"With 13-F filings released, retail investors can now observe hedge fund managers' actions in the first quarter, which offers insights for navigating the current market volatility."

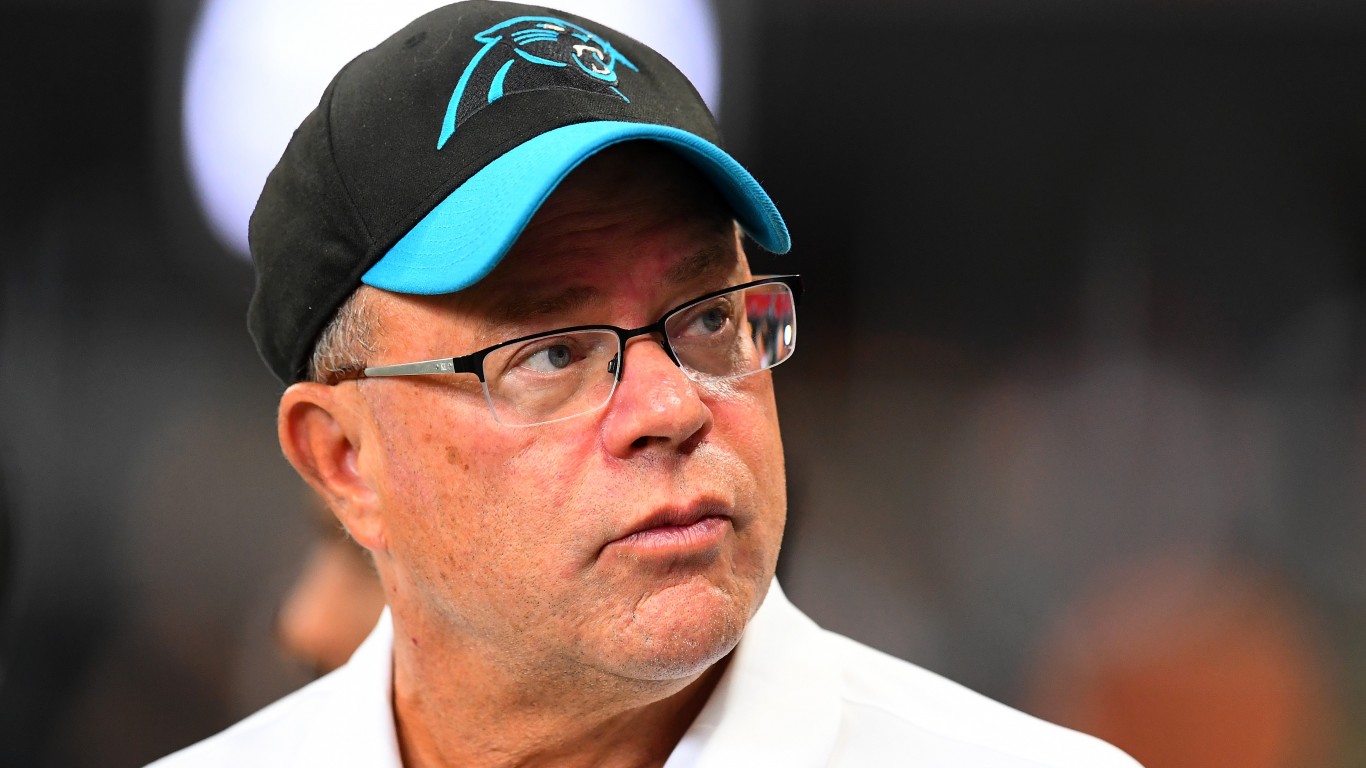

"David Tepper's significant put position in the SPYX indicates a cautious stance among leading investors, suggesting a tightening market environment that warrants careful consideration moving forward."

As the 13-F filing season concludes, retail investors gain insights into hedge fund managers' decisions from Q1. This analysis offers a clearer view of market sentiment amidst ongoing volatility and trade tensions influenced by shifting tariff policies. Notably, investor David Tepper's $2.5 billion put position in the SPYX ETF highlights a careful approach among top investors as they anticipate potential market shifts. With profit-taking and cautious optimism prevailing, understanding these large-scale moves can guide individual investors in adapting their strategies.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]