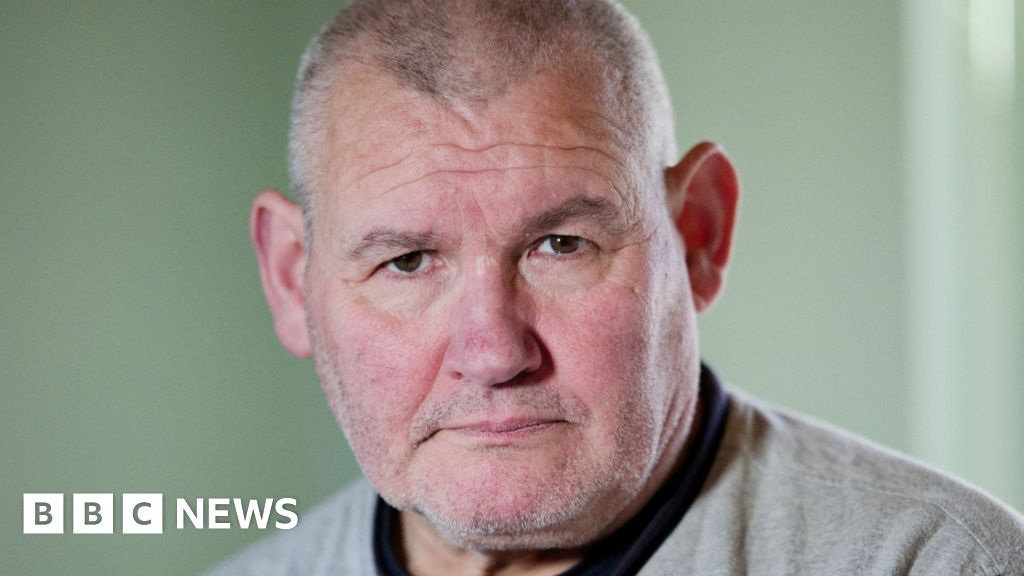

"The interest-only mortgage on the three-bedroom property was taken out more than 20 years ago in the hope he and his then wife would save up enough to eventually cover the capital sum. But the collapse of the marriage and his ex-wife's departure to Brazil in 2015, left Mr Da Costa Diogo unable to repay the 80,000 still outstanding. And because his ex-wife was still on both the mortgage documents and the property deeds, he was also unable to sell the property to cover the outstanding amount."

"Court figures show the number of mortgage repossession orders in England and Wales reached 10,853 in 2024-25 - the highest number in five years. Experts say the rise is down to a variety of factors including interest rate increases and the rise in the general cost of living. Mr Da Costa Diogo registered as homeless with Breckland Council, his local authority. He is far from alone."

Mortgage repossession orders in England and Wales reached 10,853 in 2024-25, the highest number in five years. The increase is linked to rising interest rates and higher everyday living costs. Many homeowners with long-standing interest-only mortgages face large outstanding capital balances and, in some cases, legal obstacles to selling properties when former partners remain on deeds. Presentations as homeless because of repossession have risen markedly among councils that provided comparable data, increasing from 1,517 to 2,370 and to 3,406 in the most recent year, straining council housing resources.

Read at www.bbc.com

Unable to calculate read time

Collection

[

|

...

]