"Jeff Bezos joined Sam Altman in admitting the existence of an AI bubble-but Amazon's founder sees upside. Recently, many AI-related companies have seen voracious optimism and spikes in valuations. In August, the OpenAI CEO told reporters the AI market was in a bubble. When bubbles happen, "smart people get overexcited about a kernel of truth," Altman warned, drawing parallels with the dot-com boom. Still, he said his personal belief is "on the whole, this would be a huge net win for the economy.""

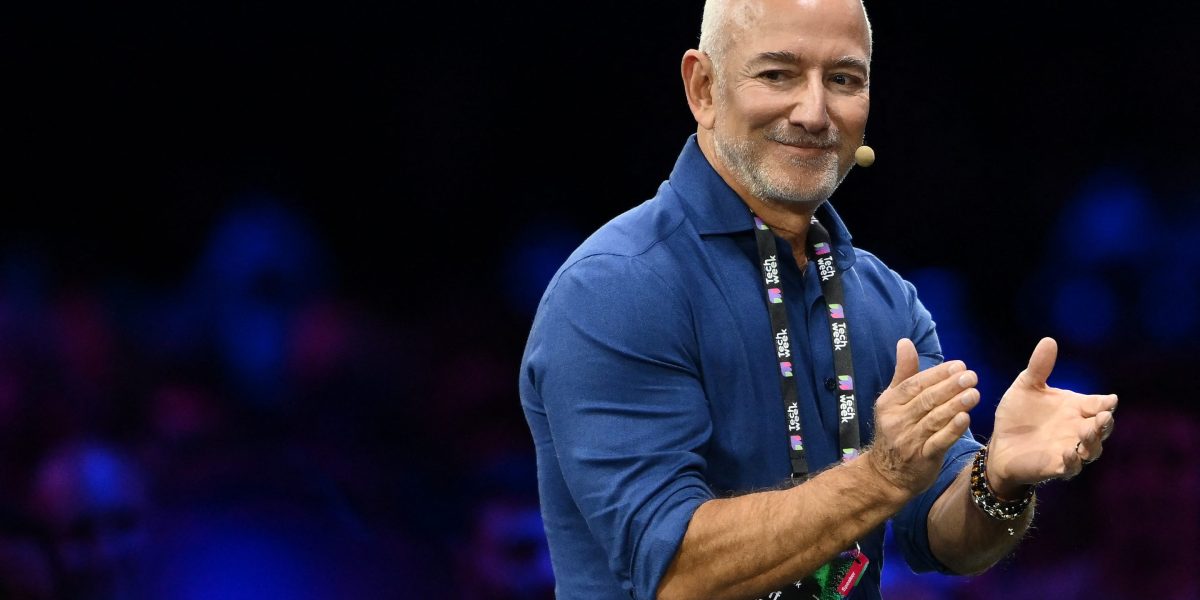

""This is a kind of industrial bubble, as opposed to financial bubbles," he said at Italian Tech Week on Friday. Ultimately, industrial bubbles can be positive, Bezos added, pointing out that the biotech and pharmaceutical bubble in the 1990s led to the development of life-saving drugs-though in the process, many public companies that IPO'd during the boom went bankrupt or were acquired at a fraction of their starting value by the end."

"But, Bezos said industrial bubbles are "not nearly as bad" as other bubbles, like "It can even be good, because when the dust settles and you see who are the winners, societies benefit from those investors," Bezos said. "That is what is going to happen here too. This is real, the benefits to society from AI are going to be gigantic.""

An AI bubble is underway, driven by voracious optimism and sharp valuation spikes across AI-related companies. The bubble shares features with the dot-com boom and creates substantial financial risk for investors. The current bubble is characterized as industrial rather than purely financial, meaning heavy investment in infrastructure and research. Historical industrial bubbles, such as biotech in the 1990s, funded discovery that produced life-saving drugs even as many public companies failed or lost value. During such booms everything gets funded and investors have difficulty separating promising projects from poor ones. When the cycle ends, winners consolidate and society captures long-term benefits.

Read at Fortune

Unable to calculate read time

Collection

[

|

...

]