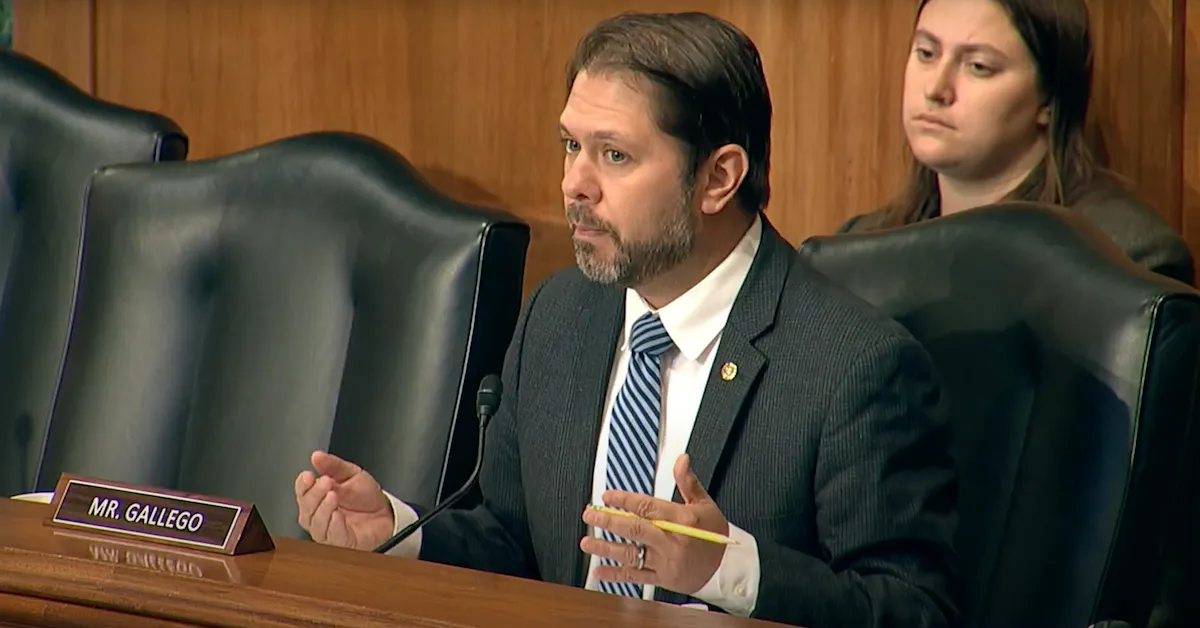

"The group of Democrats, which included Senate Banking ranking member Ruben Gallego (AZ), Kirsten Gillibrand (NY), and Catherine Cortez Masto (NV), stated in the first page of the document that digital assets legislation should be guided by certain values, include "protecting financial privacy while denying bad actors access to the financial system." In the fifth section of the framework, they outlined what this looks like. The outline included the following points:"

"Require digital asset platforms to register with FinCEN as "financial institutions" under the Bank Secrecy Act (BSA), while adopting anti-money laundering/combatting the financing of terrorism (AML/CFT) policies Address bad actors' use of DeFi platforms to circumvent illicit finance controls Ensure that crypto platforms serving U.S. customers comply with sanctions and AML/CFT requirements, even if domiciled abroad Shape ecosystems to isolate non-compliant platforms that enable illicit activity"

Twelve Senate Democrats published a six-page framework proposing digital asset market structure legislation that aims to combat illicit finance while protecting users' financial privacy. The document emphasizes values including "protecting financial privacy while denying bad actors access to the financial system." The framework's fifth section outlines requirements: register digital asset platforms with FinCEN as financial institutions under the BSA and adopt AML/CFT policies; address bad actors' use of DeFi to circumvent controls; require crypto platforms serving U.S. customers to comply with sanctions and AML/CFT even if domiciled abroad; shape ecosystems to isolate non-compliant platforms. The framework leaves ambiguous how regulators would implement some proposals.

Read at Bitcoin Magazine

Unable to calculate read time

Collection

[

|

...

]