"If this reduction goes ahead, savers may increasingly turn to gold to make up the difference."

"While ISA rules can be redrawn with every Budget, the tax treatment of UK legal tender bullion coins has remained consistently favourable."

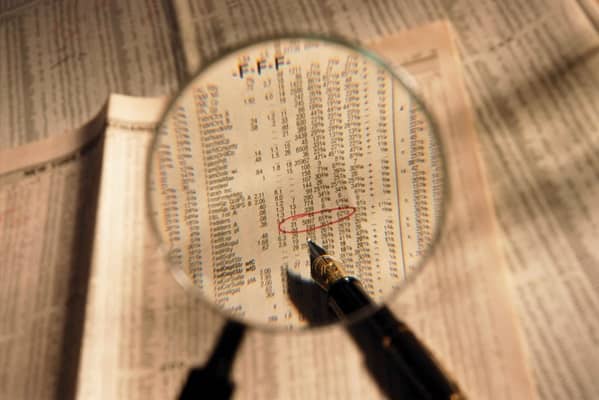

New Financial proposes capping cash ISAs at £10,000, shifting surplus funds into UK equities, which could benefit markets and provide a political win for Chancellor Rachel Reeves. However, individual savers may face challenges as investing in equities requires market engagement. As a result, many might turn to gold as a stable investment alternative, offering tax-free advantages without the volatility of stocks. Gold's consistent tax treatment and recent price increase make it an appealing option for preserving wealth amidst changing ISA regulations.

Read at London Business News | Londonlovesbusiness.com

Unable to calculate read time

Collection

[

|

...

]