"The biggest macro questions are whether the alarm bells about AI and the labor market will start to ring true - and whether the productivity effects move from just anecdotes to the economic data. Last year, much evidence pointed to AI as a marginal part of the labor market slowdown. Some economists (and officials inside the White House) argue that broader adoption of the technology would boost the labor market, at least in the short term."

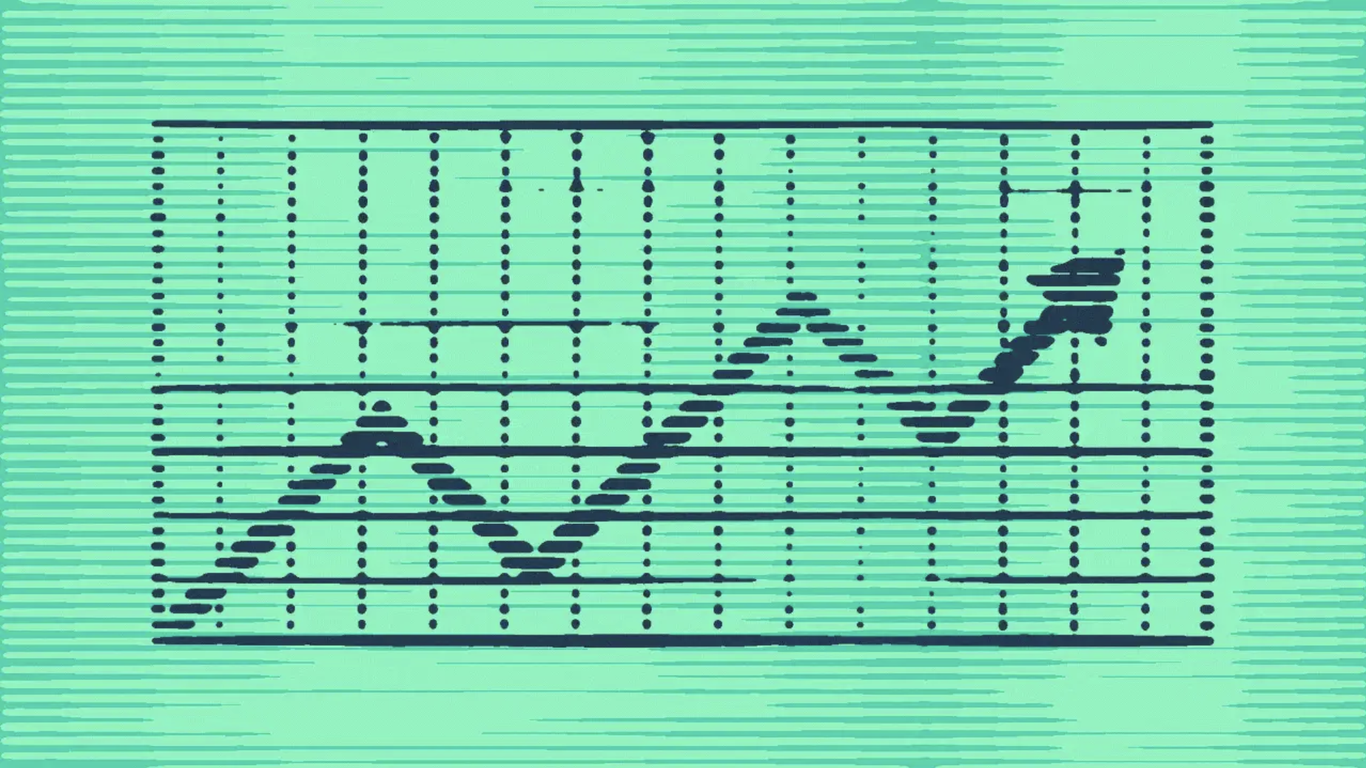

"Of note: AI spending buoyed economic growth, at least in the first nine months of 2025. It is also lifting the stock market, which might help support spending among wealthier consumers. Whether this turns out to be a bubble that pops - and the extent such a risk poses to the broader financial system as the Fed rolls back regulations - is the related theme to watch."

Policy shifts from the Trump administration and a large wave of AI investment are likely to shape the economy in 2026. AI's effects on the labor market remain uncertain, with concerns about job losses offset by views that broader adoption could temporarily boost employment. AI spending buoyed growth in the first nine months of 2025 and lifted the stock market, supporting spending by wealthy consumers. A potential AI-investment bubble could threaten the financial system as the Fed rolls back regulations, though a major correction appears more likely after 2026. The One Big, Beautiful Bill's tax cuts are expected to boost early-2026 growth, adding roughly 2.3 percentage points to first-quarter GDP per the Hutchins Center.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]