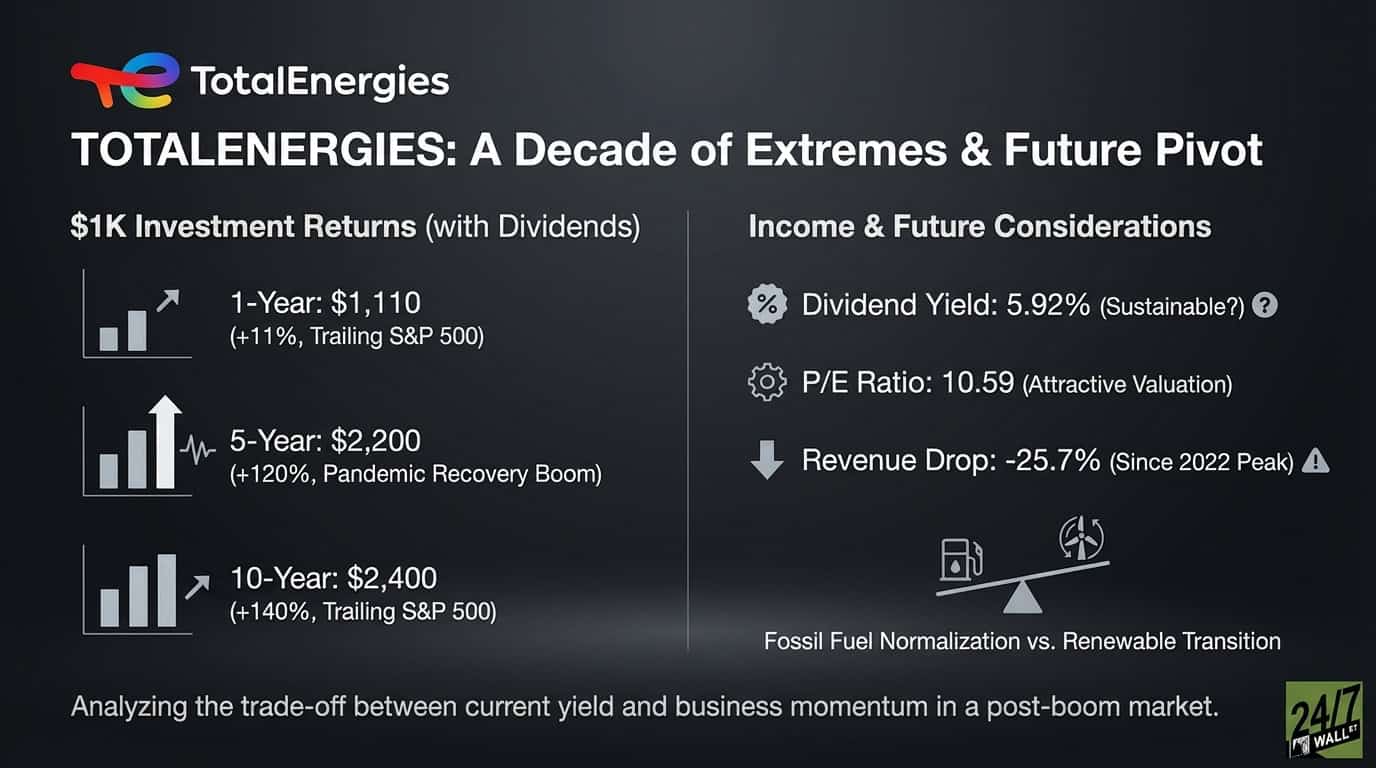

"TotalEnergies ( NYSE: TTE) has delivered a story of extremes over the past decade. The French energy giant navigated a devastating pandemic crash, rode the 2022 energy crisis to record profits, and now finds itself in a post-boom cooldown while attempting a gradual pivot toward renewable energy. For dividend investors, the question is whether that 5.92% yield remains sustainable as fossil fuel markets normalize."

"The recovery proved explosive. Revenue surged to $263 billion in 2022 during the energy crisis triggered by Russia's invasion of Ukraine. Net income hit $20.5 billion. But that peak didn't last. By 2024, revenue had fallen 25.7% to $196 billion, and earnings dropped to $15.8 billion. The company now trades near its 52-week high of $66.92, but underlying business momentum has clearly shifted."

TotalEnergies suffered a pandemic-induced $7.2 billion loss in 2020 as oil prices briefly went negative, then saw revenue surge to $263 billion and net income to $20.5 billion in 2022 during the energy crisis. By 2024 revenue fell 25.7% to $196 billion and earnings dropped to $15.8 billion, with the stock trading near a $66.92 52-week high while momentum softened. A $1,000 investment returned 11% over one year and 140% over ten years, with dividends contributing roughly half the five-year gains. The company is gradually pivoting toward renewables while maintaining a 5.92% yield.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]