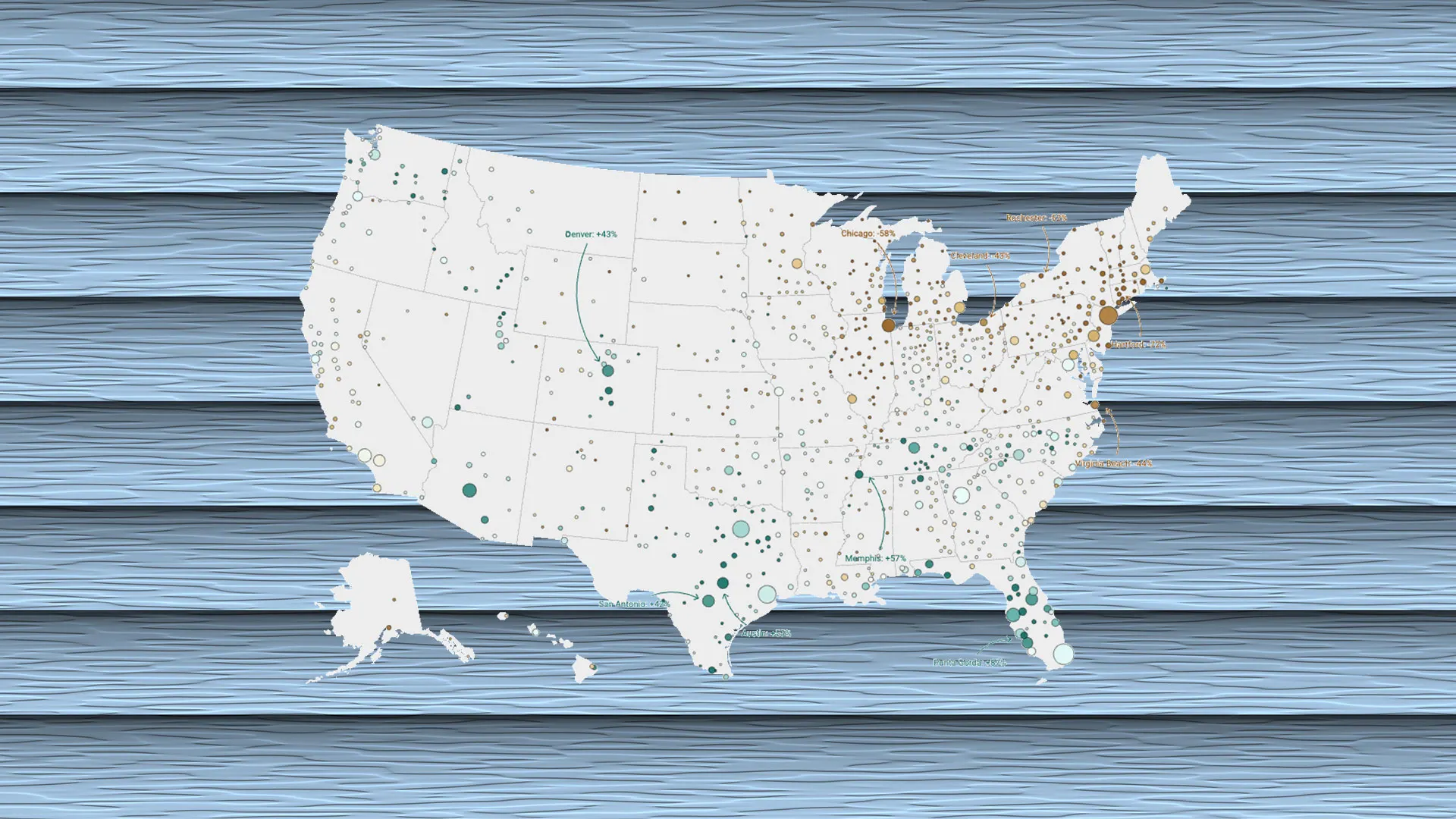

"Generally speaking, housing markets where inventory (i.e., active listings) has returned to pre-pandemic 2019 levels have experienced weaker home price growth (or outright declines) over the past 36 months. Conversely, housing markets where inventory remains far below pre-pandemic 2019 levels have, generally speaking, experienced more resilient home price growth over the past 36 months. Of the 50 largest metro area housing markets, 21 major metros now have more homes for sale than at the same point in 2019."

"Last year, that count was 13 markets. These are the 21 major markets where homebuyers have gained the most leverage: Memphis, TN; Austin, TX; Phoenix, AZ; Tucson, AZ; Denver, CO; San Antonio, TX; Orlando, FL; Nashville, TN; Tampa, FL; Oklahoma City, OK; Dallas, TX; Charlotte, NC; Seattle, WA; Houston, TX; Jacksonville, FL; Las Vegas, NV; Raleigh, NC; Birmingham, AL; Miami, FL; San Francisco, CA; and Portland, OR."

Housing markets where active listings returned to pre-pandemic 2019 levels experienced weaker home price growth or outright declines over the past 36 months. Markets where inventory remains below 2019 levels experienced more resilient home price growth. Of the 50 largest metro housing markets, 21 now have more homes for sale than at the same point in 2019, up from 13 last year. Many softest markets are in the Southeast, Southwest, and Mountain West and include pandemic boomtowns that pushed prices beyond local incomes. D.R. Horton reported excess inventory in parts of Florida, notably Jacksonville and Southwest Florida. Once migration slowed and mortgage rates spiked, markets such as Punta Gorda and Austin faced challenges.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]