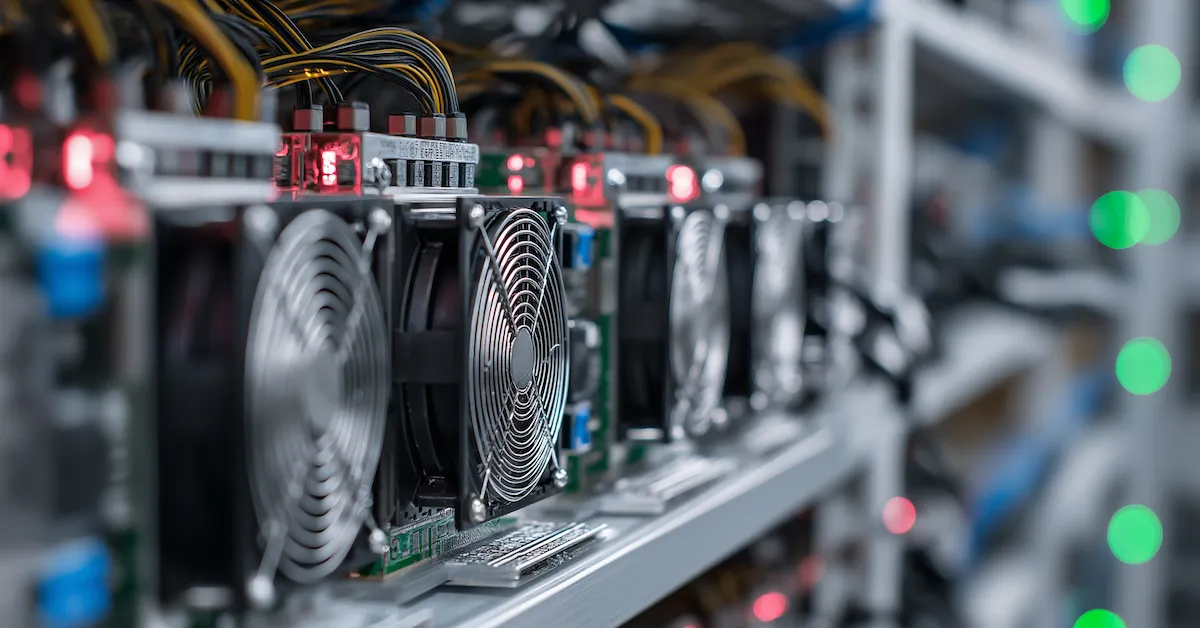

"Yesterday, two members of the New York State (NYS) Senate introduced Senate Bill 8518 (S8518), which imposes excise taxes on digital asset mining using the proof-of-work consensus mechanism, making it even more difficult than it already is for bitcoin miners to operate in the state. NEW: New York introduces anti-bitcoin mining billS8518 would impose an excise tax on proof-of-work mining, to fund low income utilities affordability programs. pic.twitter.com/Yw5TguNkGv- Bitcoin Laws (@Bitcoin_Laws) October 2, 2025"

"The rates are as follows: 0 cents per kilowatt-hour (kWh) for every kWh less than or equal to 2.25 million kWh per year 2 cents per kWh for every kWh between 2.25 million and 5 million kWh per year 3 cents per kWh for every kWh between 5 million and 10 million kWh per year 4 cents per kWh for every kWh between 10 million and 20 million kWh per year 5 cents per kWh for every kWh over 20 million kWh per year"

Senate Bill 8518 would impose excise taxes on proof-of-work digital-asset mining in New York State based on annual energy consumption. Co-sponsors include Liz Krueger and Andrew Gounardes. Tax rates range from 0 cents per kWh up to 2.25 million kWh, then 2¢/kWh for 2.25–5 million, 3¢/kWh for 5–10 million, 4¢/kWh for 10–20 million, and 5¢/kWh for consumption above 20 million kWh. Taxes would not apply to facilities powered by renewable energy as defined by Section 66-P, and facilities must not operate with an electric corporation's transmission and distribution facilities. All collected revenue would subsidize customers in New York's energy affordability programs. The bill follows expiration of a moratorium on fossil-fuel-dependent digital-asset mining.

Read at Bitcoin Magazine

Unable to calculate read time

Collection

[

|

...

]