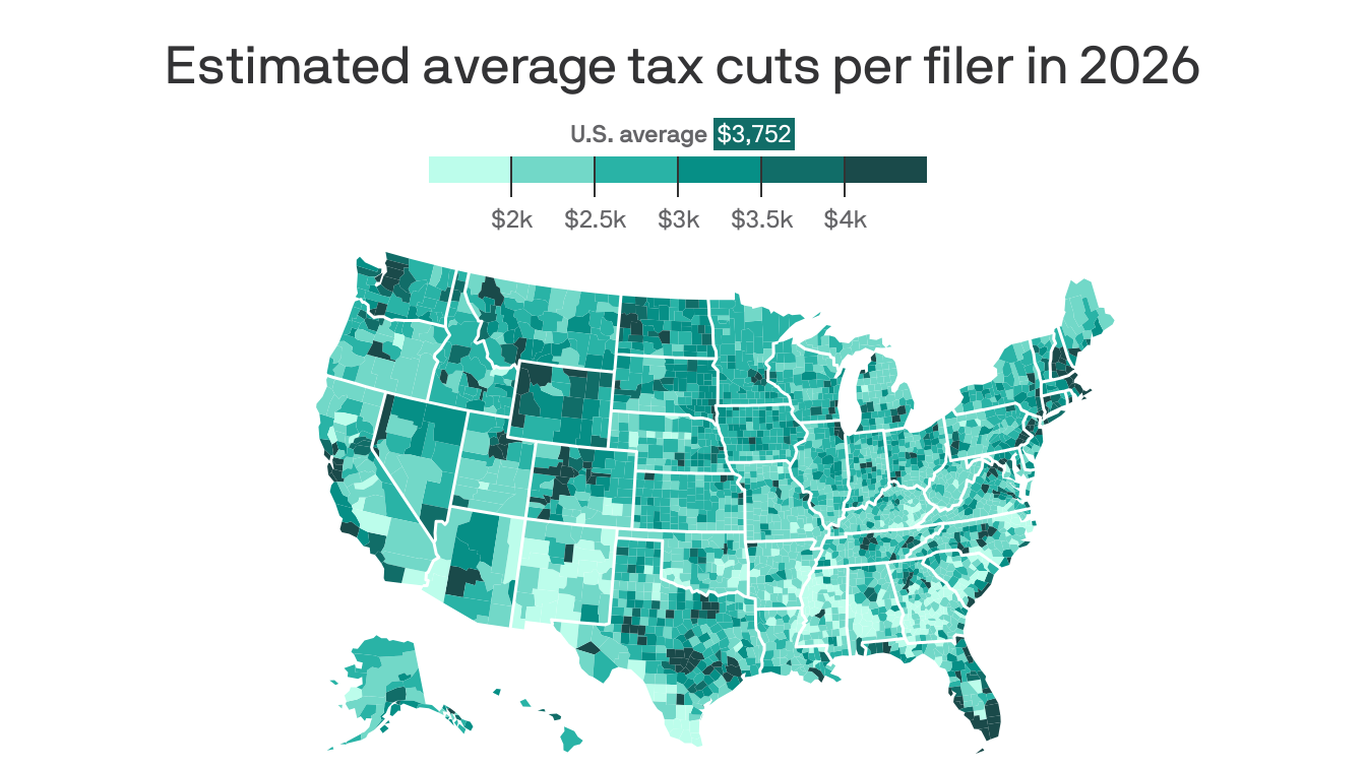

"The average American will receive a federal tax cut of $3,752 in 2026, attributed to the bill by the Tax Foundation."

"The largest average tax cuts will occur in Wyoming, Washington, and Massachusetts, with amounts of $5,375, $5,372, and $5,139 respectively."

"Business owners will benefit significantly from permanent tax breaks for research and development, along with other provisions."

"Residents in high-tax coastal regions will also see substantial tax breaks due to the increased cap on state and local tax deductions."

In 2026, the average American is expected to receive a federal tax cut of $3,752 due to the new tax bill, according to the Tax Foundation. Major tax reductions will be experienced in states like Wyoming, Washington, and Massachusetts. Business owners will particularly benefit from permanent tax breaks related to research and development expenses, alongside other deductions. Coastal regions with high taxes will see significant breaks from an increased cap on state and local tax deductions. However, looming cuts to social spending in 2027 may negate these benefits for lower-income Americans.

#federal-tax-cuts #tax-bill #high-income-regions #social-spending-cuts #state-and-local-tax-deductions

Read at Axios

Unable to calculate read time

Collection

[

|

...

]