"The U.S. government has been clear that it will support Milei-though has stopped short of putting its hand into its own coffers to boost Argentina's economy. In September, Bessent wrote on X that "all options for stabilization are on the table," suggesting that swap lines, direct currency purchases, and purchases of U.S. dollar-denominated government debt from Treasury's Exchange Stabilization Fund were all possibilities. "Opportunities for private investment remain expansive," he added."

"telling CNBC in an interview yesterday that the U.S. is providing a swap line, adding "we are not putting money into Argentina." A swap line is a standard agreement between two central banks to exchange currencies, to stabilize financial markets in one or both nations because it guarantees sufficient supply of a foreign currency. At a given date the swap is reversed. Given the fact the U.S. dollar is the global currency, this adds a significant safety net to Argentina's economy."

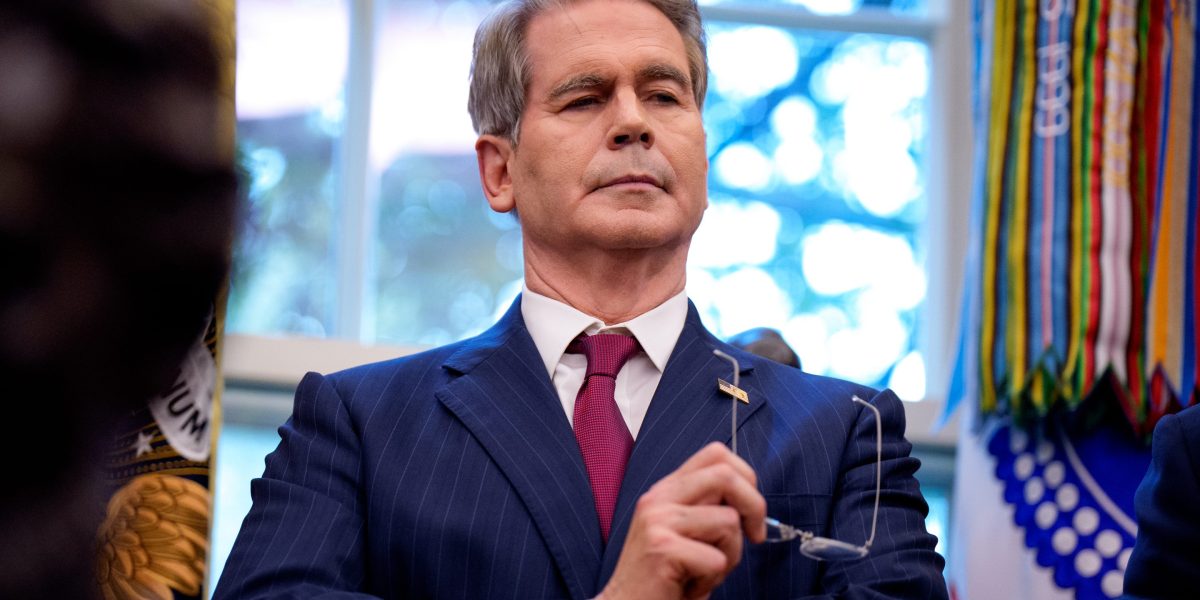

Scott Bessent praised President Javier Milei as a regional beacon and said the United States will back Argentina's economic overhaul by providing a swap line but will not inject direct funds. The Treasury previously signaled that all stabilization options were on the table, including swap lines, direct currency purchases, and Exchange Stabilization Fund purchases, while emphasizing opportunities for private investment. The swap line guarantees U.S. dollar access as a safety net. Washington framed the move as strategic to prevent another failed state and encourage regional reform, but markets remain skeptical as the peso and bonds slide.

Read at Fortune

Unable to calculate read time

Collection

[

|

...

]