"As it stands, the bill's 90% deduction cap would mean a gambler who wins $100,000 and then loses $100,000 would be required to pay $10,000 in taxes, despite the loss of profit."

"My FAIR BET Act has been sitting in Ways and Means Democrat for eight months, despite commitments from the House to restore the full gambling loss deduction."

"Both high-stakes and hobby gamblers are struggling, and local economies like #OnlyInDistrictOne that depend on gaming revenue are hurting. We need 218 signatures to bring this commonsense fix to the floor. Call your representatives and tell them to sign on."

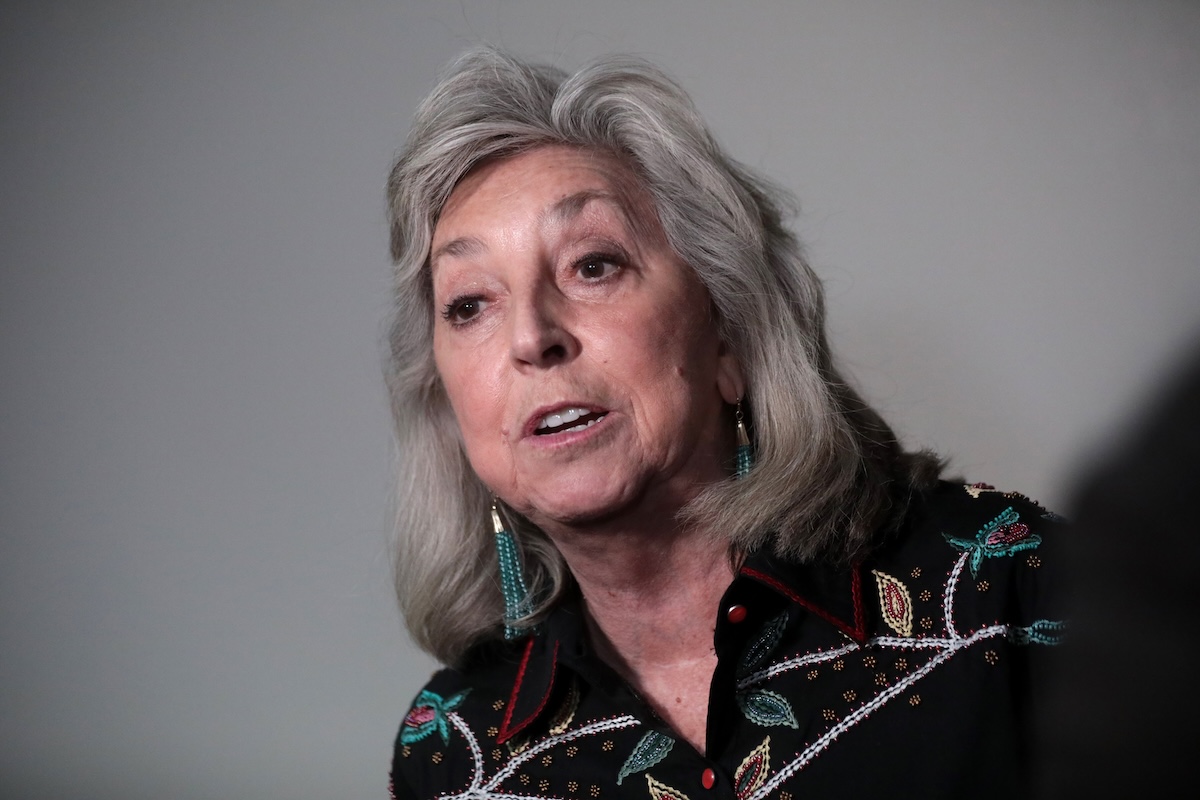

Dina Titus filed a discharge petition to force a House vote on the FAIR BET Act, which aims to restore full gambling loss deductions removed under President Trump's 'Big Beautiful Bill'. The bill targets a 90% deduction cap that can require a gambler who wins then loses equal amounts to still pay taxes on presumed profit. The FAIR BET Act was first pursued in July 2025 and has been stalled in the House Ways and Means Committee for eight months. The discharge petition requires 218 signatures to bring the bill to the House floor and bypass committee chairs and House leadership who are blocking action.

Read at ReadWrite

Unable to calculate read time

Collection

[

|

...

]