"While national active inventory is still up year-over-year, the pace of growth has slowed since summer as some home sellers have thrown in the towel and delisted their properties. Indeed, according to Redfin, U.S. delistings as a share of inventory recently ticked up to 5.5%-a decade-high reading for this time of year. Looking ahead, in markets seeing the biggest jumps in delistings right now, many of those listings will likely return to the resale market in spring 2026-or test out the rental market."

""More sellers are giving up because their homes have been sitting on the market for a long time, and they don't want to or can't afford to settle on accepting a low price," says Asad Khan, a senior economist at Redfin. "Many homes have a sticker price higher than buyers are willing to pay, but many sellers are unwilling to negotiate. When tens of thousands of homeowners pull their homes off the market rather than accept a low offer, it effectively reduces the supply of homes that are actually available for buyers.""

""Many homeowners who bought during the pandemic demand frenzy still expect sky-high prices," says Khan. "They remember a seller's market, so they're hesitant to yield to buyers who want to negotiate the price down and/or ask for concessions. Recent buyers are also more likely to be testing the market; maybe they would sell and move up to a bigger home in a more desirable neighborhood if they get the price they want, but otherwi"

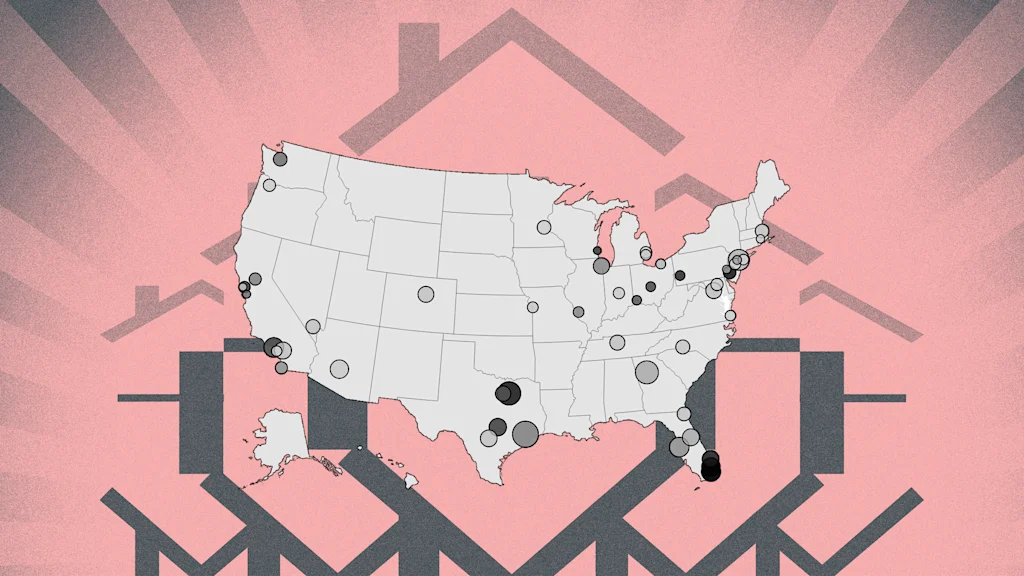

National active inventory remains higher year-over-year, but the pace of growth has slowed since summer as an increasing number of sellers delist properties. Delistings have risen to about 5.5% of inventory, a decade-high for this season. In markets with the largest delisting increases, many removed listings may return to resale in spring 2026 or shift to the rental market. Without stronger housing demand, those returns could speed inventory growth. Sellers are pulling listings because homes have sat long and owners refuse low offers or cannot accept reduced prices, reducing supply available to buyers. Delisting rates vary regionally, higher in Texas and Florida and lower in the Midwest. Pandemic-era buyers often expect high prices and resist negotiating.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]