"Teradyne (NASDAQ:TER) is having a stellar start to 2026. The stock has surged 66.07% year-to-date, reaching $321.45. That's more than four times the semiconductor sector benchmark's 14.98% gain over the same period. Even more telling, Teradyne is now the second-best performing stock in the entire S&P 500. The only stock Teradyne's trailing is Sandisk (Nasdaq: SNDK), which is up an astonishing 152.5%. The reason both stocks is rising is similar: booming demand for AI infrastructure."

"The catalyst came on February 3, 2026, when Teradyne reported fourth-quarter results that blew past expectations. Revenue hit $1.08 billion, crushing the $983 million estimate and marking 44% year-over-year growth. Earnings per share of $1.80 easily topped the $1.38 consensus. The stock jumped 18.44% in the week following earnings, reaching a 52-week high. That reaction triggered a wave of analyst upgrades, with 11 firms raising price targets. Susquehanna led the charge with a $335 target, while Stifel and UBS both went to $325."

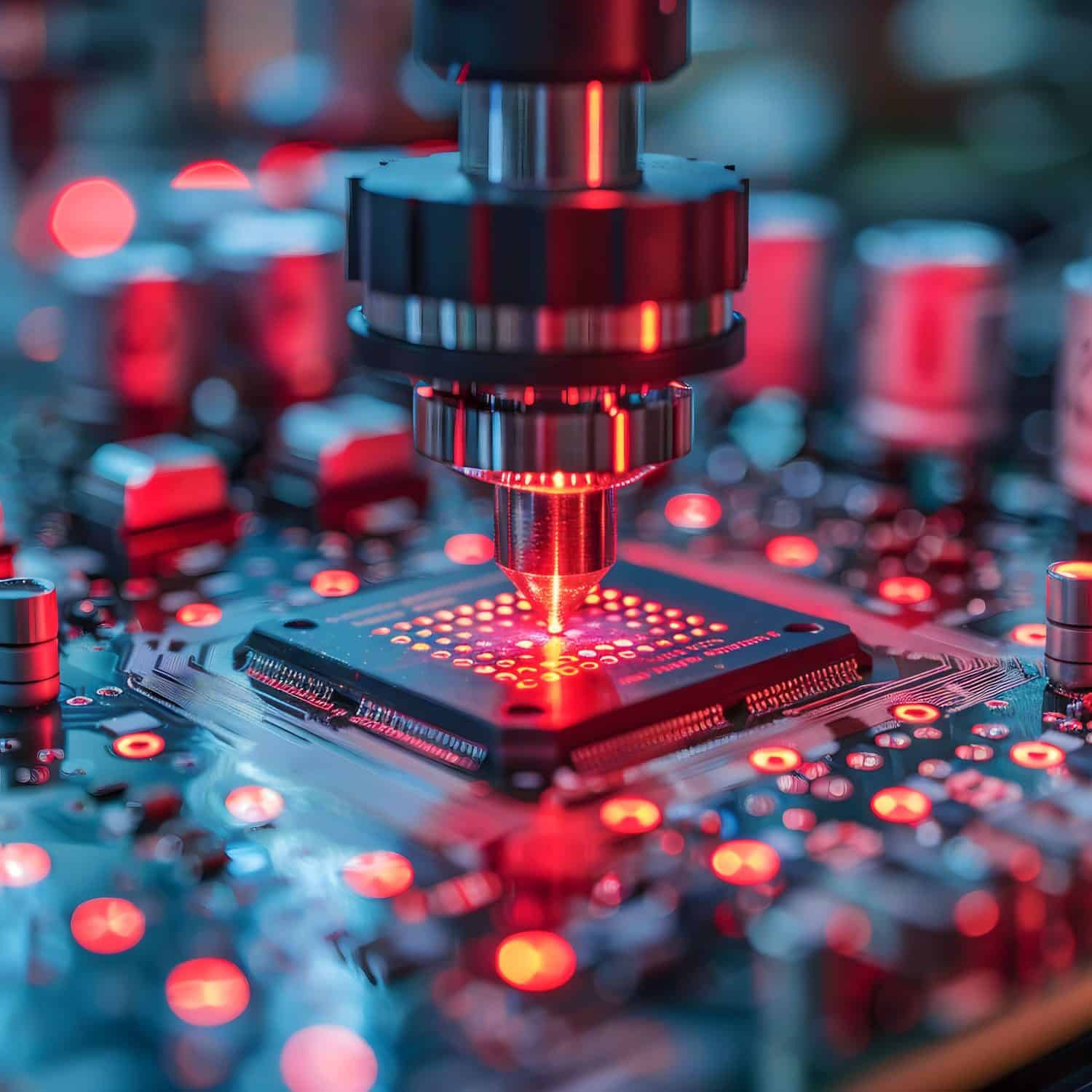

"Teradyne's business is simple: it makes automated test equipment for semiconductors. What's changed is where the demand is coming from. CEO Greg Smith laid out the transformation on the earnings call: "In Q3, AI demand accounted for 40% to 50% of our revenue, and in Q4, it rose to over 60%. Looking ahead to Q1 of 2026, we anticipate that AI applications will drive upwards of 70% of our revenue." This isn't just about testing more chips. It's about testing the right chips. The company's semiconductor test segment, which generated $883 million in Q4, is now heavily weighted toward compute and memory applications that power AI data centers. Smith noted that compute became the largest portion of revenue in 2025, experiencing 90% year-over-year growth."

Teradyne's shares jumped 66.07% year-to-date to $321.45, outpacing the semiconductor sector benchmark and ranking as the second-best performer in the S&P 500. Fourth-quarter revenue reached $1.08 billion, up 44% year-over-year, and EPS of $1.80 beat estimates, prompting an 18.44% stock rise and multiple analyst price-target increases. AI-related demand rose from 40–50% of revenue in Q3 to over 60% in Q4, and management expects AI to drive over 70% of Q1 2026 revenue. The semiconductor test segment produced $883 million in Q4, with compute revenue growing 90% year-over-year and a focus on merchant GPU testing.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]