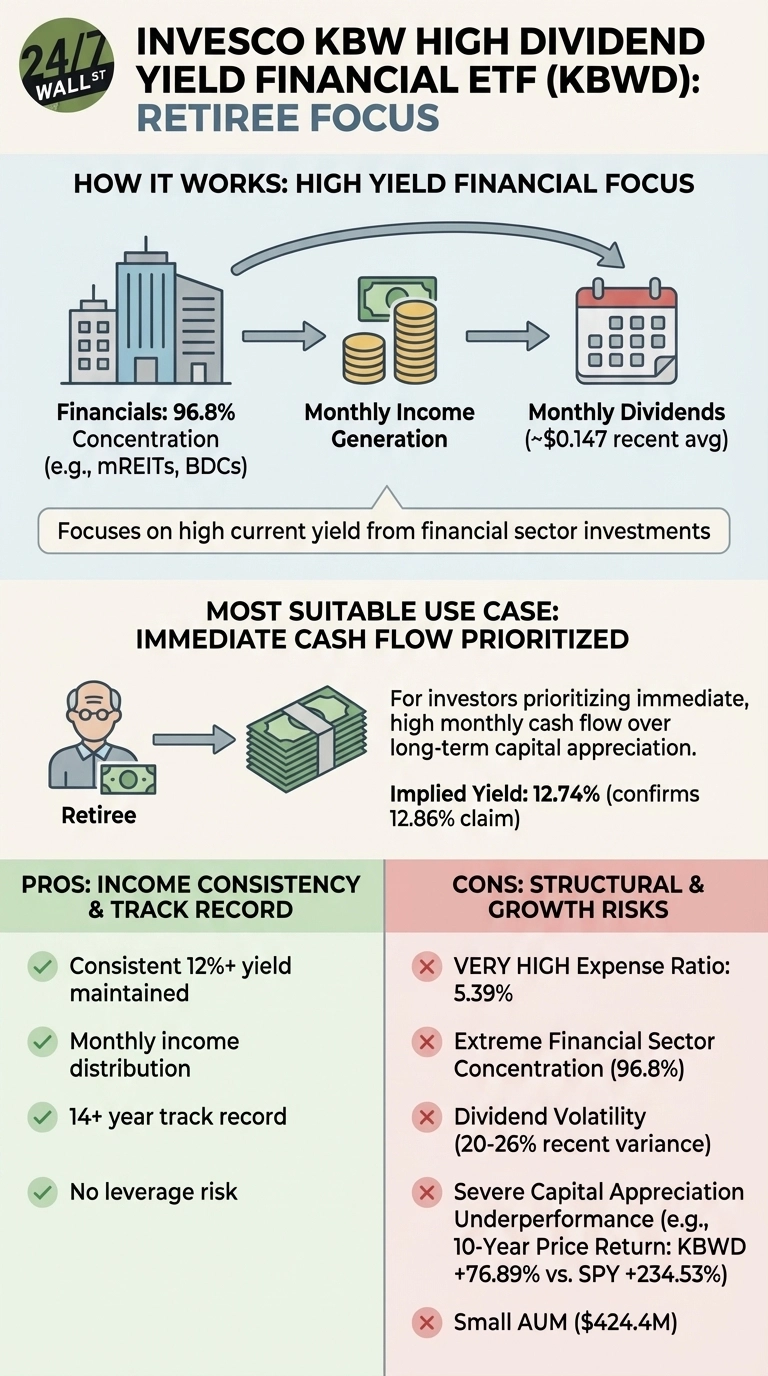

"KBWD generates immediate cash flow from financial sector dividend payers. The fund tracks the KBW Nasdaq Financial Sector Dividend Yield Index, with 96.8% of assets in financials and top holdings like Invesco Mortgage Capital, Orchid Island Capital, and AGNC Investment. The portfolio tilts heavily toward mortgage REITs that earn spreads on residential mortgage-backed securities. These companies borrow short-term funds at low rates, invest in longer-term mortgage securities, and distribute the interest spread as dividends."

"The yield comes with structural costs that compound over time. KBWD charges a 5.39% expense ratio, consuming nearly half the gross yield before investors see a penny. Over ten years, that fee alone extracts more value than most equity ETFs generate in returns. The fund also carries a negative cash position and 60% annual turnover. More concerning is what happens to principal. While KBWD delivered 76.89% total return over ten years, the S&P 500 gained 235%."

Invesco KBW High Dividend Yield Financial ETF (KBWD) targets high monthly income by concentrating in financial-sector dividend payers, primarily mortgage REITs and BDCs, and currently yields about 12.9% with average monthly distributions near $0.147 per share. The portfolio is heavily weighted to financials (96.8%) and top holdings include Invesco Mortgage Capital, Orchid Island Capital, and AGNC Investment. The fund has maintained distributions for over 14 years but carries structural drawbacks: a 5.39% expense ratio, a negative cash position, 60% annual turnover, volatile monthly payments, and ten‑year total returns that trail the S&P 500 significantly.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]