"The fund achieves K-1-free income by blending traditional MLPs with C-corporations in the energy infrastructure sector. Top holdings include MLP structures like MPLX LP ( NYSE:MPLX), Plains All American Pipeline ( NASDAQ:PAA), and Energy Transfer ( NYSE:ET) alongside C-corps like Cheniere Energy ( NYSE:LNG), Targa Resources ( NYSE:TRGP), and Kinder Morgan ( NYSE:KMI). This mix lets AMZA qualify as a Regulated Investment Company, generating 1099s for investors while capturing MLP-like yields."

"The fund concentrates heavily in midstream energy infrastructure with over 120% sector exposure through derivatives strategies. The fund provides monthly distributions, with recent payments reflecting the cash flows from pipeline operators benefiting from North American energy production. The Price You Pay for Simplicity AMZA charges a 2.75% expense ratio, substantially higher than traditional MLP ETFs. The Alerian MLP ETF ( NYSE:AMLP), which holds MLPs directly and issues K-1s, charges just 0.85% while delivering a similar 8.75% yield. That 1.90% annual cost difference adds up, particularly for larger portfolios."

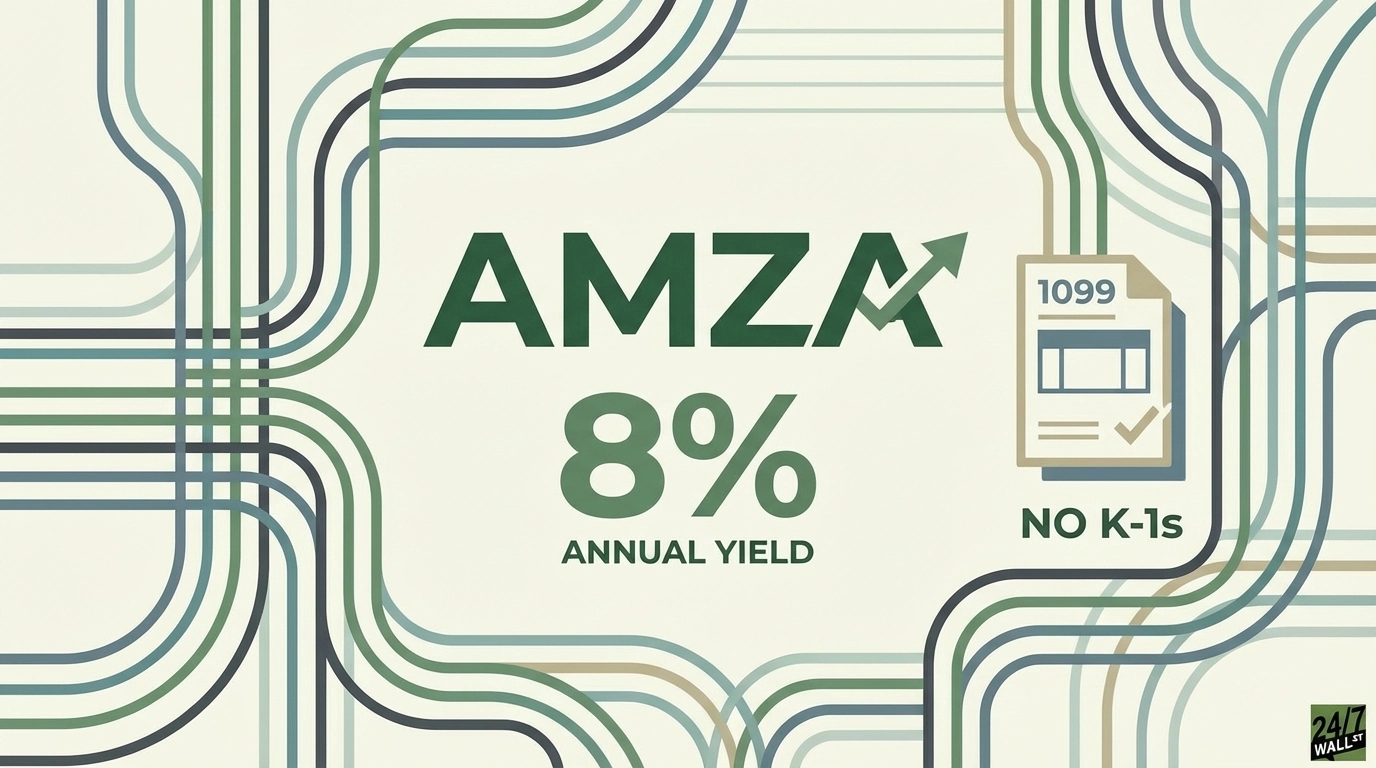

"The income is attractive, but the K-1 tax forms turn April into a paperwork nightmare. Tax preparers charge extra fees to handle these schedules, and mistakes can trigger amended returns. InfraCap MLP ETF ( NYSEARCA:AMZA) offers a solution. The fund delivers approximately 8% annual yield through monthly distributions while issuing a simple 1099 tax form instead of K-1s. For retirees managing their own taxes or paying accountants by the form, this structure eliminates a persistent headache."

Master Limited Partnerships produce attractive yields but generate K-1 tax forms that complicate filing, increase preparer fees, and risk amended returns. InfraCap MLP ETF (AMZA) offers roughly 8% annual yield paid monthly while issuing 1099s by blending traditional MLPs with energy C-corporations and qualifying as a Regulated Investment Company. The fund concentrates in midstream energy infrastructure, sometimes using derivatives for over 120% sector exposure. AMZA's expense ratio is 2.75%, versus 0.85% for AMLP with similar yield, creating a 1.90% cost gap. The cost-benefit depends on portfolio size and tax complexity.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]