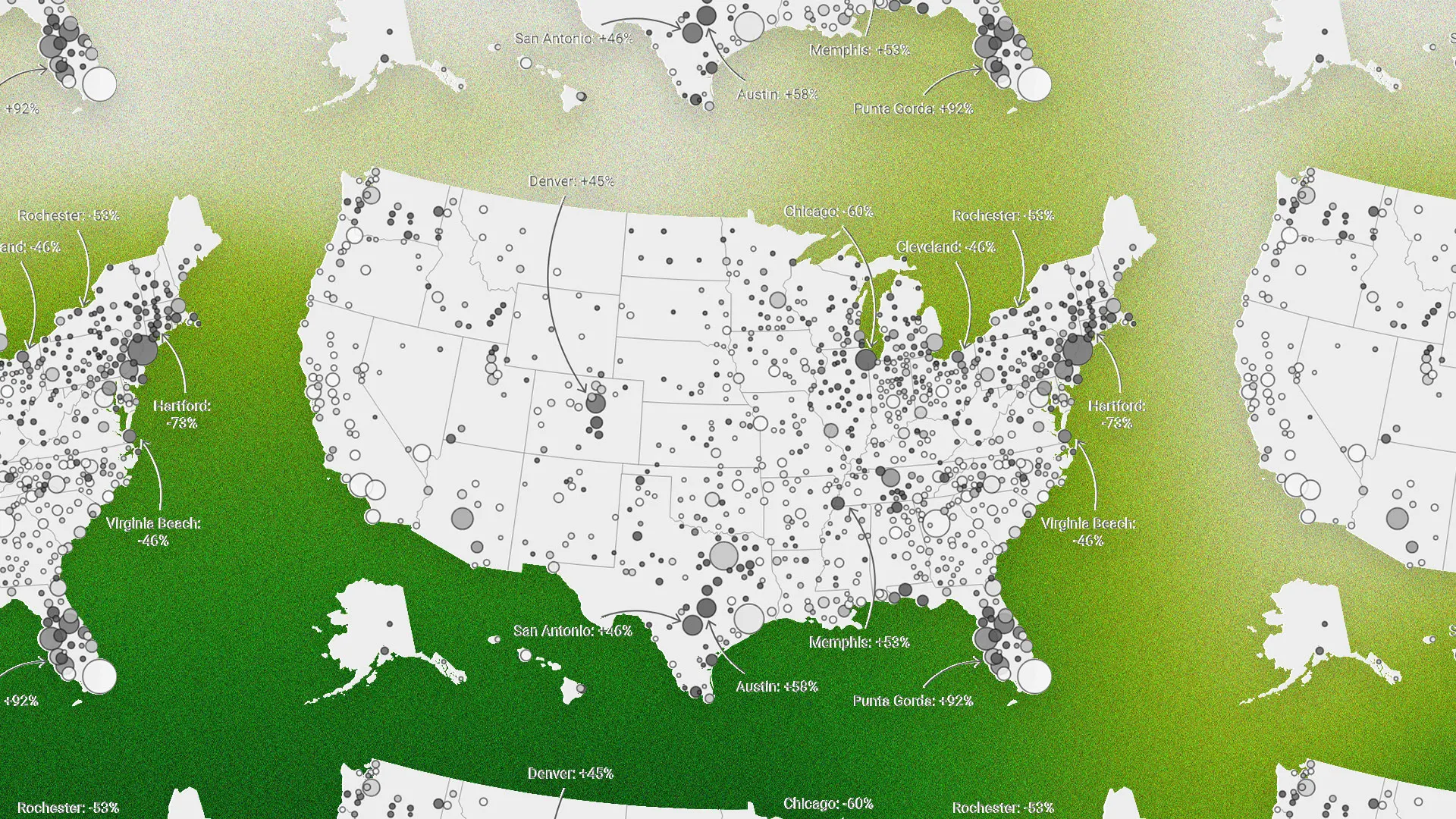

"During the pandemic housing boom, from summer 2020 to spring 2022, the number of active homes for sale in most housing markets plummeted as homebuyer demand quickly absorbed almost everything that came up for sale and home sellers had ultimate power. Fast-forward to the current housing market, and the places where active inventory has rebounded to 2019 levels (due to strained affordability suppressing buyer demand) are now the very places where homebuyers have gained the most power."

"January 2025: 41 of the 200 largest metro-area housing markets were back above pre-pandemic 2019 inventory levels. February 2025: 44 of the 200 largest metro-area housing markets were back above pre-pandemic 2019 inventory levels. March 2025: 58 of the 200 largest metro-area housing markets were back above pre-pandemic 2019 inventory levels. April 2025: 69 of the 200 largest metro-area housing markets were back above pre-pandemic 2019 inventory levels."

"May 2025: 75 of these 200 major markets were back above pre-pandemic 2019 inventory levels. June 2025: 78 of these 200 major markets were back above pre-pandemic 2019 inventory levels. July 2025: 80 of these 200 major markets were back above pre-pandemic 2019 inventory levels. Now, at the latest reading for the end of August 2025, 80 of the 200 markets are above pre-pandemic 2019 inventory levels."

Active housing inventory plunged during the pandemic boom from summer 2020 to spring 2022 as buyer demand absorbed most listings and sellers held pricing power. By June 2025 national active inventory remained 11% below June 2019 levels, while an increasing number of metro markets reached or exceeded pre‑pandemic inventory. Monthly counts rose from 41 of 200 metros in January 2025 to 80 of 200 by July and August 2025. Inventory growth has slowed in recent months—more than typical seasonality would suggest—and conditions among sellers in soft and weak Sun Belt markets are a contributing factor.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]