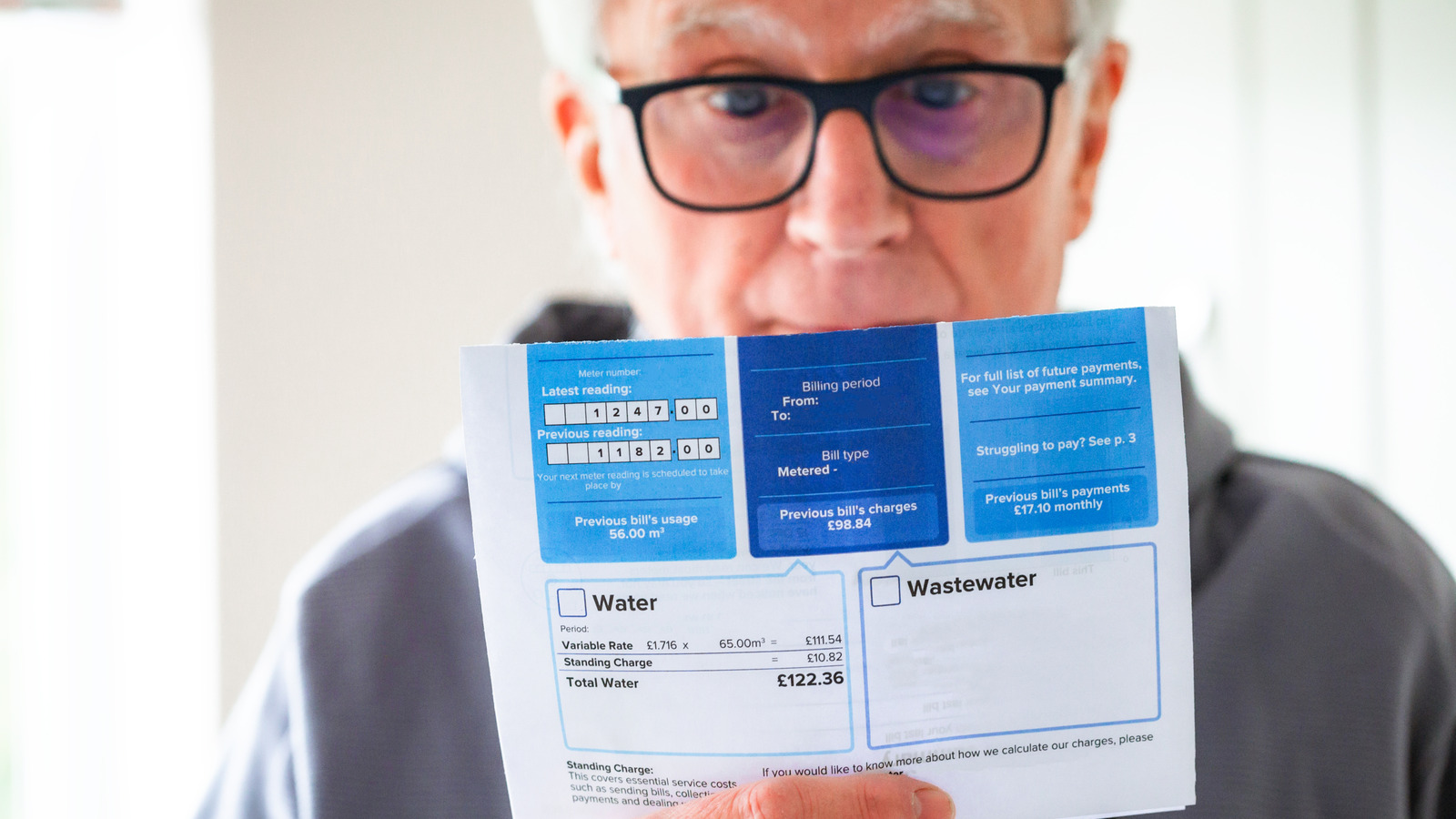

"Imagine working decades to pay off your mortgage only to find out your home was sold right out from under you - and all because you hadn't paid a water bill, which you didn't even know you owed. As impossible as this might sound, such nightmares do happen. In many municipalities across the country, a delinquent bill - even for a few hundred dollars - can put your home at risk of being foreclosed."

"In the Brooklyn neighborhood of East Flatbush, such a situation has been making headlines. After a homeowner missed a water bill for $600 back in 2019 - right after he paid off the mortgage - the bill swiftly jumped to $5,000, racking up 18% interest a day, before multiplying to $20,000 as fees and penalties from the city piled on."

"On its official NYC 311 website, New York City makes it clear that unpaid bills could result in foreclosure. The website states that overdue water and sewer charges are considered a lien against the property, which the city can sell to a lienholder if the charges are delinquent for more than a year. If the lienholder can't collect what's owed, they can begin the foreclosure process."

Unpaid municipal water bills can create liens that lead to property foreclosure even for relatively small amounts. A homeowner in East Flatbush missed a $600 water bill, which grew rapidly to $5,000 with 18% daily interest and then to $20,000 after fees and penalties, triggering a lien sale and eventual foreclosure. New York City classifies overdue water and sewer charges as property liens that can be sold to lienholders after a year of delinquency, and lienholders may pursue foreclosure if debts remain unpaid. Multiple municipalities nationwide allow liens and tax lien sales for unpaid utility bills.

Read at House Digest

Unable to calculate read time

Collection

[

|

...

]