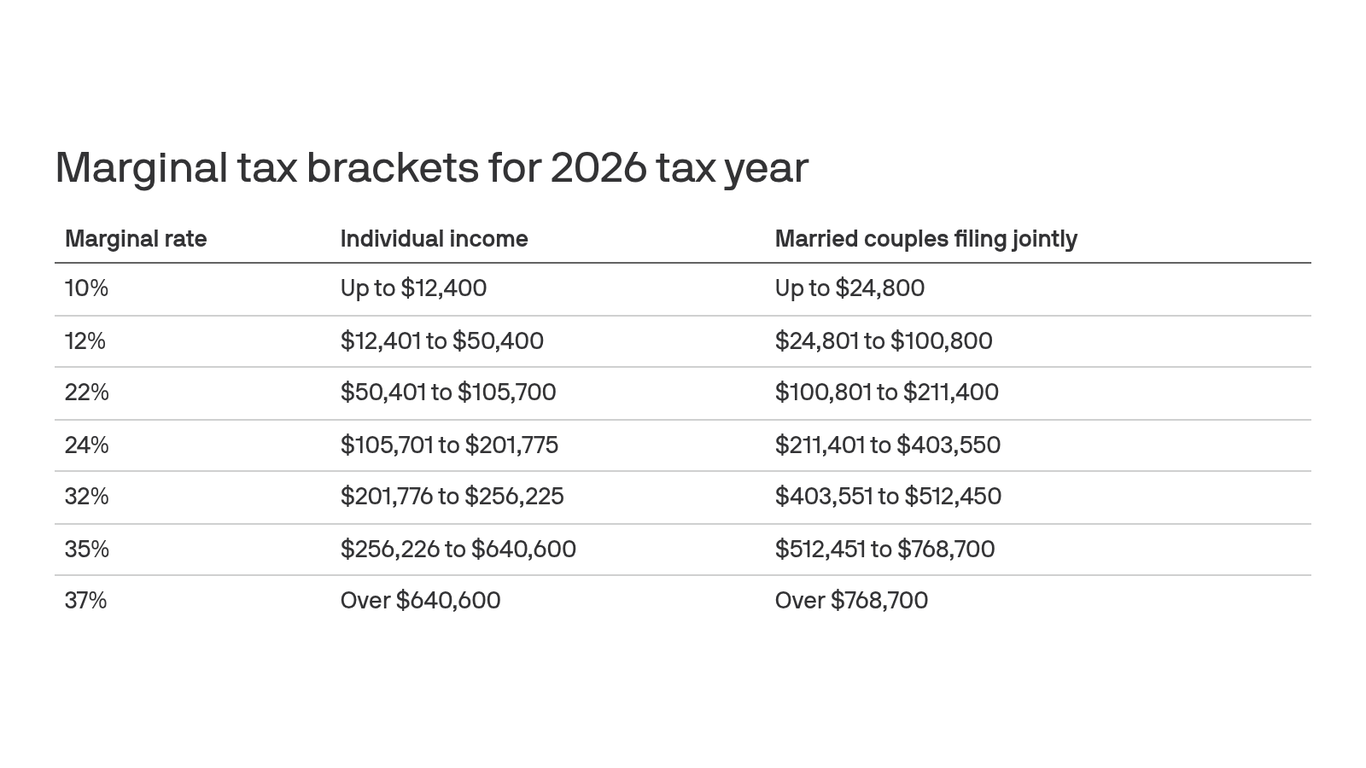

"The legislation signed earlier this year made key provisions from the 2017 tax overhaul permanent and added new increases to deductions and credits. New tax brackets and standard deductions will slightly boost paychecks and lower income tax for many Americans. Income tax brackets 2026 The big picture: By adjusting the brackets each year, the IRS aims to prevent "bracket creep," which happens when inflation pushes taxpayers into higher tax brackets without real income gains. (See chart above.) The bill's permanent extensions mean these thresholds - first introduced in the 2017 tax law - won't expire after 2025."

"Tax deduction updates for 2025 tax year State of play: Because of the big bill, the IRS announced changes to the 2025 tax year standard deductions that were originally set last October. The revised standard deductions are: $31,500 for married couples filing jointly (originally set at $30,000) $15,750 for single filers (originally set at $15,000) $23,625 for heads of household (originally was $22,500) Tax deductions for 2026 tax year The IRS said Thursday that the standard deduction under the bill rises to: $32,200 for married couples filing jointly $16,100 for single filers $24,150 for heads of household Between the lines: Normally, the IRS adjusts the standard deduction each fall to keep up with inflation, but the new law boosted the deductions early - and made those higher amounts permanent going forward."

"Zoom in: The estate tax exclusion increases to $15 million in 2026, up from $13.99 million in 2025. Earned Income Tax Credit (EITC) increases to $8,231 for families with three or more children, up from $8,046 for tax year 2025. See more of the changes here. Senior tax deduction and Social Security Catch up fast: A new $6,000 federal tax deduction for Americans 65 and"

Key 2017 tax-law provisions were made permanent and additional increases to deductions and credits were enacted. Annual inflation adjustments to tax brackets will continue to prevent bracket creep and the thresholds will not expire after 2025. Standard deductions were raised early for 2025 to $31,500 for married filing jointly, $15,750 for single filers, and $23,625 for heads of household, with 2026 amounts set slightly higher at $32,200, $16,100, and $24,150 respectively. The estate tax exclusion rises to $15 million in 2026. The Earned Income Tax Credit for families with three or more children increases to $8,231. A new $6,000 federal deduction is introduced for seniors.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]