"Regulators said the review uncovered repeated breaches of the Gambling (Anti-Money Laundering and Countering the Financing of Terrorism) Code 2019. According to the commission, the company fell short across core safeguards, including enhanced due diligence, customer checks, record-keeping, risk assessments and ongoing monitoring of player activity. Inspectors found that accounts were left open without the extra scrutiny required for higher-risk customers, even after red flags had been identified."

"The regulator said Shelgeyr could not show that it had properly established customers' source of wealth, applied enhanced checks to politically exposed persons or consistently monitored accounts over time. Required documentation was either missing or poorly maintained, leaving gaps in audit trails that are meant to demonstrate compliance with the law. In setting the penalty, the commission said the fine reflects the "serious nature" of the non-compliance."

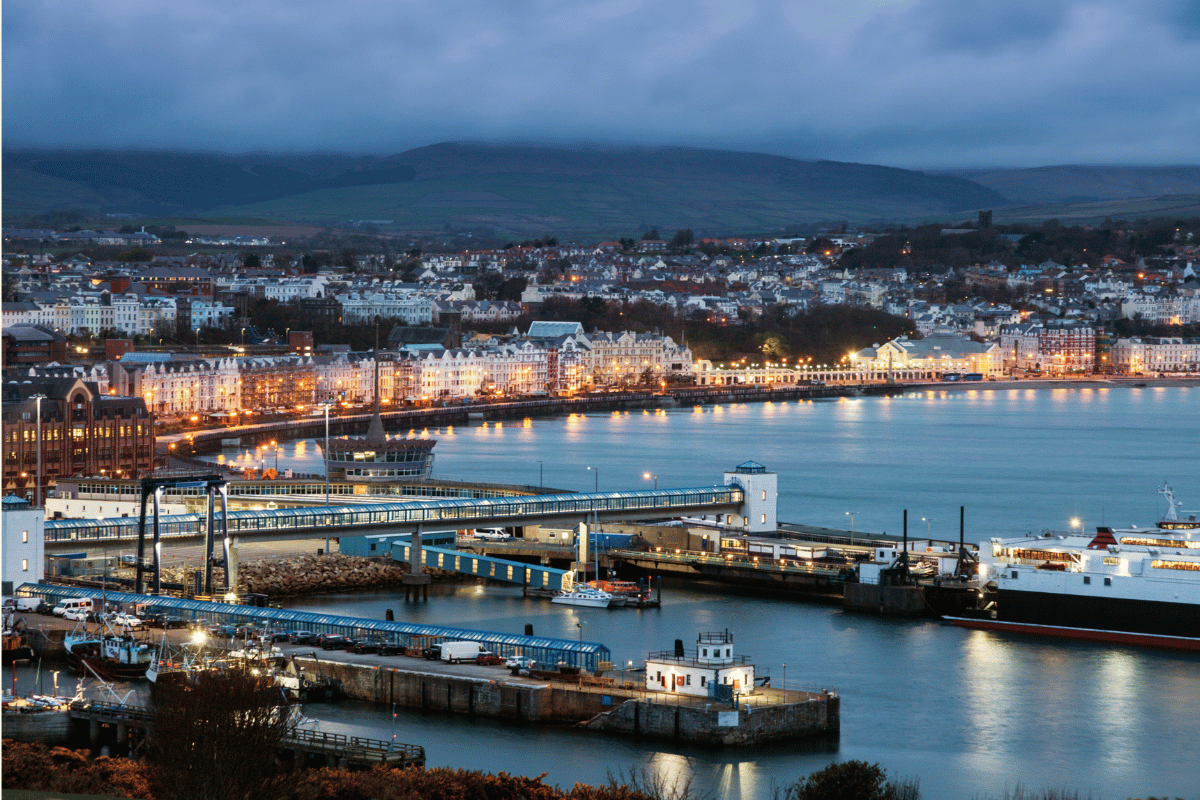

The Gambling Supervision Commission imposed a £200,000 penalty on Shelgeyr Limited following an enforcement inspection that revealed repeated breaches of AML rules. Shelgeyr operated under an Isle of Man licence from November 2018 until voluntarily surrendering approval in July 2024. Regulatory findings identified failures in enhanced due diligence, customer checks, record-keeping, risk assessments and ongoing monitoring, with accounts left open despite red flags. The company could not demonstrate proper source-of-wealth checks, enhanced screening for politically exposed persons, or consistent account monitoring. Documentation gaps hindered audit trails. Cooperation by the company and senior staff reduced the penalty under discretionary policy.

Read at ReadWrite

Unable to calculate read time

Collection

[

|

...

]