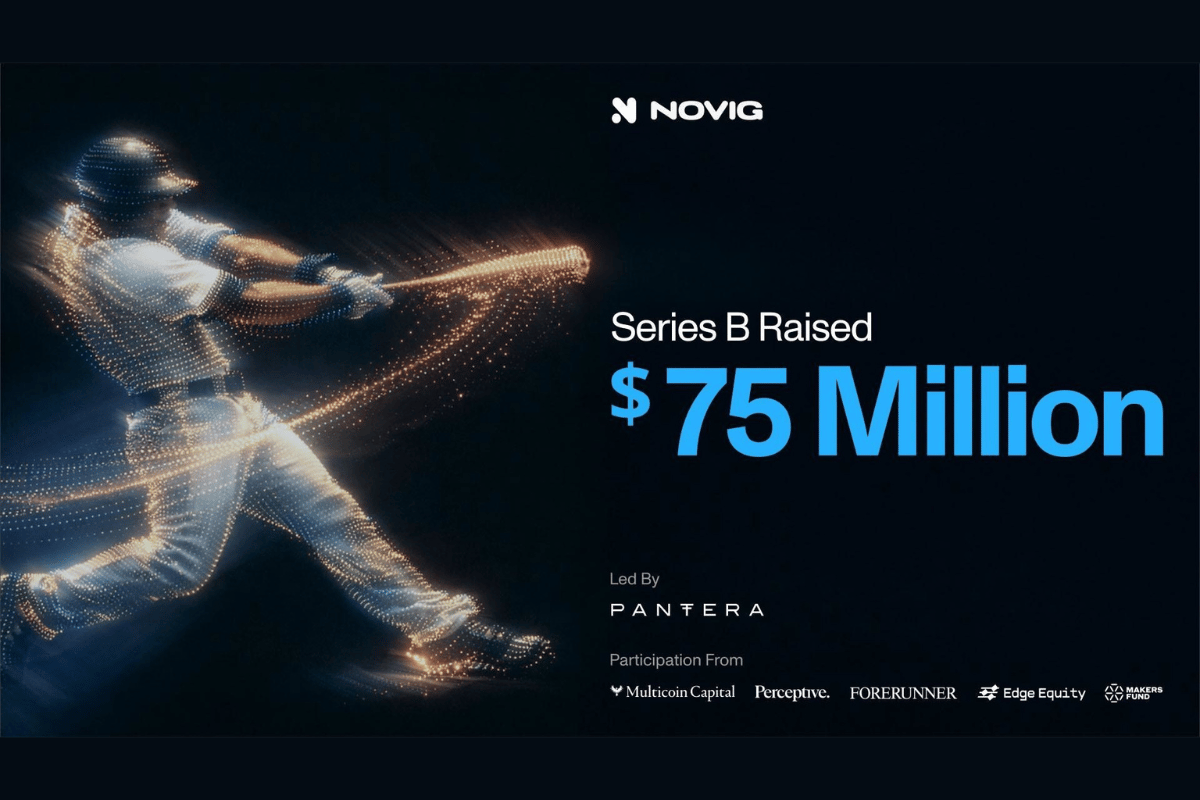

"Novig has pulled in $75 million in fresh funding as it works to grow its sports trading platform and secure a clearer path to federal oversight. The Series B round was led by Pantera Capital, with Multicoin Capital, Makers Fund and Edge Equity joining in. Existing investors Forerunner, Perceptive Ventures and NFX also participated. With this latest raise, the company's total funding now tops $105 million."

"Unlike traditional sportsbooks, Novig runs as a commission-free exchange where users trade against one another instead of betting against a house. The company says its order-book system allows odds to shift naturally based on supply and demand, rather than being set by a bookmaker. Over the past year, that approach appears to have gained traction. Trading volume jumped tenfold in 2025, and annualized volume has climbed past $4 billion."

"The company has f ormally applied to the Commodity Futures Trading Commission for approval to operate as a Designated Contract Market (DCM). If granted, that status would allow Novig to function as a federally regulated exchange and potentially make its platform available in all 50 states, similar to Kalshi. The application could prove important as much of the sports betting industry operates under state-by-state rules."

Novig raised $75 million in a Series B round led by Pantera Capital, with Multicoin Capital, Makers Fund, Edge Equity and existing investors participating, bringing total funding above $105 million. The company previously closed an $18 million Series A that expanded operations and refined its peer-to-peer sports market model. Novig operates a commission-free exchange where users trade against one another and an order-book system lets odds shift based on supply and demand. Trading volume jumped tenfold in 2025 and annualized volume exceeds $4 billion. Novig has applied to the CFTC to become a Designated Contract Market to gain federal oversight and wider availability.

Read at ReadWrite

Unable to calculate read time

Collection

[

|

...

]